R 1, Business Registration Form Virginia Tax 2022

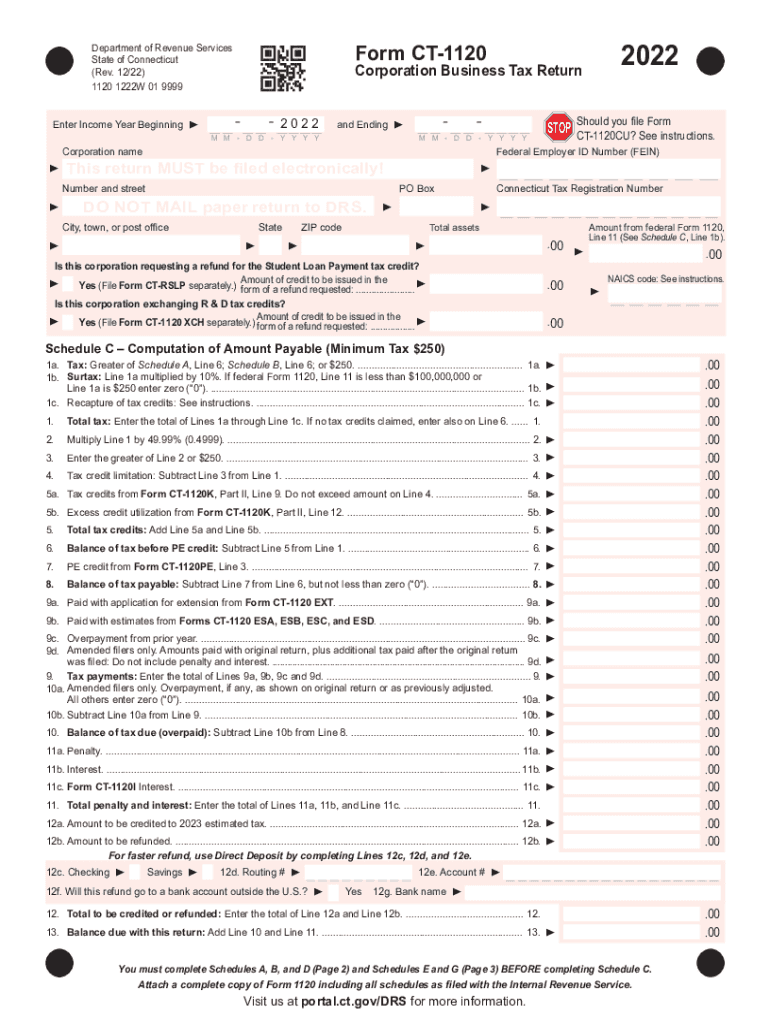

Understanding the CT 1120 Form

The CT 1120 form, also known as the Connecticut Corporation Business Tax Return, is essential for corporations operating in Connecticut. This form is used to report income, calculate tax liability, and ensure compliance with state tax regulations. It is important for businesses to accurately complete this form to avoid penalties and ensure proper tax reporting.

Steps to Complete the CT 1120 Form

Completing the CT 1120 form requires careful attention to detail. Here are the steps to follow:

- Gather financial documents, including profit and loss statements, balance sheets, and any relevant tax documents.

- Fill out the form with accurate financial information, ensuring that all income, deductions, and credits are reported.

- Calculate the corporation's tax liability based on the information provided on the form.

- Review the completed form for accuracy before submission.

Filing Deadlines for the CT 1120 Form

Corporations must be aware of the filing deadlines associated with the CT 1120 form. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the due date is April 15. If additional time is needed, businesses can file for an extension using the CT 1120 EXT form.

Required Documents for CT 1120 Submission

When filing the CT 1120 form, certain documents are necessary to support the information reported. These may include:

- Financial statements, such as balance sheets and income statements.

- Supporting documentation for deductions and credits claimed.

- Previous tax returns, if applicable, for reference.

Penalties for Non-Compliance with CT 1120 Regulations

Failure to file the CT 1120 form on time or inaccuracies in reporting can lead to penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for corporations to adhere to filing requirements to avoid these consequences.

Digital vs. Paper Version of the CT 1120 Form

The CT 1120 form can be completed and submitted either digitally or on paper. The digital version offers benefits such as easier data entry, automatic calculations, and faster submission times. However, some businesses may prefer the traditional paper method. Regardless of the method chosen, ensuring accuracy is essential for compliance.

Quick guide on how to complete r 1 business registration form virginia tax

Accomplish R 1, Business Registration Form Virginia Tax effortlessly on any device

Online document administration has become increasingly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Manage R 1, Business Registration Form Virginia Tax on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign R 1, Business Registration Form Virginia Tax with ease

- Locate R 1, Business Registration Form Virginia Tax and select Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant portions of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign R 1, Business Registration Form Virginia Tax and ensure remarkable communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r 1 business registration form virginia tax

Create this form in 5 minutes!

How to create an eSignature for the r 1 business registration form virginia tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 1120 form?

The CT 1120 form is a business tax return required for corporations operating in Connecticut. It is essential for accurately reporting income, calculating taxes owed, and ensuring compliance with state regulations. Completing the CT 1120 form correctly helps businesses avoid penalties.

-

How can airSlate SignNow assist with the CT 1120 form?

airSlate SignNow simplifies the process of completing and submitting the CT 1120 form by allowing users to eSign documents securely and easily. Our platform streamlines document workflows, ensuring compliance while saving time on paperwork. This efficiency enhances accuracy and reduces stress during tax season.

-

What features does airSlate SignNow offer for handling the CT 1120 form?

With airSlate SignNow, users can create, send, and eSign the CT 1120 form seamlessly. Our platform offers customizable templates, in-app annotations, and secure storage for all your important documents. These features help ensure that all relevant information is captured accurately on the CT 1120 form.

-

Is airSlate SignNow affordable for small businesses needing to file the CT 1120 form?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses handling the CT 1120 form. We provide various subscription options, allowing businesses of any size to choose a plan that fits their budget and needs. Our goal is to provide an accessible solution without compromising on quality.

-

Can I integrate airSlate SignNow with other software for the CT 1120 form?

Absolutely! airSlate SignNow supports integrations with various applications that can help streamline the process of preparing and filing the CT 1120 form. Whether you use accounting software or document management tools, our platform connects easily with your existing workflows for better efficiency.

-

What are the benefits of using airSlate SignNow for the CT 1120 form?

Using airSlate SignNow offers numerous benefits for managing the CT 1120 form, including increased efficiency, enhanced security, and improved collaboration. Our platform allows for real-time updates and notifications, ensuring everyone involved is informed and can respond quickly. This makes the tax filing process smoother and less stressful.

-

How secure is airSlate SignNow when filing the CT 1120 form?

Security is a top priority at airSlate SignNow. We employ advanced encryption and secure servers to protect sensitive data when filling out and submitting the CT 1120 form. Our compliance with industry standards ensures that your information remains safe throughout the eSigning process.

Get more for R 1, Business Registration Form Virginia Tax

- Letter from tenant to landlord about illegal entry by landlord tennessee form

- Letter from landlord to tenant about time of intent to enter premises tennessee form

- Letter tenant notice 497326748 form

- Letter from tenant to landlord about sexual harassment tennessee form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children tennessee form

- Notice termination landlord form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497326752 form

- Tennessee tenant landlord 497326753 form

Find out other R 1, Business Registration Form Virginia Tax

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms