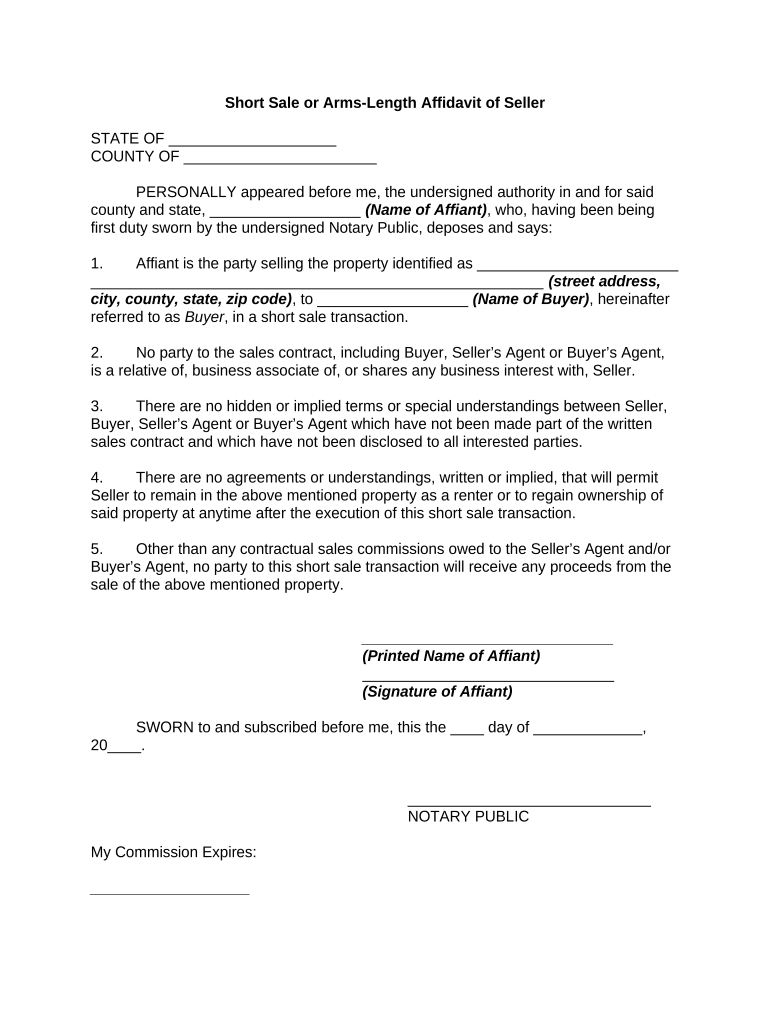

Short Sale Arms Form

What is the short sale arms length?

The short sale arms length refers to a transaction in which a property is sold for less than the amount owed on the mortgage, with the approval of the lender. This process is designed to ensure that the sale is conducted fairly and without collusion between the buyer and seller. In an arms length transaction, both parties act in their own self-interest, which helps to establish the legitimacy of the sale. This is particularly important in the context of short sales, as lenders want to ensure they are receiving a fair market value for the property.

Key elements of the short sale arms length

Several key elements define a short sale arms length transaction:

- Independent Parties: Both the buyer and seller must operate independently, without any prior relationship that could influence the transaction.

- Fair Market Value: The sale price should reflect the fair market value of the property, ensuring that the lender receives a reasonable offer.

- Disclosure: Both parties must disclose any relevant information that could affect the sale, including liens or other encumbrances on the property.

- Approval from Lender: The lender must approve the sale, confirming that it meets their criteria for a short sale.

Steps to complete the short sale arms length

Completing a short sale arms length transaction involves several steps:

- Consult with a Real Estate Professional: Engage a real estate agent experienced in short sales to guide you through the process.

- Prepare Required Documents: Gather necessary documents, including financial statements and a hardship letter, to submit to the lender.

- List the Property: List the property for sale at a price that reflects its fair market value.

- Receive Offers: Review offers from potential buyers, ensuring they are legitimate arms length transactions.

- Submit Offer to Lender: Once an acceptable offer is received, submit it to the lender for approval.

- Close the Sale: Upon lender approval, complete the sale and transfer ownership of the property.

Legal use of the short sale arms length

Legally, the short sale arms length must adhere to specific guidelines to ensure compliance with local and federal laws. This includes the necessity of transparency in the transaction, as well as the requirement for both parties to act in good faith. Failure to comply with these legal standards can result in penalties, including the potential for the lender to reject the short sale or pursue further action against the parties involved. It is essential to maintain proper documentation throughout the process to protect all parties legally.

Required documents for the short sale arms length

To successfully navigate a short sale arms length transaction, certain documents are required:

- Hardship Letter: A letter explaining the financial difficulties faced by the seller.

- Financial Statements: Documentation detailing the seller's current financial situation, including income and expenses.

- Listing Agreement: A contract with a real estate agent to market the property.

- Purchase Agreement: The agreement between the buyer and seller outlining the terms of the sale.

- Comparative Market Analysis: A report showing the fair market value of the property, often provided by the real estate agent.

Examples of using the short sale arms length

Examples of short sale arms length transactions can vary widely, but they typically involve situations where homeowners face financial hardship. For instance, a family may need to sell their home due to job loss or medical expenses. In these cases, they would work with a real estate agent to list the property at a fair market value. Once an offer is received, the seller submits it to the lender for approval, demonstrating that the transaction meets the arms length criteria. Another example could involve a property that has significantly decreased in value due to market conditions, prompting the owner to seek a short sale to avoid foreclosure.

Quick guide on how to complete short sale arms

Handle Short Sale Arms seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly replacement for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Short Sale Arms on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Short Sale Arms easily

- Obtain Short Sale Arms and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details using the tools that airSlate SignNow offers specifically for that use.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Short Sale Arms to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a short sale arms length transaction?

A short sale arms length transaction refers to a property sale where the seller's bank agrees to accept less than the mortgage balance due. This type of transaction is crucial in facilitating a smooth selling process and avoiding foreclosure. Ensuring the sale is arms length helps maintain transparency and integrity in the transaction.

-

How does airSlate SignNow support short sale arms length transactions?

airSlate SignNow offers a seamless electronic signature platform that simplifies the process of handling documents related to short sale arms length transactions. With features like document templates and secure signing, it allows users to efficiently manage their paperwork while ensuring compliance and legality. This greatly reduces the time needed to finalize agreements.

-

What are the benefits of using airSlate SignNow for short sale arms length deals?

Using airSlate SignNow for short sale arms length deals provides signNow benefits such as reduced paperwork processing time and enhanced security. The platform ensures that all parties can sign documents remotely, making it convenient for both buyers and sellers. Additionally, the audit trail feature keeps track of all document activities for peace of mind.

-

Is there a specific pricing model for short sale arms length transactions with airSlate SignNow?

airSlate SignNow offers flexible pricing plans suitable for handling short sale arms length transactions effectively. Users can choose from various subscription tiers based on their transaction volume and feature needs. It's important to review the plans to select one that aligns with your business requirements and budget.

-

Can airSlate SignNow integrate with real estate platforms for short sale arms length transactions?

Yes, airSlate SignNow can integrate with various real estate platforms, making it ideal for managing short sale arms length transactions. This integration allows users to sync their documents and streamline the workflow between different applications. It ultimately enhances efficiency and helps keep all related documents in one place.

-

What features does airSlate SignNow offer that are beneficial for short sale arms length processes?

AirSlate SignNow supports features like bulk sending, templates, and secure cloud storage, which are especially beneficial for short sale arms length processes. These functionalities enable users to manage transactions smoothly and efficiently. Additionally, the user-friendly interface makes it easy for all parties to navigate the signing process.

-

How does airSlate SignNow ensure security during short sale arms length transactions?

AirSlate SignNow prioritizes security during short sale arms length transactions by implementing industry-standard encryption and robust authentication methods. Documents are securely stored in the cloud, protecting sensitive information from unauthorized access. These security measures offer peace of mind for all parties involved in the transaction.

Get more for Short Sale Arms

Find out other Short Sale Arms

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT