Promissory Note Secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Form

What is the Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business

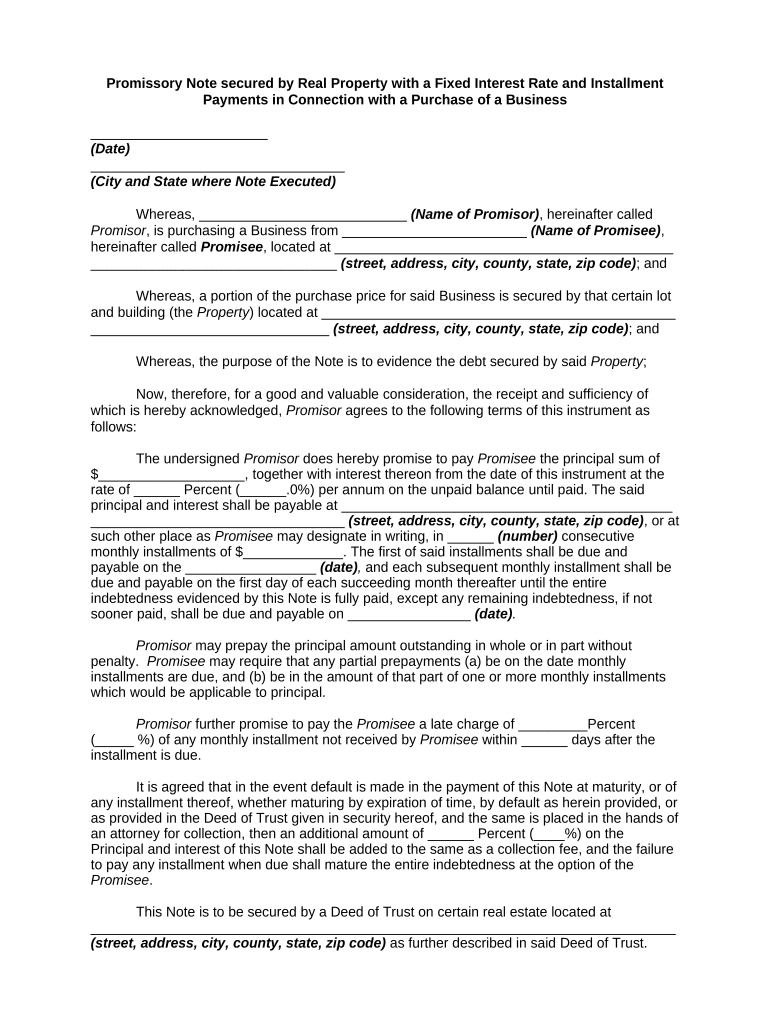

A promissory note secured by real property with a fixed interest rate and installment payments in connection with a purchase of a business is a legal document that outlines the terms of a loan. This note serves as a promise from the borrower to repay the lender over a specified period, typically through regular installment payments. The note is secured by real property, meaning that the property itself acts as collateral. If the borrower defaults on the loan, the lender has the right to take possession of the property to recover the owed amount. This type of financing is common in business transactions where the buyer requires funding to acquire a business, and the seller may offer financing to facilitate the sale.

Key Elements of the Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business

Understanding the key elements of this promissory note is essential for both borrowers and lenders. The primary components include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the principal.

- Payment Schedule: Details on how often payments will be made, typically monthly or quarterly.

- Term Length: The duration over which the loan will be repaid.

- Collateral Description: A detailed description of the real property securing the loan.

- Default Terms: Conditions under which the lender can claim the collateral if the borrower fails to make payments.

Steps to Complete the Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business

Completing this promissory note involves several important steps:

- Gather Information: Collect all necessary details about the borrower, lender, and the property being used as collateral.

- Draft the Note: Create a document that includes all key elements, ensuring clarity and accuracy in the terms.

- Review Legal Requirements: Ensure compliance with state laws regarding promissory notes and secured transactions.

- Sign the Document: Both parties should sign the note, ideally in the presence of a notary public to enhance its legal standing.

- Store Securely: Keep the signed document in a safe location, as it is a critical legal record.

Legal Use of the Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business

The legal use of this promissory note is governed by various laws and regulations. It must adhere to the Uniform Commercial Code (UCC) and any relevant state laws. The note should be clear in its terms to avoid disputes. Proper execution, including signatures and notarization, is vital for enforceability. Additionally, the lender should ensure that the note is properly recorded if required by state law to protect their interest in the collateral. This legal framework helps ensure that both parties understand their rights and obligations under the agreement.

How to Use the Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business

Using this promissory note effectively involves several considerations:

- Negotiation: Before finalizing the note, both parties should negotiate terms that are acceptable, ensuring mutual understanding.

- Documentation: Maintain thorough records of all communications and agreements related to the note.

- Payment Tracking: Set up a system for tracking payments to ensure compliance with the payment schedule.

- Legal Advice: Consulting with a legal professional can help clarify any complex terms and ensure compliance with applicable laws.

Examples of Using the Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business

Examples of scenarios where this promissory note is utilized include:

- A buyer purchasing a small retail business, using the property as collateral for a loan from the seller.

- A franchisee acquiring a franchise location, securing financing through a promissory note backed by the real estate.

- A partnership buying out a partner's share in a business, using the business property to secure the loan.

Quick guide on how to complete promissory note secured by real property with a fixed interest rate and installment payments in connection with a purchase of a

Prepare Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A with ease

- Obtain Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A and click Get Form to commence.

- Make use of the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your modifications.

- Choose how you prefer to send your form: via email, SMS, invite link, or download it to your computer.

Put an end to lost or misfiled documents, cumbersome form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

A Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business is a legal document where the borrower agrees to repay a specific amount over time, secured against real estate. This agreement ensures that the lender has a claim to the property if the borrower defaults, making it a secure option for financing business purchases.

-

How does the interest rate work for a Promissory Note Secured By Real Property?

The interest rate for a Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business is predetermined and does not change throughout the life of the loan. This fixed rate provides predictability in monthly payments, allowing borrowers to budget effectively without worrying about fluctuating interest costs.

-

What benefits does using a Promissory Note provide when purchasing a business?

Utilizing a Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business offers several benefits, including lower initial capital needs and extended time to repay the loan. This structure allows buyers to manage cash flow better while securing their investment with real property.

-

Are there specific legal requirements for creating a Promissory Note?

Yes, to create a valid Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business, certain legal requirements must be met. This includes ensuring all parties involved are in agreement, the document is in writing, and it is signed by the borrower to make it legally enforceable.

-

Can I customize the terms of a Promissory Note?

Yes, borrowers can negotiate specific terms of the Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business, such as payment schedule, principal amount, and interest rate. Customizing these terms helps align the agreement with the financial situation and business goals of both the buyer and the seller.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults on a Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business, the lender has the right to take legal action to recover the owed amount. Typically, this involves claiming the secured property through foreclosure, thus ensuring that the investment is protected.

-

Is there a way to speed up the repayment of a Promissory Note?

Yes, borrowers may choose to make additional payments towards the principal to expedite the repayment of the Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business. However, it's essential to review any prepayment penalties that may apply in the original agreement before proceeding.

Get more for Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A

- Doh application form for renewal of license to operate 2021

- Form 6765 rev december 2020 credit for increasing research activities

- Instructions for form 8283 rev december 2020 instructions for form 8283 noncash charitable contributions

- I whose signature appears form

- Get a temporary work visa for new zealandnew zealand now form

- 2013 2019 form nz inz 1146 fill online printable fillable blank

- Pilotage exemption certificate form

- 2020 form 4136 credit for federal tax paid on fuels

Find out other Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast