Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return 2019

Understanding the Form 540 California Resident Income Tax Return

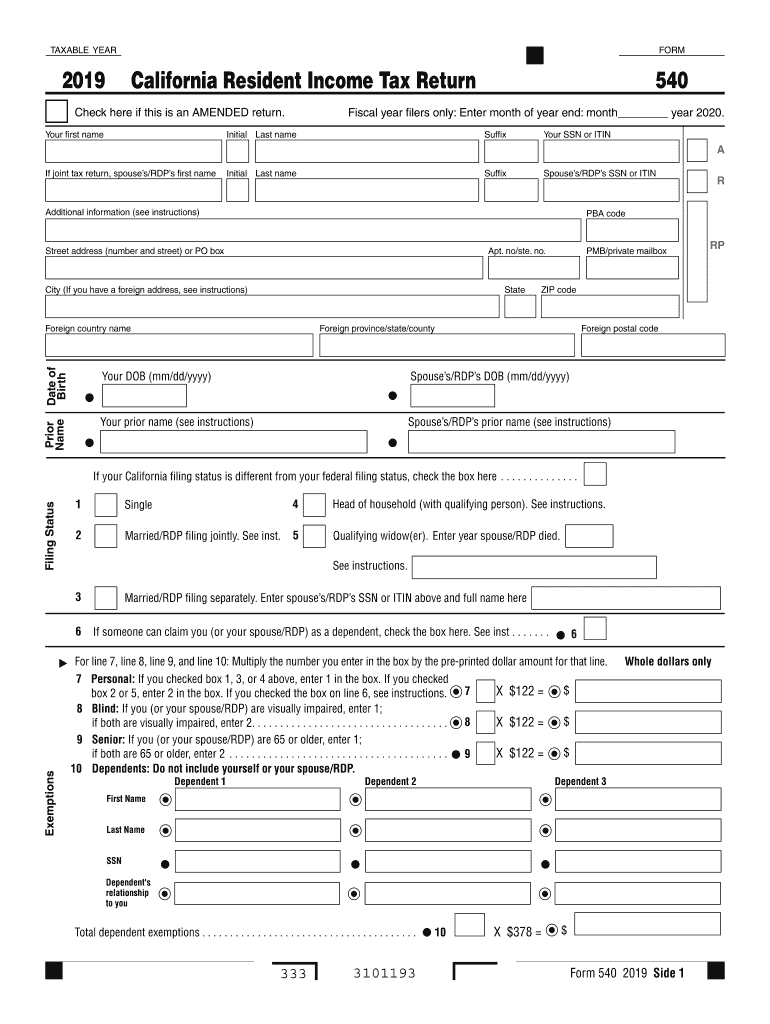

The Form 540 is the California Resident Income Tax Return used by individuals who are residents of California to report their income, claim deductions, and calculate their tax liability. This form is essential for those who earn income within the state and must comply with California tax laws. It includes various sections that require detailed information regarding income sources, deductions, credits, and other relevant financial data.

Steps to Complete the Form 540 California Resident Income Tax Return

Completing the Form 540 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: List all sources of income, including wages, interest, dividends, and any other taxable income.

- Claim deductions and credits: Identify and claim any applicable deductions and tax credits to reduce your taxable income.

- Calculate tax liability: Use the tax tables provided in the instructions to determine your tax owed based on your taxable income.

- Sign and date the form: Ensure that you sign and date the form to validate your submission.

How to Obtain the Form 540 California Resident Income Tax Return

The Form 540 can be obtained through several methods. It is available for download directly from the California Franchise Tax Board (FTB) website. Additionally, physical copies can be requested through the FTB or found at various local government offices, libraries, and tax preparation services. Ensuring you have the correct version for the tax year you are filing is crucial.

Key Elements of the Form 540 California Resident Income Tax Return

Understanding the key elements of the Form 540 is vital for accurate completion. The form includes sections for:

- Filing status: Indicate whether you are single, married filing jointly, married filing separately, or head of household.

- Income reporting: Detail all types of income, including wages, rental income, and investment earnings.

- Deductions: Specify standard or itemized deductions to reduce taxable income.

- Tax credits: Include any credits that apply to your situation, such as the California Earned Income Tax Credit.

Legal Use of the Form 540 California Resident Income Tax Return

The Form 540 serves as a legally binding document for reporting income and calculating taxes owed to the state of California. When filled out correctly and submitted on time, it fulfills the taxpayer's legal obligation under California tax law. It is essential to provide accurate information to avoid penalties or legal repercussions.

Filing Deadlines for the Form 540 California Resident Income Tax Return

The filing deadline for the Form 540 typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines and ensure timely submission to avoid late fees or penalties.

Quick guide on how to complete 2019 form 540 california resident income tax return 2019 form 540 california resident income tax return

Effortlessly Prepare Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return on Any Device

The management of documents online has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as it allows you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return from any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return with Ease

- Find Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 540 california resident income tax return 2019 form 540 california resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 540 california resident income tax return 2019 form 540 california resident income tax return

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the form 540 2004 and why is it important?

The form 540 2004 is an essential tax form used by Californians to report their income and calculate their state taxes. Understanding and accurately completing this form is crucial for compliance with state tax laws, avoiding penalties, and ensuring eligible deductions are claimed.

-

How can airSlate SignNow help me with the form 540 2004?

airSlate SignNow streamlines the process of completing the form 540 2004 by allowing users to digitally sign and send documents effortlessly. With its user-friendly interface, you can prepare, send, and eSign your forms quickly, ensuring accuracy and efficiency in your tax filing.

-

Is there a cost associated with using airSlate SignNow for the form 540 2004?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to a range of features that facilitate the completion and eSigning of documents, including the form 540 2004, at a cost-effective rate.

-

Are there any features in airSlate SignNow that specifically assist with tax forms like the form 540 2004?

Absolutely! airSlate SignNow includes features such as customizable templates, smart fields, and document tracking, which are particularly beneficial for ensuring the form 540 2004 is filled out correctly and submitted on time. These functionalities help minimize errors and improve overall efficiency.

-

Can I integrate airSlate SignNow with other applications to help with the form 540 2004?

Yes, airSlate SignNow easily integrates with various applications, allowing you to manage your documents and the form 540 2004 seamlessly. With integrations into popular productivity tools, you can enhance your workflows and ensure that your tax forms are always accessible and organized.

-

What security measures does airSlate SignNow provide for sensitive documents like the form 540 2004?

security is a top priority at airSlate SignNow. When handling sensitive documents such as the form 540 2004, we utilize advanced encryption, secure access controls, and regular audits to ensure that your data remains protected and confidential throughout the signing process.

-

How can I get started with airSlate SignNow to fill out the form 540 2004?

Getting started with airSlate SignNow is straightforward! Simply sign up for an account, choose the plan that suits you best, and begin creating or uploading your form 540 2004. Our user-friendly platform guides you through the eSigning process step by step.

Get more for Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return

- Special delivery special offer agreement form

- Media agreement 497336803 form

- Provider agreement form

- Credit extension 497336805 form

- General agreement contract form

- Sale purchase agreement 497336807 form

- Web site and cybercasting agreement 497336808 form

- Relative cargiver safety agreement formdoc dfcs dhr georgia

Find out other Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy