Form Ct 1120 2016

What is the Form CT 1120

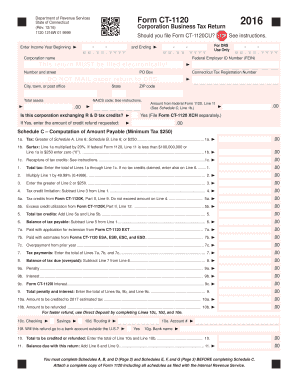

The Form CT 1120 is the Connecticut Corporation Business Tax Return, which corporations operating in Connecticut must file annually. This form is essential for reporting the income, deductions, and credits of a corporation, ensuring compliance with state tax laws. It is specifically designed for C corporations, which are taxed separately from their owners. Understanding the purpose of this form is crucial for accurate tax reporting and maintaining good standing with the state.

How to use the Form CT 1120

Using the Form CT 1120 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by entering the required information, such as gross income, deductions, and tax credits. After completing the form, review it for accuracy before signing and submitting it. Corporations can file the form electronically or via mail, depending on their preference and compliance requirements.

Steps to complete the Form CT 1120

Completing the Form CT 1120 requires careful attention to detail. Follow these steps:

- Begin by entering the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other income sources.

- Deduct allowable expenses, such as operating costs and depreciation.

- Calculate the corporation's taxable income by subtracting total deductions from total income.

- Apply any available tax credits to reduce the overall tax liability.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Form CT 1120. The standard due date for filing is the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically falls on April 15. If additional time is needed, corporations may file for an extension, which grants an additional six months to submit the return. However, it is important to note that any taxes owed must still be paid by the original due date to avoid penalties.

Legal use of the Form CT 1120

The Form CT 1120 serves a legal purpose in the context of state taxation. It is a formal declaration of a corporation's financial activity and tax obligations to the state of Connecticut. Filing this form accurately is essential for compliance with state tax laws. Failure to file or inaccuracies in the form can lead to penalties, interest on unpaid taxes, and potential legal repercussions. Therefore, understanding the legal implications of the Form CT 1120 is crucial for all corporations operating in Connecticut.

Who Issues the Form

The Form CT 1120 is issued by the Connecticut Department of Revenue Services (DRS). This state agency is responsible for administering tax laws and ensuring compliance among corporations operating within Connecticut. The DRS provides guidelines and resources related to the form, including instructions for completion and submission. Corporations can access the form and related materials through the DRS website or by contacting the agency directly for assistance.

Quick guide on how to complete form ct 1120 xch ctgov

Your assistance manual on how to prepare your Form Ct 1120

If you’re looking to understand how to generate and dispatch your Form Ct 1120, here are a few brief instructions on how to simplify tax reporting signNowly.

Initially, you just need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, generate, and finalize your tax documents with ease. Utilizing its editor, you can toggle between text, check boxes, and digital signatures and return to modify information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to finish your Form Ct 1120 in no time:

- Establish your account and commence working on PDFs almost immediately.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your Form Ct 1120 in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally recognized eSignature (if necessary).

- Examine your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Kindly note that submitting on paper can increase return mistakes and postpone refunds. Furthermore, prior to e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1120 xch ctgov

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

How does a radiologist tell from CT coronary scan results whether an atherosclerotic plaque is calcified or not? How accurate is a CT scan to work out a calcium score?

CT is exquisitely sensitive to differences in x-ray attenuation. So, in the case of coronary artery plaque, it is relatively easy to quantify (and see) how much calcium is present versus how much soft tissue. I think, therefore,that coronary artery calcium score is considered a pretty good predictor of cardiac risk. In addition, however, there are features of the plaque such as remodelling and low attenuation that can be seen that cause the plaque to be considered 'high risk plaque’ that can also add to the predictve value of the test. Overall, I think coronary artery calcium scoring is considered a reliable test.

-

How do I get updates about the government jobs to fill out the form?

Employment news is the best source to know the notifications published for govt job vacancy. The details are given in the notices. The news available on net also. One can refer the news on net too. It is published regularly on weekly basis. This paper includes some good article also written by experts which benefits the students and youths for improving their skill and knowledge. Some time it gives information regarding carrier / institution/ special advance studies.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How correct is it to criticise Jadeja so much after that run out in the CT 2017 final?

Place: - country full of Indian since 1600Event :- political cricketTime :- 2nd innings of Harassment.Over no. 26.3 - jadeja dabbed the the ball straight to fielder and a young hot blooded homosapien run almost blindly....and after that the whole started to so called "troll" jadeja....Its not the first time that this happens in indian cricket....Let's head back to 1975.....a young short heigheted without helmet man faced one of the best team and trying to chase 338 by making174 ball 36...In 2003 .... a master who couldn't be able to keep his promise which he made to indian cricket fansIn 2007 .... a flamboyant new indian batsmen who is yet to be so mature to understand the political system of Indian cricket supporters...was under the scrutiny of the so called indian fans ......In 2014 .... a former cancer patient who is redefining passion made a 21 ball 12 in a world TT finals.....In 2015 .... another bearded man faced the best team at that time and made a 10 ball 1 while chasing 326....Ok!!!! So don't scratch your head by thinking " why on earth this boy is mentioning these stats to me".....so as I know everybody almost follow cricket ...You know there were 2 common things between these players in the stats above....one, at that time they were playing one of their best cricket ever in their career ( eliminate 1975 as I was yet to come in the list of Indian cricket fans)....two, they were brutally criticised world wide for these acts ......Its quite funny that sometime your small decision can turn into a disaster for not only for you but also for your families....as an Indian cricket fan ...when I look back into these situation I feel sorry for the critics....because the irony is that the one who is criticising in their home or in a group in "chai pe charcha" or sitting in an ac chamber of a newsroom ( that not includes everyone ) is justifying the ones who are the worldwide recigonised legends of the game of cricket.....And for the upcoming indian legends I saw no hope for evasion either......But as a jharkhand citizen I learnt to hope , quite a bit....so I hope that may be some western breeze will blow our minds towards good fanaticism. ....

-

How can I get interested MRI and CT scan engineers to form a maintenance group to serve a fast growing African market?

Cash and equity in the company.There is a huge number of older service engineers who have been waiting decades to move up, manage, or do more. They are excellent teachers, know the depths of the system, can scrounge parts when customers sell old machines for scrap. They usually feel highly undervalued.Cash, Equity, and Respect. Don’t BS them, explain the risk reward, give them cash and a percentage of the business, don’t micromanage them. They tend to be easy to find on LinkedIn, especially with smaller companies.If you need some references, let me know.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the form ct 1120 xch ctgov

How to create an electronic signature for the Form Ct 1120 Xch Ctgov online

How to generate an eSignature for the Form Ct 1120 Xch Ctgov in Google Chrome

How to make an eSignature for putting it on the Form Ct 1120 Xch Ctgov in Gmail

How to generate an electronic signature for the Form Ct 1120 Xch Ctgov straight from your mobile device

How to generate an electronic signature for the Form Ct 1120 Xch Ctgov on iOS devices

How to make an electronic signature for the Form Ct 1120 Xch Ctgov on Android OS

People also ask

-

What is Form Ct 1120 and how can airSlate SignNow help?

Form Ct 1120 is the Connecticut corporation tax return form used by businesses operating in the state. airSlate SignNow simplifies the process of filling, signing, and sending Form Ct 1120 electronically. With our user-friendly interface, you can easily prepare your tax documents and ensure compliance with state requirements.

-

Is airSlate SignNow suitable for filing Form Ct 1120?

Yes, airSlate SignNow is highly suitable for filing Form Ct 1120. Our platform enables you to create, edit, and sign your tax documents securely and efficiently. This ensures that your Form Ct 1120 is filed correctly and on time, reducing the risk of errors and penalties.

-

What are the pricing options for using airSlate SignNow for Form Ct 1120?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you're a small business or a large corporation, our plans allow you to manage Form Ct 1120 efficiently without breaking the bank. You can choose a plan that fits your budget and get started with ease.

-

Can I integrate airSlate SignNow with other software for filing Form Ct 1120?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making the process of filing Form Ct 1120 even easier. This integration allows you to import your data directly and streamline the workflow, saving you time and reducing errors.

-

What features does airSlate SignNow offer for completing Form Ct 1120?

airSlate SignNow provides a range of features that enhance the experience of completing Form Ct 1120. These include customizable templates, electronic signatures, and secure cloud storage. With these tools, you can ensure that your tax documents are accurate and easily accessible.

-

How secure is my data when using airSlate SignNow to file Form Ct 1120?

The security of your data is our top priority at airSlate SignNow. When you use our platform to manage Form Ct 1120, your information is protected with industry-standard encryption and secure cloud storage. You can trust that your sensitive data is safe while you focus on your business.

-

Can I track the status of my Form Ct 1120 using airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Form Ct 1120 seamlessly. You can receive notifications when documents are viewed, signed, and completed, giving you full visibility throughout the filing process. This feature helps ensure that you stay informed and on schedule.

Get more for Form Ct 1120

- Furniture specification sheet template form

- How to apply for privilege licenses in chicago illinois form

- Passenger arrival card new zealand customs service form

- New york criminal history record check form

- Attendant form 23647842

- Anything form 100095924

- Oregon metal detecting permit form

- Hypertension disability benefits questionnaire nam form

Find out other Form Ct 1120

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple