Indiana * 2020

What is the IFTA 105 Form 2nd Quarter?

The IFTA 105 form 2nd quarter is a crucial document used by motor carriers to report fuel usage and calculate taxes owed to various jurisdictions. The International Fuel Tax Agreement (IFTA) simplifies the reporting of fuel taxes for interstate motor carriers, allowing them to file a single quarterly return instead of separate returns for each state or province. This form specifically pertains to the second quarter of the fiscal year, covering fuel consumption from April to June.

Key Elements of the IFTA 105 Form 2nd Quarter

When completing the IFTA 105 form 2nd quarter, several key elements must be included:

- Carrier Information: This includes the carrier's name, address, and IFTA account number.

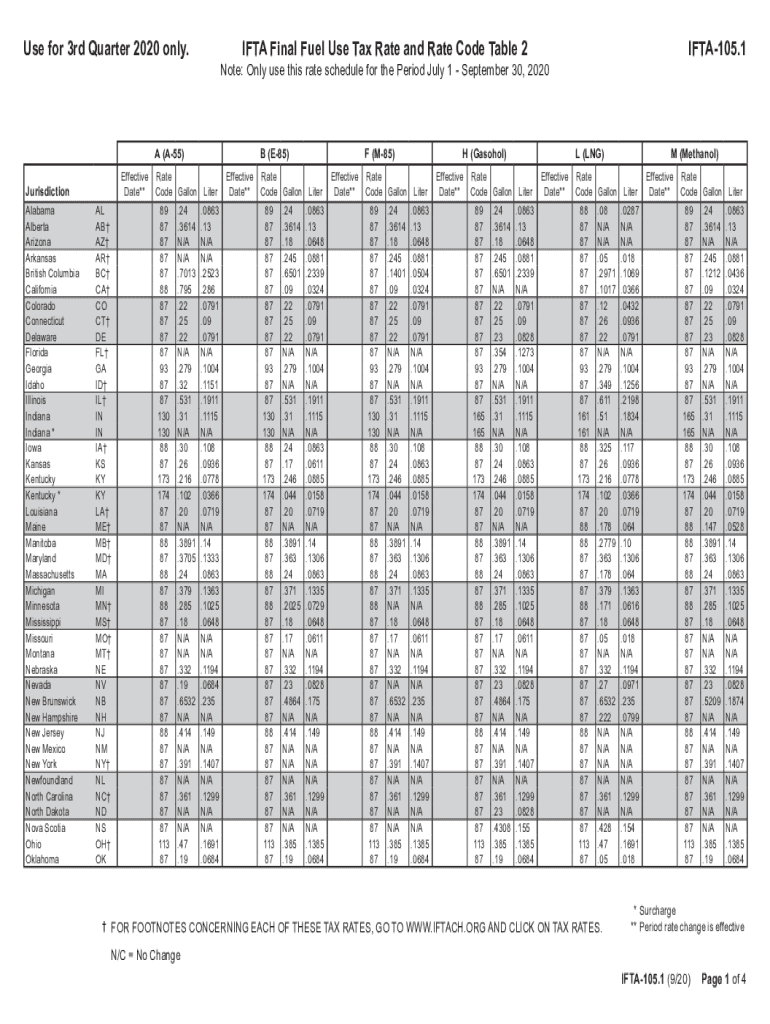

- Jurisdictional Fuel Tax Rates: The form requires the tax rates for each jurisdiction where fuel was purchased and used.

- Total Miles Driven: Report the total miles driven in each jurisdiction during the quarter.

- Fuel Purchases: Document the total gallons of fuel purchased in each jurisdiction.

- Tax Calculations: The form includes sections for calculating the total fuel tax owed or the refund due.

Steps to Complete the IFTA 105 Form 2nd Quarter

Filling out the IFTA 105 form 2nd quarter involves several steps to ensure accuracy and compliance:

- Gather necessary documentation, including fuel purchase receipts and mileage logs.

- Fill in the carrier information section accurately.

- Enter the total miles driven and fuel purchases for each jurisdiction.

- Calculate the tax owed based on jurisdictional rates and total fuel usage.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the IFTA 105 form 2nd quarter. Typically, the deadline for submission is the last day of the month following the end of the quarter, which means the form must be filed by July 31. Late submissions may result in penalties and interest charges, so timely filing is crucial.

Form Submission Methods

The IFTA 105 form 2nd quarter can be submitted through various methods:

- Online: Many jurisdictions allow electronic filing through their respective tax websites.

- Mail: The completed form can be printed and mailed to the appropriate tax authority.

- In-Person: Some jurisdictions permit in-person submissions at designated tax offices.

Penalties for Non-Compliance

Failure to file the IFTA 105 form 2nd quarter on time or inaccuracies in the submitted information can lead to significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential audits by tax authorities, leading to further scrutiny of records.

Quick guide on how to complete indiana

Effortlessly Prepare Indiana * on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Indiana * on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

Edit and eSign Indiana * with Ease

- Find Indiana * and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from your chosen device. Modify and eSign Indiana * and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana

Create this form in 5 minutes!

How to create an eSignature for the indiana

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the IFTA 105 2nd quarter form used for?

The IFTA 105 2nd quarter form is used by licensed interstate carriers to report their fuel use in multiple jurisdictions. This report ensures compliance with tax obligations and provides a comprehensive overview of fuel consumption during the specified quarter. By completing this form, businesses can maintain proper records and avoid penalties related to fuel tax reporting.

-

How does airSlate SignNow help with IFTA 105 2nd quarter submissions?

airSlate SignNow streamlines the process of submitting the IFTA 105 2nd quarter form by allowing users to eSign and send documents quickly and securely. The platform's intuitive interface helps users complete forms accurately, reducing error rates and saving time. With easy access to previous documents, users can efficiently manage their fuel tax filings.

-

What are the pricing options for using airSlate SignNow for IFTA 105 2nd quarter filings?

airSlate SignNow offers a variety of pricing plans to fit different business needs, with options that allow for unlimited document signing and storage. Customers can choose a plan based on the frequency of their IFTA 105 2nd quarter filings and other features they may need. Most plans come with a free trial, enabling potential users to evaluate the service before making a commitment.

-

Are there any features in airSlate SignNow that specifically facilitate IFTA 105 2nd quarter compliance?

Yes, airSlate SignNow includes features like automated reminders for IFTA 105 2nd quarter filing deadlines and compliance tracking. The platform also enables users to store and manage scanned copies of past filings securely, helping ensure all data is readily accessible. These tools together help businesses stay compliant and organized.

-

What benefits do users gain from preparing the IFTA 105 2nd quarter form electronically?

Preparing the IFTA 105 2nd quarter form electronically through airSlate SignNow offers numerous benefits, including reduced paper usage and minimized risk of form loss. Users can easily edit and update their information, ensuring accuracy in their filings. Additionally, eSigning speeds up the approval process, helping businesses meet compliance deadlines seamlessly.

-

Can I integrate airSlate SignNow with other software for managing IFTA 105 2nd quarter submissions?

Yes, airSlate SignNow offers integrations with various accounting and tax software solutions, which can assist users in managing their IFTA 105 2nd quarter submissions more effectively. These integrations streamline data flow and ensure that all relevant information is synchronized for accurate reporting. Users can enhance their workflow by leveraging these powerful tools.

-

Is airSlate SignNow suitable for businesses of all sizes when dealing with IFTA 105 2nd quarter filings?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, from small startups to large corporations, when handling IFTA 105 2nd quarter filings. Its user-friendly interface and scalable pricing plans make it an ideal choice for any organization. Regardless of size, users can benefit from efficient document management and eSigning capabilities.

Get more for Indiana *

- Securityholders agreement between gst telecommunications inc and ocean horizon srl form

- Bylaws of via networks inc form

- Stock option agreement form 497336779

- Sample employee confidentiality form

- Retention agreement form

- Termination agreement 497336782 form

- Registration rights agreement 497336783 form

- Closing agreement 497336784 form

Find out other Indiana *

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors