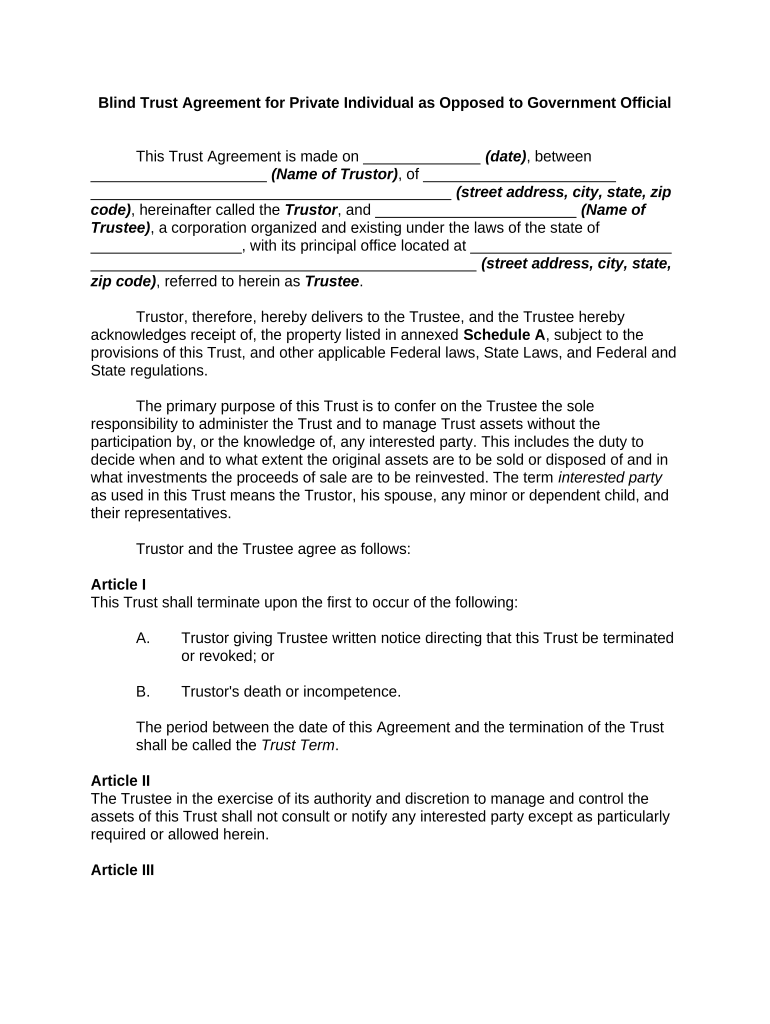

Blind Trust Form

What is the blind trust?

A blind trust is a financial arrangement where a trustee manages the assets on behalf of the trust's beneficiaries without the beneficiaries' knowledge of the specific assets or transactions. This structure is often used to avoid conflicts of interest, especially for public officials or individuals in sensitive positions. By placing assets in a blind trust, the individual can ensure that their financial decisions remain separate from their personal interests, promoting transparency and integrity.

How to use the blind trust

Using a blind trust involves several steps to ensure proper management and compliance with legal requirements. Initially, the trustor must select a qualified trustee who will manage the assets without any input or influence from the trustor. The trustor then transfers their assets into the trust, which the trustee will manage according to the terms laid out in the trust agreement. Regular reporting to the beneficiaries is not required, allowing the trustee to operate independently. This setup helps maintain the trustor's privacy while ensuring that the assets are managed responsibly.

Steps to complete the blind trust

Completing a blind trust involves a series of methodical steps:

- Choose a qualified trustee who has experience managing trusts.

- Draft a trust agreement that outlines the terms, including the powers of the trustee and the rights of the beneficiaries.

- Transfer ownership of the assets into the trust, ensuring all legal documents are properly executed.

- Ensure compliance with any relevant state laws and regulations regarding blind trusts.

- Review the trust periodically to ensure it meets the changing needs of the trustor and beneficiaries.

Legal use of the blind trust

The legal use of a blind trust is crucial for maintaining compliance with various regulations. In the United States, blind trusts are often utilized by public officials to avoid conflicts of interest. The trust must be set up in accordance with state laws, and the trustee must adhere to fiduciary duties, ensuring that the assets are managed in the best interest of the beneficiaries. Additionally, the trustor must refrain from influencing the trustee’s decisions to maintain the trust's integrity.

Key elements of the blind trust

Several key elements define a blind trust:

- Trustee Selection: A qualified individual or institution must be chosen to manage the trust.

- Asset Management: The trustee has full discretion over the management of the trust's assets.

- Beneficiary Rights: Beneficiaries have limited knowledge of the trust's holdings, ensuring impartiality.

- Legal Compliance: The trust must comply with applicable laws and regulations to maintain its validity.

Examples of using the blind trust

Blind trusts are commonly used in various scenarios, particularly by individuals in public service. For instance, a politician may place their investments in a blind trust to prevent any potential conflicts of interest while in office. Similarly, corporate executives may use blind trusts to manage their personal investments, ensuring that their financial interests do not interfere with their professional responsibilities. These examples highlight the trust's role in promoting ethical conduct and transparency.

Quick guide on how to complete blind trust 497331491

Complete Blind Trust seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Blind Trust on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Blind Trust effortlessly

- Find Blind Trust and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign Blind Trust and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a blind trust and how does it work?

A blind trust is a legal arrangement where a trustee manages assets on behalf of a beneficiary without any communication between them. This ensures that the beneficiary has no knowledge of the trust's investments and operations, effectively eliminating conflicts of interest. Using airSlate SignNow, you can securely eSign documents related to establishing or managing a blind trust with ease.

-

What are the benefits of setting up a blind trust?

Setting up a blind trust can help protect your privacy, avoid potential conflicts of interest, and ensure impartial investment management. With airSlate SignNow, you can streamline the documentation process required for a blind trust, making it simple to manage your legal obligations efficiently. This empowers you to focus on your financial growth while ensuring compliance.

-

How does airSlate SignNow support the creation of a blind trust?

airSlate SignNow provides an intuitive platform for preparing and signing all necessary documents related to creating a blind trust. Our eSignature tools ensure that you can securely sign critical agreements online, eliminating the need for paper-based processes. This not only saves you time but also enhances the security of your confidential information.

-

What types of documents do I need to create a blind trust?

To create a blind trust, you typically need a trust agreement, powers of attorney, and any relevant financial documents. AirSlate SignNow simplifies the preparation and signing of these documents, allowing you to manage the entire process online. This ensures that you have all necessary paperwork in order to establish your blind trust legally and efficiently.

-

Is airSlate SignNow affordable for small businesses looking to set up a blind trust?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for businesses of all sizes, including small businesses. Our platform allows you to sign and send documents needed for establishing a blind trust without breaking the bank. This affordability ensures that even small enterprises can securely manage their legal documents.

-

Can I integrate airSlate SignNow with other software for managing my blind trust?

Absolutely! airSlate SignNow seamlessly integrates with various applications and tools that businesses already use, such as CRM systems and document management software. This capability allows you to manage all aspects of your blind trust process in one place, enhancing your workflow efficiency and convenience.

-

How secure is airSlate SignNow when handling documents related to a blind trust?

AirSlate SignNow prioritizes security and compliance, utilizing advanced encryption and authentication measures to protect your documents. This means that your blind trust agreements are safeguarded against unauthorized access, ensuring that your sensitive information remains confidential. You can confidently rely on our platform to handle your trust-related documents securely.

Get more for Blind Trust

- Philadelphia eh form

- Purchase order request northwest area school district northwest k12 pa form

- Pakeys form

- Application welcome letter york township fire ytfd form

- Extended trip application girl scouts of eastern pennsylvania gsep form

- Interstate adsap form

- Preincident survey form

- The american legion educator of the year award program guide the american legion department of south dakota p sdlegion form

Find out other Blind Trust

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe