Partners Instructions for Schedule K 3 Form 1065 2021Partners Instructions for Schedule K 3 Form 1065 2021Partners Instructions 2022-2026

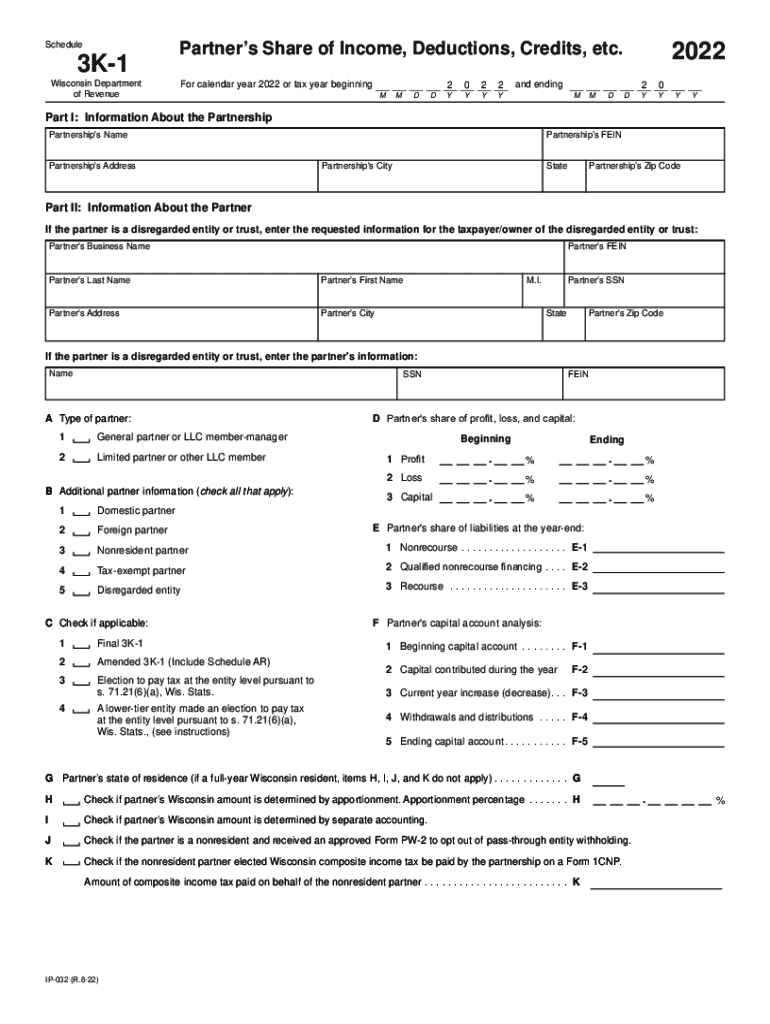

Understanding the Wisconsin Schedule 3K-1 Instructions

The Wisconsin Schedule 3K-1 is a vital tax form used by partnerships to report income, deductions, and credits to their partners. Each partner receives a copy of the Schedule 3K-1, which details their share of the partnership's income, losses, and other tax-related items. Understanding how to read and use this form is essential for accurate tax reporting and compliance.

Steps to Complete the Wisconsin Schedule 3K-1

Completing the Wisconsin Schedule 3K-1 involves several key steps:

- Gather all necessary financial information from the partnership, including income statements and expense reports.

- Fill out the partner's identifying information, including name, address, and taxpayer identification number.

- Report the partner's share of income, deductions, and credits in the appropriate sections of the form.

- Ensure all calculations are accurate and double-check for any errors.

- Provide the completed Schedule 3K-1 to each partner for their records and tax filings.

Legal Use of the Wisconsin Schedule 3K-1

The Wisconsin Schedule 3K-1 is legally binding when filled out correctly and submitted in compliance with state tax regulations. It serves as an official record of a partner's share of the partnership's financial activities, which can be crucial during audits or disputes. Ensuring the form is completed accurately helps maintain transparency and accountability among partners.

Filing Deadlines for the Wisconsin Schedule 3K-1

Filing deadlines for the Wisconsin Schedule 3K-1 typically align with the partnership's tax return due dates. Partnerships must file their returns by the 15th day of the third month following the end of their tax year. For most partnerships operating on a calendar year, this means the deadline is March 15. Partners should receive their Schedule 3K-1 in a timely manner to prepare their individual tax returns accurately.

Required Documents for Completing the Wisconsin Schedule 3K-1

To complete the Wisconsin Schedule 3K-1, several documents are necessary:

- Partnership tax return (Form 1065)

- Income statements detailing the partnership's earnings

- Expense reports to document deductions

- Any applicable supporting documentation for credits or other tax items

Examples of Using the Wisconsin Schedule 3K-1

Partners can use the Wisconsin Schedule 3K-1 in various scenarios:

- A partner in a real estate partnership may report rental income and property depreciation.

- A partner in a service-based business can report their share of income and related expenses.

- Partners involved in investments may report capital gains and losses allocated to them.

Quick guide on how to complete partners instructions for schedule k 3 form 1065 2021partners instructions for schedule k 3 form 1065 2021partners instructions

Complete Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly option to conventional printed and signed paperwork, as you can access the appropriate format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without hindrances. Handle Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and electronically sign Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions smoothly

- Find Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions and press Get Form to initiate.

- Employ the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form hunting, or mistakes that necessitate reprinting new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from a device of your preference. Edit and electronically sign Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partners instructions for schedule k 3 form 1065 2021partners instructions for schedule k 3 form 1065 2021partners instructions

Create this form in 5 minutes!

People also ask

-

What are the Wisconsin 3K 1 instructions?

The Wisconsin 3K 1 instructions provide detailed guidelines for completing and filing certain documents in the state of Wisconsin. These instructions ensure that all necessary information is included and facilitate the proper electronic signing process through platforms like airSlate SignNow.

-

How can airSlate SignNow assist with Wisconsin 3K 1 instructions?

airSlate SignNow simplifies the process of managing Wisconsin 3K 1 instructions by allowing users to easily upload, edit, and eSign documents. The platform streamlines workflows, ensuring compliance with state requirements without unnecessary hassle.

-

Are there any costs associated with using airSlate SignNow for Wisconsin 3K 1 instructions?

Yes, airSlate SignNow offers various pricing plans to fit the needs of individuals and businesses dealing with Wisconsin 3K 1 instructions. These plans provide a cost-effective solution for sending and signing documents while enhancing productivity.

-

What features does airSlate SignNow offer for Wisconsin 3K 1 instructions?

airSlate SignNow offers a range of features designed to streamline the management of Wisconsin 3K 1 instructions, including customizable templates, audit trails, and mobile access. These features not only enhance user experience but also ensure document security.

-

How do I integrate airSlate SignNow with other platforms for Wisconsin 3K 1 instructions?

Integrating airSlate SignNow with other platforms is straightforward, allowing users to seamlessly manage Wisconsin 3K 1 instructions alongside their existing software. The platform offers various integration options with popular apps to enhance productivity.

-

What are the benefits of using airSlate SignNow for eSigning Wisconsin 3K 1 instructions?

Using airSlate SignNow for eSigning Wisconsin 3K 1 instructions provides benefits such as increased efficiency, enhanced security, and ease of use. Users can quickly send and receive signed documents, helping to speed up workflows.

-

Can airSlate SignNow help with multiple Wisconsin 3K 1 instructions at once?

Absolutely! airSlate SignNow allows users to batch process multiple Wisconsin 3K 1 instructions, making it easy to manage numerous documents efficiently. This feature saves time and helps maintain organization within your documentation.

Get more for Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions

- Legal last will and testament form for divorced person not remarried with adult children north carolina

- Legal last will and testament form for divorced person not remarried with no children north carolina

- Legal last will and testament form for divorced person not remarried with minor children north carolina

- North carolina will testament form

- Mutual wills package with last wills and testaments for married couple with adult children north carolina form

- Married couple no form

- Mutual wills package with last wills and testaments for married couple with minor children north carolina form

- Legal last will and testament form for married person with adult children north carolina

Find out other Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions For Schedule K 3 Form 1065 2021Partners Instructions

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself