Form Ct 1120 Att Instructions 2020

What is the Form CT 1120?

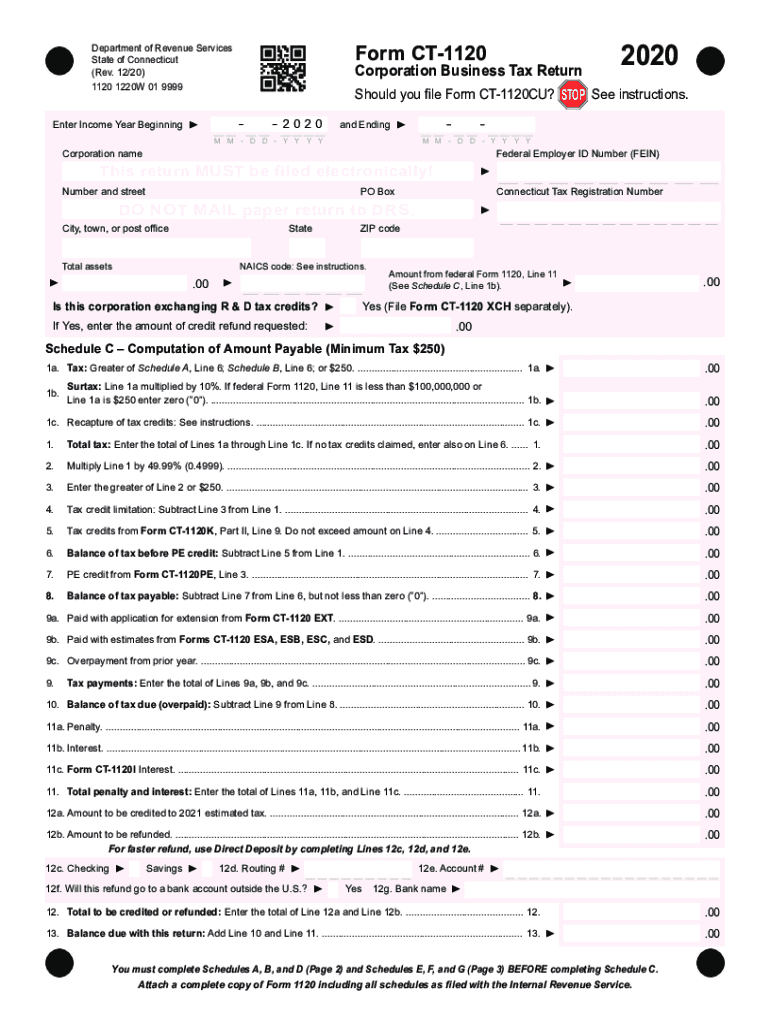

The Form CT 1120 is the Connecticut Corporation Business Tax Return. It is used by corporations doing business in Connecticut to report their income and calculate the tax owed to the state. This form is essential for compliance with state tax regulations and is required for all domestic and foreign corporations operating within Connecticut. The form captures various financial data, including gross income, deductions, and credits that may apply to the corporation.

Steps to Complete the Form CT 1120

Completing the Form CT 1120 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the corporation’s identification information, including the name, address, and federal Employer Identification Number (EIN).

- Report total income and allowable deductions in the appropriate sections of the form.

- Calculate the corporation's tax liability based on the income reported.

- Review the completed form for accuracy and ensure all required signatures are included.

Filing Deadlines / Important Dates

Corporations must file the Form CT 1120 by the 15th day of the fourth month following the end of their fiscal year. For most corporations operating on a calendar year, this means the deadline is April 15. Extensions may be requested, but it is essential to file the extension form (Form CT-1120 EXT) by the original due date to avoid penalties.

Required Documents

To successfully complete the Form CT 1120, corporations should prepare the following documents:

- Income statements and balance sheets for the reporting period.

- Records of any deductions or credits claimed.

- Federal tax return, as it may provide necessary information for state filing.

- Any supporting documentation for special deductions or credits.

Form Submission Methods

The Form CT 1120 can be submitted through various methods:

- Electronically through the Connecticut Department of Revenue Services (DRS) e-Services portal.

- By mail, sending the completed form to the appropriate address provided by the DRS.

- In-person at designated DRS offices, if necessary.

Legal Use of the Form CT 1120

The Form CT 1120 is legally binding and must be completed accurately to reflect the corporation's financial activities. Filing this form ensures compliance with Connecticut tax laws, and failure to file or inaccuracies can lead to penalties or audits. Corporations should maintain copies of submitted forms and supporting documents for record-keeping and potential future reference.

Quick guide on how to complete form ct 1120 att instructions 2020

Effortlessly Prepare Form Ct 1120 Att Instructions on Any Device

Online document administration has gained popularity among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to locate the required form and store it securely online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without complications. Manage Form Ct 1120 Att Instructions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Form Ct 1120 Att Instructions with Ease

- Locate Form Ct 1120 Att Instructions and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Form Ct 1120 Att Instructions and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1120 att instructions 2020

Create this form in 5 minutes!

How to create an eSignature for the form ct 1120 att instructions 2020

The best way to create an e-signature for your PDF in the online mode

The best way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an e-signature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an e-signature for a PDF on Android OS

People also ask

-

What is Form CT 1120?

Form CT 1120 is a Connecticut corporation business tax return that corporations must file annually. This form is crucial for reporting income and calculating tax obligations to the state. Proper completion of Form CT 1120 ensures compliance with state regulations and avoids potential penalties.

-

How can airSlate SignNow help with Form CT 1120?

airSlate SignNow simplifies the eSigning process for Form CT 1120 by enabling businesses to send and sign documents electronically. The platform allows users to create, send, and manage their Form CT 1120 with ease. It streamlines workflows and ensures that all signatures are legally binding and securely stored.

-

Is there a cost associated with using airSlate SignNow for Form CT 1120?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including those who regularly file Form CT 1120. The cost varies based on the features and the number of users you need. This investment can lead to signNow time savings and increased efficiency in your tax filing process.

-

Can I integrate airSlate SignNow with other tools for Form CT 1120 management?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications such as Salesforce, Google Workspace, and more. These integrations enhance your workflow when managing Form CT 1120, making it easier to collaborate and share necessary documents.

-

What features does airSlate SignNow provide for efficient filing of Form CT 1120?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure cloud storage for documents. These tools are designed to enhance the overall user experience while filing Form CT 1120. Additionally, its user-friendly interface ensures that you can complete documents quickly and accurately.

-

What are the benefits of using airSlate SignNow for my Form CT 1120 filings?

Using airSlate SignNow for your Form CT 1120 filings offers numerous benefits, including reduced paperwork, faster turnaround times, and enhanced document security. You can easily track the status of your form and ensure timely submissions. This leads to a more efficient process, ultimately saving your business time and resources.

-

Is airSlate SignNow legally compliant for eSigning Form CT 1120?

Yes, airSlate SignNow's eSignature feature is compliant with the ESIGN Act and UETA, ensuring that your electronically signed Form CT 1120 is legally valid. This compliance provides confidence that your documents meet all regulatory requirements. Thus, you can worry less about legal issues and focus more on your business operations.

Get more for Form Ct 1120 Att Instructions

- State tax form

- Fillable online personal identifiers on it such as social security form

- Redacting personal identifiersprotecting sensitive information in

- Local property complaint packet nj courts form

- Note in a tax court complaint where the form

- Attorneypro se name form

- 4 ways to change your name in new jersey wikihow form

- El salvador cdigo de procedimientos civiles refworld form

Find out other Form Ct 1120 Att Instructions

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament