Form Ct 1120 2018

What is the Form CT 1120

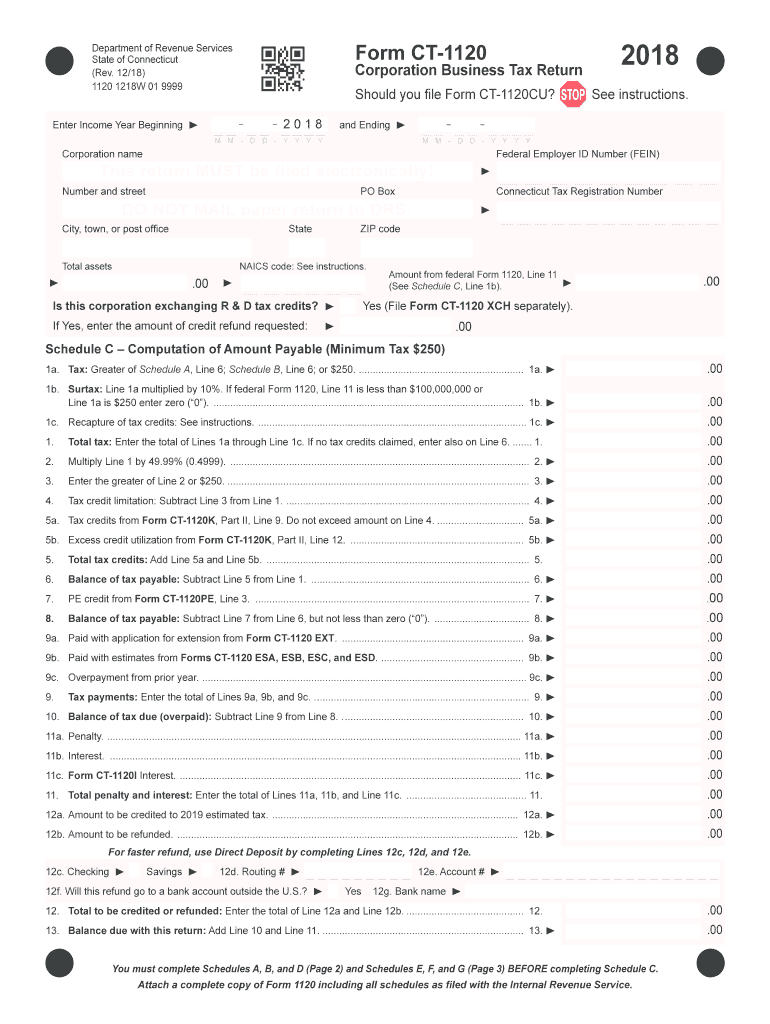

The Form CT 1120 is the Connecticut Corporation Business Tax Return. This tax form is used by corporations operating in the state of Connecticut to report their income, calculate their tax liability, and ensure compliance with state tax regulations. The form is essential for corporations to fulfill their tax obligations and maintain good standing with the Connecticut Department of Revenue Services.

Steps to Complete the Form CT 1120

Completing the Form CT 1120 involves several key steps:

- Gather necessary financial records, including income statements and balance sheets.

- Fill out the identification section, providing the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other income sources.

- Calculate allowable deductions, such as business expenses and losses.

- Determine the corporation's tax liability based on the calculated income and applicable tax rates.

- Sign and date the form, ensuring all information is accurate before submission.

How to Obtain the Form CT 1120

The Form CT 1120 can be obtained through the Connecticut Department of Revenue Services website or by contacting their office directly. It is available in a downloadable PDF format, allowing businesses to print and fill it out manually. Additionally, many tax preparation software programs may include the form, simplifying the filing process for users.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form CT 1120. Generally, the return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically falls on April 15. It is crucial for corporations to file on time to avoid penalties and interest on unpaid taxes.

Legal Use of the Form CT 1120

The Form CT 1120 serves as a legal document for corporations to report their financial activities to the state. Proper completion and timely submission of this form ensure compliance with Connecticut tax laws. Failure to file or inaccurate reporting can result in penalties, interest, and potential legal repercussions for the corporation.

Form Submission Methods

Corporations can submit the Form CT 1120 through various methods:

- Online: Many corporations opt to file electronically through the Connecticut Department of Revenue Services' e-filing system.

- Mail: The completed form can be printed and mailed to the designated address provided in the form instructions.

- In-Person: Corporations may also deliver the form directly to the local Department of Revenue Services office.

Quick guide on how to complete ct 1120 2018 2019 form

Your assistance manual on how to prepare your Form Ct 1120

If you’re interested in understanding how to complete and submit your Form Ct 1120, here are some brief instructions on how to simplify tax submission.

To get started, you just need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an incredibly intuitive and powerful document solution that allows you to modify, generate, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, returning to edit details as necessary. Enhance your tax management with advanced PDF editing, electronic signing, and easy sharing.

Follow the instructions below to complete your Form Ct 1120 in just a few minutes:

- Establish your account and begin editing PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Form Ct 1120 in our editor.

- Populate the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper submissions can lead to increased errors and delays in refunds. Moreover, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 1120 2018 2019 form

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the ct 1120 2018 2019 form

How to make an eSignature for the Ct 1120 2018 2019 Form online

How to create an eSignature for the Ct 1120 2018 2019 Form in Chrome

How to generate an electronic signature for putting it on the Ct 1120 2018 2019 Form in Gmail

How to create an eSignature for the Ct 1120 2018 2019 Form right from your mobile device

How to create an eSignature for the Ct 1120 2018 2019 Form on iOS devices

How to create an eSignature for the Ct 1120 2018 2019 Form on Android

People also ask

-

What are the core features of airSlate SignNow related to form CT 1120 instructions 2017?

AirSlate SignNow offers a range of features tailored for efficiently managing form CT 1120 instructions 2017, including eSignature capabilities, document tracking, and templates. These features simplify the signing process and ensure compliance with filing requirements.

-

How does airSlate SignNow help with the completion of form CT 1120 instructions 2017?

With airSlate SignNow, users can easily fill out and sign form CT 1120 instructions 2017 online. The platform allows for real-time collaboration, enabling teams to complete the necessary forms efficiently and accurately.

-

What is the pricing structure for airSlate SignNow when handling form CT 1120 instructions 2017?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you're looking for a basic eSigning solution or advanced features for handling form CT 1120 instructions 2017, you can find a plan that fits your needs and budget.

-

Can I integrate airSlate SignNow with other applications for form CT 1120 instructions 2017?

Yes, airSlate SignNow supports integration with various popular applications, allowing for seamless workflows when dealing with form CT 1120 instructions 2017. This ensures that your document management processes are streamlined and efficient.

-

What are the benefits of using airSlate SignNow for form CT 1120 instructions 2017?

Using airSlate SignNow for form CT 1120 instructions 2017 streamlines document signing, enhances security, and saves time. The user-friendly interface makes it easy for clients and team members to complete the necessary paperwork without unnecessary delays.

-

Is airSlate SignNow secure for handling sensitive information related to form CT 1120 instructions 2017?

Absolutely, airSlate SignNow employs advanced security measures to protect sensitive data associated with form CT 1120 instructions 2017, including encryption and secure servers. Your documents are safe from unauthorized access while being processed.

-

How can I access support for airSlate SignNow concerning form CT 1120 instructions 2017?

AirSlate SignNow provides robust customer support to assist with any inquiries related to form CT 1120 instructions 2017. You can access a help center, FAQs, and even contact support directly for personalized assistance.

Get more for Form Ct 1120

Find out other Form Ct 1120

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile