Paper Return to DRS 2019

What is the Paper Return To DRS

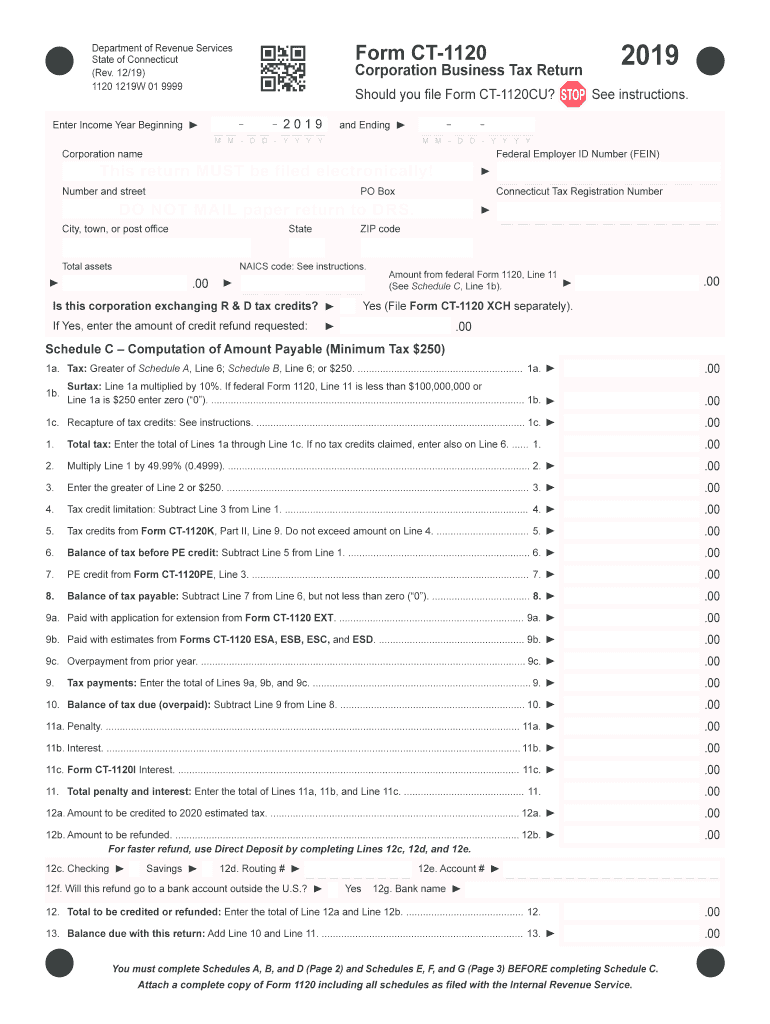

The Paper Return to the Department of Revenue Services (DRS) refers to the traditional method of filing the Connecticut Corporation Business Tax Return, known as Form CT-1120. This form is essential for corporations operating in Connecticut, as it reports income, deductions, and tax liability. The paper return must be completed accurately to ensure compliance with state tax laws and to avoid penalties associated with incorrect filings.

Steps to complete the Paper Return To DRS

Completing the Paper Return to DRS involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Download the Form CT-1120 from the DRS website or obtain a physical copy from their office.

- Fill out the form, ensuring that all sections are completed accurately, including income, deductions, and credits.

- Review the completed form for accuracy and ensure all required signatures are included.

- Submit the form by mailing it to the appropriate DRS address, ensuring it is postmarked by the filing deadline.

Legal use of the Paper Return To DRS

The legal use of the Paper Return to DRS is governed by Connecticut state tax laws. Corporations must file this return to fulfill their tax obligations. Failure to submit the return can result in penalties and interest charges. It is crucial that all information provided is truthful and accurate, as discrepancies may lead to audits or legal actions by the state.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines for the Paper Return to DRS. Typically, the due date for Form CT-1120 is the fifteenth day of the fourth month following the end of the corporation's fiscal year. For most corporations operating on a calendar year, this means the return is due by April 15. Extensions may be available, but they must be filed properly to avoid penalties.

Required Documents

When preparing to file the Paper Return to DRS, certain documents are necessary to ensure accurate reporting. These include:

- Financial statements, including income statements and balance sheets.

- Documentation of any tax credits or deductions claimed.

- Previous year's tax returns for reference.

- Any additional schedules required by the form, such as those for apportionment or special deductions.

Form Submission Methods (Online / Mail / In-Person)

The Paper Return to DRS can be submitted through various methods, although the primary method is by mail. Corporations must print and sign the completed form before mailing it to the appropriate DRS address. While electronic filing options may exist for other forms, the Paper Return must be physically submitted. In-person submissions are generally not recommended, but may be possible at DRS offices during business hours.

Quick guide on how to complete paper return to drs

Complete Paper Return To DRS seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Paper Return To DRS on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related processes today.

How to modify and eSign Paper Return To DRS with ease

- Locate Paper Return To DRS and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight essential parts of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign Paper Return To DRS and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct paper return to drs

Create this form in 5 minutes!

How to create an eSignature for the paper return to drs

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What are the key features of airSlate SignNow related to form ct 1120 instructions 2017?

airSlate SignNow offers a user-friendly platform that simplifies the signing process for documents related to form ct 1120 instructions 2017. Features include customizable templates, easy document sharing, and secure electronic signatures, making compliance with instructions effortless.

-

How can airSlate SignNow help me with filing form ct 1120 for 2017?

With airSlate SignNow, you can easily manage the documentation required for filing form ct 1120 instructions 2017. The platform allows you to edit and sign the necessary forms, providing a streamlined process that ensures you stay compliant and meet deadlines stress-free.

-

Is airSlate SignNow cost-effective for small businesses handling form ct 1120 instructions 2017?

Absolutely! airSlate SignNow offers competitive pricing plans tailored for small businesses, enabling them to efficiently manage their document needs—including form ct 1120 instructions 2017—without breaking the bank. Its affordable solutions save time and reduce administrative overhead.

-

Can I integrate airSlate SignNow with other software to streamline form ct 1120 instructions 2017?

Yes, airSlate SignNow offers seamless integrations with popular software like Google Drive, Dropbox, and various CRM systems. This allows you to sync your workflow efficiently while managing documents related to form ct 1120 instructions 2017 without leaving your primary tools.

-

What benefits does airSlate SignNow provide for eSigning form ct 1120 instructions 2017?

The benefits of using airSlate SignNow for eSigning form ct 1120 instructions 2017 include increased efficiency, enhanced security, and a user-friendly interface. By opting for electronic signatures, businesses can eliminate paper waste and speed up the document approval process.

-

How secure is airSlate SignNow when handling form ct 1120 instructions 2017?

airSlate SignNow prioritizes security with features like encryption, secure cloud storage, and compliance with industry standards. When dealing with sensitive documents like form ct 1120 instructions 2017, you can trust that your data is protected from unauthorized access.

-

What support does airSlate SignNow provide for issues related to form ct 1120 instructions 2017?

airSlate SignNow offers comprehensive customer support that includes live chat, email assistance, and an extensive help center. If you encounter any issues related to form ct 1120 instructions 2017, their support team is ready to guide you through resolving any questions or concerns.

Get more for Paper Return To DRS

- Waiver and release from liability for minor child for duck hunting form

- Waiver liability house 497427241 form

- Waiver and release from liability for adult for scout function form

- Waiver and release from liability for adult for lodge membership form

- Waiver liability land 497427244 form

- Waiver and release from liability for adult for intramural sports form

- Release minor child 497427246 form

- Waiver and release from liability for adult for aerobic sports form

Find out other Paper Return To DRS

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word