Enter Income Year Beginning Corporation Business 2024-2026

Understanding the Enter Income Year Beginning for Corporation Business

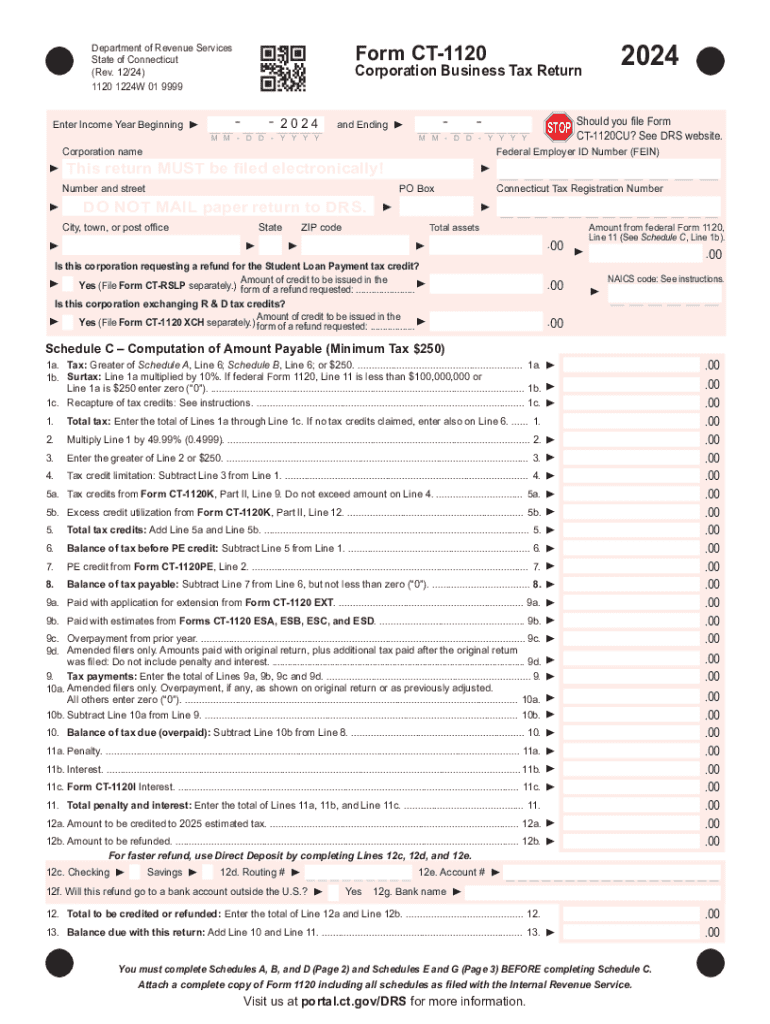

The Enter Income Year Beginning is a crucial component of the tax process for corporations in Connecticut. This section of the tax form allows businesses to specify the starting date of their income year. Accurate reporting of this date is essential for determining the corporation's tax liability and ensuring compliance with state tax regulations. Typically, the income year can align with the calendar year or a fiscal year, depending on how the business is structured.

Steps to Complete the Enter Income Year Beginning

Completing the Enter Income Year Beginning section of the Connecticut 1120 form involves several key steps:

- Identify the appropriate income year for your corporation, either the calendar year or a fiscal year.

- Clearly state the starting date of the income year in the designated field on the form.

- Double-check the date for accuracy to avoid potential issues with tax calculations.

- Ensure that this date aligns with your corporation's accounting practices.

Filing Deadlines for the Connecticut 1120

Corporations must adhere to specific filing deadlines to avoid penalties. For most businesses, the Connecticut 1120 must be filed by the fifteenth day of the fourth month following the end of the income year. If the corporation operates on a calendar year basis, this typically means a due date of April 15. It's important to mark this date on your calendar and prepare your documents in advance to ensure timely submission.

Required Documents for Filing

When preparing to file the Connecticut 1120, certain documents are essential. These include:

- Financial statements that reflect the corporation's income and expenses.

- Supporting documentation for any deductions or credits claimed.

- Previous tax returns, if applicable, to provide context for the current filing.

Having these documents organized can streamline the filing process and help ensure compliance with state regulations.

Penalties for Non-Compliance

Failure to accurately complete and submit the Connecticut 1120 can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal repercussions. It is important for corporations to understand the implications of non-compliance and to take the necessary steps to file correctly and on time.

Digital vs. Paper Version of the Connecticut 1120

Corporations have the option to file the Connecticut 1120 either digitally or via paper submission. Digital filing is often more efficient, allowing for quicker processing times and immediate confirmation of receipt. However, some businesses may prefer the traditional paper method. Regardless of the chosen method, ensuring that all information is accurate and complete is crucial for successful submission.

Create this form in 5 minutes or less

Find and fill out the correct enter income year beginning corporation business

Create this form in 5 minutes!

How to create an eSignature for the enter income year beginning corporation business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tax Connecticut 1120 form?

The tax Connecticut 1120 form is used by corporations to report their income, deductions, and tax liability to the state of Connecticut. This form is essential for businesses operating in Connecticut to ensure compliance with state tax laws. Properly filing the tax Connecticut 1120 helps avoid penalties and ensures that your business remains in good standing.

-

How can airSlate SignNow help with filing the tax Connecticut 1120?

airSlate SignNow simplifies the process of preparing and signing the tax Connecticut 1120 form by providing an easy-to-use platform for document management. With our eSignature capabilities, you can quickly gather necessary signatures from stakeholders, ensuring timely submission. This streamlines your workflow and reduces the risk of errors in your tax filings.

-

What are the pricing options for airSlate SignNow for tax Connecticut 1120 users?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses filing the tax Connecticut 1120. Our plans are designed to be cost-effective, allowing you to choose the features that best suit your requirements. You can start with a free trial to explore our services before committing to a subscription.

-

What features does airSlate SignNow provide for tax Connecticut 1120 preparation?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for preparing the tax Connecticut 1120. These tools help ensure that your documents are accurate and compliant with state regulations. Additionally, our platform allows for easy collaboration among team members, enhancing efficiency.

-

Are there any integrations available with airSlate SignNow for tax Connecticut 1120?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your tax Connecticut 1120 filings. These integrations allow for automatic data transfer, reducing manual entry and minimizing errors. You can connect with popular platforms to streamline your tax preparation process.

-

What are the benefits of using airSlate SignNow for tax Connecticut 1120?

Using airSlate SignNow for your tax Connecticut 1120 filings offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and are easily accessible when needed. Additionally, the eSigning feature speeds up the approval process, allowing you to meet deadlines with ease.

-

Is airSlate SignNow compliant with Connecticut tax regulations?

Absolutely, airSlate SignNow is designed to comply with all relevant Connecticut tax regulations, including those pertaining to the tax Connecticut 1120. Our platform is regularly updated to reflect any changes in state laws, ensuring that your filings are always compliant. This commitment to compliance helps protect your business from potential legal issues.

Get more for Enter Income Year Beginning Corporation Business

- Laser amp skin care consultation form

- Jackson state university application fee waiver form

- Vollmacht power of attorney form

- Dd form 1172 2 march

- Child protection policy template form

- Physical therapy excuse note form

- Civil cover sheet the philadelphia courts courts phila form

- California residency questionnaire saddleback college saddleback form

Find out other Enter Income Year Beginning Corporation Business

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast