FIDUCIARY INCOME TAX RETURN SC Department of Revenue 2020

Understanding the fiduciary income tax return in South Carolina

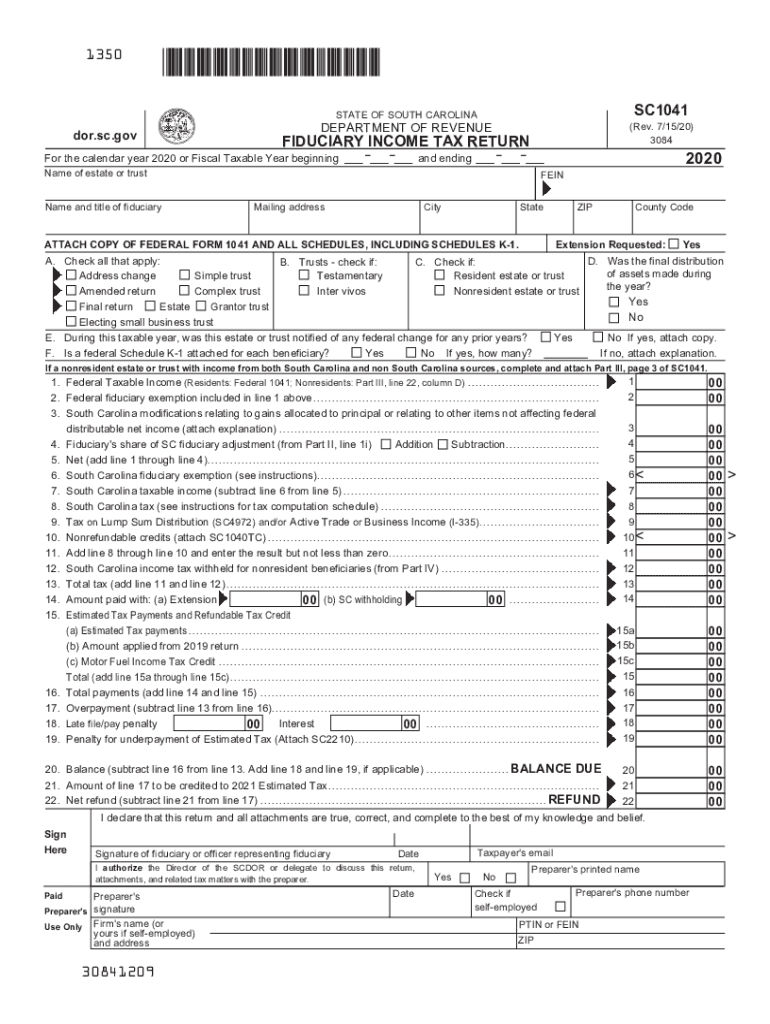

The fiduciary income tax return, known as the SC 1041, is a crucial document for estates and trusts in South Carolina. It is used to report income generated by the assets held within these entities. This form ensures that the fiduciary, or the individual responsible for managing the estate or trust, accurately reports income, deductions, and credits to the South Carolina Department of Revenue. The SC 1041 is essential for compliance with state tax laws and helps determine the tax liability of the estate or trust.

Steps to complete the fiduciary income tax return

Completing the SC 1041 involves several important steps:

- Gather necessary documents, including income statements, expense records, and prior year tax returns.

- Fill out the form accurately, ensuring that all income and deductions are reported correctly.

- Calculate the tax liability based on the income reported and applicable tax rates.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the designated deadline to avoid penalties.

Required documents for filing the SC 1041

When preparing to file the SC 1041, it is essential to have the following documents on hand:

- Income statements for the estate or trust, including interest, dividends, and rental income.

- Records of expenses incurred by the estate or trust, such as management fees and legal costs.

- Prior year tax returns, which can provide valuable information for the current filing.

- Any relevant documentation that supports deductions claimed on the return.

Filing deadlines for the SC 1041

It is important to be aware of the filing deadlines for the SC 1041 to ensure compliance and avoid penalties. Typically, the fiduciary income tax return is due on the 15th day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year basis, this means the return is generally due by April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day.

Legal use of the SC 1041

The SC 1041 serves as a legal document that must be filed to report the income and deductions of estates and trusts. Proper completion and submission of this form are essential to meet South Carolina tax obligations. Failure to file the SC 1041 can result in penalties and interest on unpaid taxes. It is important for fiduciaries to understand their responsibilities and ensure that the form is filed accurately and on time.

Digital vs. paper version of the SC 1041

Filing the SC 1041 can be done either digitally or via paper submission. The digital version offers several advantages, including easier data entry, automatic calculations, and the ability to store records electronically. On the other hand, paper submissions may be preferred by those who are more comfortable with traditional methods. Regardless of the chosen method, it is crucial to ensure that the form is filled out correctly and submitted by the deadline.

Quick guide on how to complete fiduciary income tax return sc department of revenue

Complete FIDUCIARY INCOME TAX RETURN SC Department Of Revenue effortlessly on any gadget

Digital document management has gained increased traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can access the needed form and securely archive it online. airSlate SignNow equips you with all the necessary resources to create, modify, and eSign your documents promptly without delays. Handle FIDUCIARY INCOME TAX RETURN SC Department Of Revenue on any device with airSlate SignNow Android or iOS applications and enhance any document-centric function today.

The most effective method to alter and eSign FIDUCIARY INCOME TAX RETURN SC Department Of Revenue with ease

- Obtain FIDUCIARY INCOME TAX RETURN SC Department Of Revenue and then select Get Form to commence.

- Utilize the features we provide to complete your document.

- Mark signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from a device of your choosing. Modify and eSign FIDUCIARY INCOME TAX RETURN SC Department Of Revenue and ensure smooth communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiduciary income tax return sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the fiduciary income tax return sc department of revenue

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is the tax form sc1041 used for?

The tax form sc1041 is used for filing income tax returns for estates and trusts in South Carolina. It allows fiduciaries to report income, deductions, and credits on behalf of the estate or trust. Understanding this form is crucial for compliance and accurate reporting of taxable income.

-

How can airSlate SignNow help with tax form sc1041?

airSlate SignNow simplifies the process of filling out and signing your tax form sc1041. With our user-friendly interface, you can easily upload, fill, and eSign your documents anytime, ensuring that you complete your tax obligations efficiently. Our solution streamlines workflow and saves valuable time during tax season.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers competitive pricing plans to accommodate various business needs, including those related to tax document management like tax form sc1041. With affordable subscription options, you can choose a plan that fits your budget while still benefiting from our secure, reliable eSign capabilities.

-

What features does airSlate SignNow offer for the tax form sc1041?

airSlate SignNow provides an array of features tailored for processing the tax form sc1041, including customizable templates, automated workflows, and cloud storage. These features enhance efficiency and help eliminate common errors when completing tax forms. Additionally, our mobile app allows you to manage your documents on the go.

-

Can I integrate airSlate SignNow with my existing tax software?

Absolutely! airSlate SignNow offers integrations with various tax software solutions to streamline your workflow when handling tax form sc1041. This means you can seamlessly transfer data and documents between applications, reducing duplication of effort and ensuring accuracy in your submissions.

-

What are the benefits of using airSlate SignNow for documents like tax form sc1041?

Using airSlate SignNow for your tax form sc1041 provides several benefits including increased efficiency, enhanced security, and easy access to documents. Our secure platform ensures sensitive information is protected, while eSigning capabilities speed up the overall process. With instant access to signed documents, managing your tax responsibilities becomes hassle-free.

-

How secure is the information when using airSlate SignNow for tax form sc1041?

Security is a top priority at airSlate SignNow. We implement robust security measures such as SSL encryption, secure cloud storage, and advanced authentication protocols to protect your data while working with tax form sc1041. You can confidently handle sensitive information knowing it is safeguarded throughout the signing process.

Get more for FIDUCIARY INCOME TAX RETURN SC Department Of Revenue

Find out other FIDUCIARY INCOME TAX RETURN SC Department Of Revenue

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe