Form ST 810 New York State and Local Quarterly Sales and Use Tax Return for Part Quarterly Filers Revised 1120 2020

What is the Form ST 810?

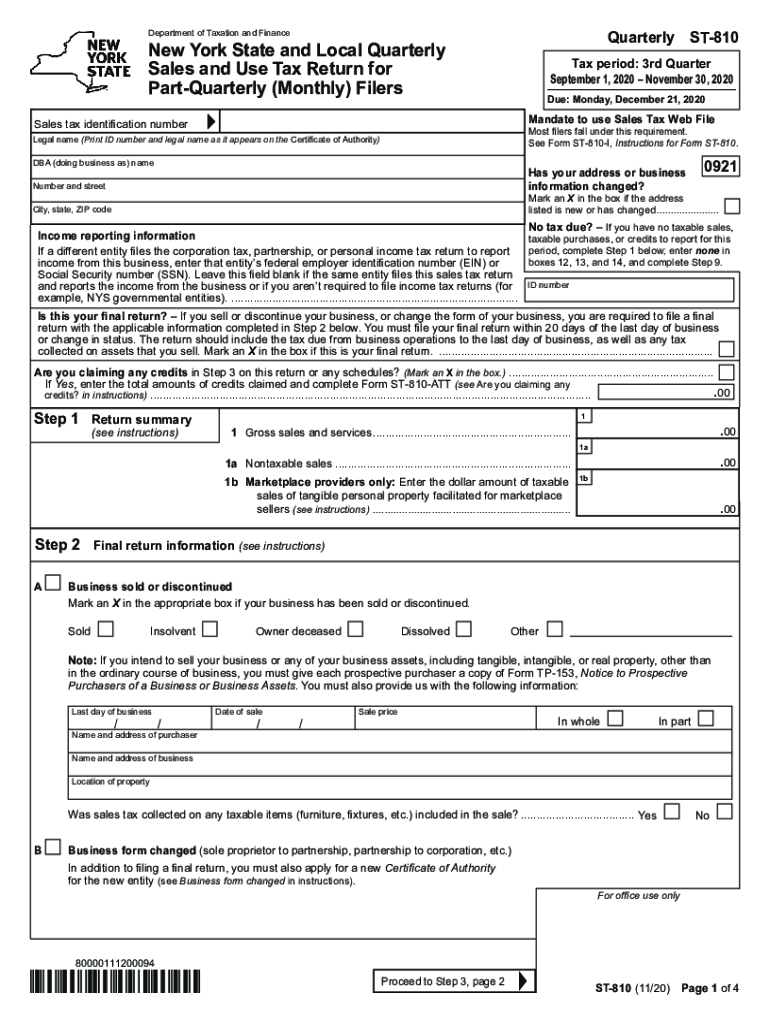

The Form ST 810 is a New York State and Local Quarterly Sales and Use Tax Return designed for businesses that need to report their sales and use tax liabilities. This form is specifically for part quarterly filers, allowing them to accurately report the taxes collected during the quarter. It is essential for compliance with state tax regulations and helps ensure that businesses fulfill their tax obligations in a timely manner.

How to Use the Form ST 810

Using the Form ST 810 involves several key steps. First, businesses must gather all necessary sales data for the quarter, including total sales, taxable sales, and any exempt sales. Next, the form should be filled out with accurate figures, ensuring that all calculations are correct. Once completed, the form can be submitted either electronically or via mail, depending on the preference of the business. It is crucial to keep a copy of the submitted form for record-keeping purposes.

Steps to Complete the Form ST 810

Completing the Form ST 810 requires careful attention to detail. Follow these steps:

- Gather sales records and calculate total sales for the quarter.

- Determine the amount of taxable sales and any exemptions.

- Fill out the form with the required information, including business details and tax amounts.

- Review the form for accuracy to avoid errors that could lead to penalties.

- Submit the form by the deadline, either online or by mail.

Filing Deadlines for the Form ST 810

Filing deadlines for the Form ST 810 are crucial for compliance. Businesses must submit their quarterly returns by the designated due dates to avoid penalties. Typically, the deadlines fall on the 20th day of the month following the end of the quarter. For example, for the quarter ending March 31, the form is due by April 20. Staying informed about these deadlines helps ensure timely submissions.

Penalties for Non-Compliance

Failing to file the Form ST 810 on time can result in significant penalties. New York State imposes late filing fees and interest on unpaid taxes. Additionally, businesses may face further scrutiny from tax authorities, which could lead to audits or additional fines. It is essential for businesses to adhere to filing deadlines and ensure accurate reporting to avoid these consequences.

Key Elements of the Form ST 810

The Form ST 810 contains several key elements that businesses must understand. These include:

- Business identification information, such as name, address, and tax identification number.

- Sections for reporting total sales, taxable sales, and exemptions.

- Calculation areas for determining total tax liability.

- Signature line for the authorized representative of the business.

Understanding these elements is vital for accurate completion and compliance with New York tax laws.

Quick guide on how to complete form st 810 new york state and local quarterly sales and use tax return for part quarterly filers revised 1120

Effortlessly prepare Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1120 on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitution for traditional printed and signed documents, allowing you to locate the correct form and securely preserve it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1120 on any device with the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The simplest method to edit and electronically sign Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1120 with ease

- Locate Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1120 then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important portions of the documents or obscure confidential information with tools specifically designed for that task by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your modifications.

- Select your preferred method to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1120 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 810 new york state and local quarterly sales and use tax return for part quarterly filers revised 1120

Create this form in 5 minutes!

How to create an eSignature for the form st 810 new york state and local quarterly sales and use tax return for part quarterly filers revised 1120

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the form ST810 and how is it used?

The form ST810 is a sales tax exemption certificate that allows eligible organizations to make tax-exempt purchases. With airSlate SignNow, you can easily eSign and send the form ST810 to vendors, simplifying the process and ensuring compliance with state regulations.

-

How can I eSign the form ST810 using airSlate SignNow?

To eSign the form ST810 with airSlate SignNow, simply upload the document, add the necessary fields for signature, and send it to the relevant parties. The platform provides a seamless experience for gathering electronic signatures, ensuring your form ST810 is signed quickly and securely.

-

What are the pricing plans for airSlate SignNow when using the form ST810?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. While using the form ST810, you can choose from various options to find a plan that meets your budget and requirements, allowing for cost-effective management of documents.

-

Can I store my completed form ST810 on airSlate SignNow?

Yes, airSlate SignNow allows you to securely store completed forms, including the form ST810, in your account. This feature enables easy access to your documents whenever needed, ensuring you maintain organized records for tax purposes.

-

What benefits does airSlate SignNow offer for managing the form ST810?

Using airSlate SignNow to manage the form ST810 streamlines the signing process and reduces paper clutter. Benefits include faster turnaround times, improved tracking, and enhanced compliance, making it an ideal solution for busy organizations.

-

Does airSlate SignNow integrate with other software to manage the form ST810?

Yes, airSlate SignNow integrates seamlessly with a variety of software tools, allowing for efficient management of the form ST810. This integration ensures that your workflow remains uninterrupted, whether you need to link with CRM systems, accounting software, or other applications.

-

Is airSlate SignNow compliant with regulations for the form ST810?

Absolutely, airSlate SignNow is designed to comply with state and federal regulations for electronic signatures, including those applicable to the form ST810. This compliance provides peace of mind, ensuring that your signed documents are legally binding and accepted.

Get more for Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1120

- Services agreement technology form

- Services agreement technology 497336771 form

- Stock agreement between pcsupportcom and cgtf inc form

- Warrant issued form

- Holdings llc company form

- Security agreement between 497336775 form

- Sample stock purchase 497336776 form

- Securityholders agreement between gst telecommunications inc and ocean horizon srl form

Find out other Form ST 810 New York State And Local Quarterly Sales And Use Tax Return For Part Quarterly Filers Revised 1120

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple