Wi Schedule 3k 1 Form 2012

What is the Wi Schedule 3k 1 Form

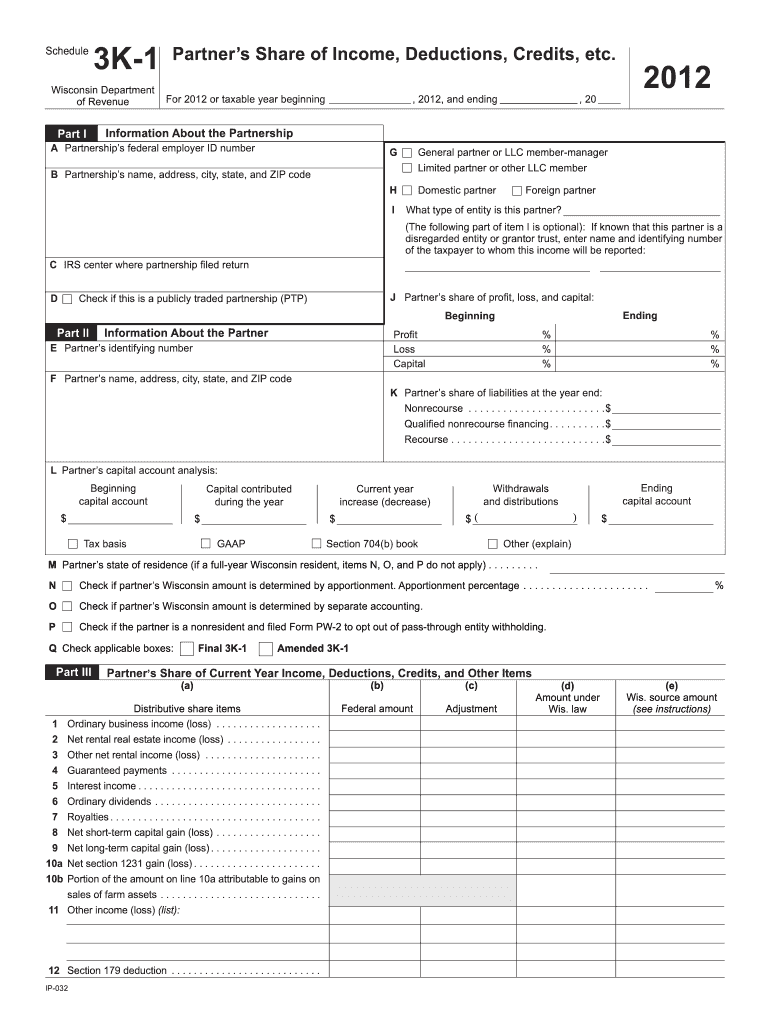

The Wi Schedule 3k 1 Form is a tax document used by partnerships and certain limited liability companies in Wisconsin to report income, deductions, and credits to the state. This form is essential for ensuring that partners receive their share of income and that the state collects the appropriate taxes. Each partner's share of the entity's income, deductions, and credits is reported on this form, which is then distributed to each partner for their individual tax filings.

How to use the Wi Schedule 3k 1 Form

Using the Wi Schedule 3k 1 Form involves several steps. First, the partnership or LLC must complete the form with accurate financial information regarding income, deductions, and credits. Once completed, the form is provided to each partner, who will use the information to report their share of the income on their personal tax returns. It is important to ensure that all data is correctly filled out to avoid discrepancies during tax filing.

Steps to complete the Wi Schedule 3k 1 Form

Completing the Wi Schedule 3k 1 Form requires careful attention to detail. Follow these steps:

- Gather all necessary financial records for the partnership or LLC.

- Fill in the entity's income, deductions, and credits accurately on the form.

- Distribute the completed form to each partner, ensuring they receive their respective shares.

- Review the form for any errors or omissions before submission.

Legal use of the Wi Schedule 3k 1 Form

The Wi Schedule 3k 1 Form is legally required for partnerships and certain LLCs in Wisconsin to report their financial activities. Proper completion and distribution of this form ensure compliance with state tax laws. Failure to file or inaccuracies can result in penalties or audits, making it crucial for entities to adhere to the legal requirements associated with this form.

Key elements of the Wi Schedule 3k 1 Form

Key elements of the Wi Schedule 3k 1 Form include:

- Identification of the partnership or LLC, including its name and tax identification number.

- Detailed reporting of income, deductions, and credits allocated to each partner.

- Signature of an authorized representative of the entity to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Wi Schedule 3k 1 Form typically align with the state tax return deadlines for partnerships and LLCs. Generally, this form must be filed by the due date of the entity's tax return, which is usually the 15th day of the fourth month following the end of the tax year. It is essential to stay informed about any changes to deadlines to avoid late filing penalties.

Quick guide on how to complete wi schedule 3k 1 2012 form

Your assistance manual on how to prepare your Wi Schedule 3k 1 Form

If you’re wondering how to fill out and submit your Wi Schedule 3k 1 Form, here are a few concise directions on how to streamline tax filing.

To begin, you simply need to set up your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, create, and finalize your tax forms with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures, and return to revise details as necessary. Simplify your tax processing with advanced PDF editing, eSigning, and user-friendly sharing.

Execute the following steps to complete your Wi Schedule 3k 1 Form in just a few minutes:

- Create your account and start editing PDFs in no time.

- Explore our catalog to locate any IRS tax document; sift through variations and schedules.

- Press Get form to access your Wi Schedule 3k 1 Form in our editor.

- Complete the necessary fillable sections with your details (text, numbers, check marks).

- Utilize the Sign Tool to insert your legally-recognized eSignature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your gadget.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may lead to more errors and postpone refunds. Additionally, before e-filing your taxes, verify the IRS website for filing requirements in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct wi schedule 3k 1 2012 form

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the wi schedule 3k 1 2012 form

How to make an eSignature for the Wi Schedule 3k 1 2012 Form in the online mode

How to create an electronic signature for your Wi Schedule 3k 1 2012 Form in Google Chrome

How to make an electronic signature for signing the Wi Schedule 3k 1 2012 Form in Gmail

How to make an eSignature for the Wi Schedule 3k 1 2012 Form right from your smartphone

How to make an eSignature for the Wi Schedule 3k 1 2012 Form on iOS

How to generate an electronic signature for the Wi Schedule 3k 1 2012 Form on Android

People also ask

-

What is the Wi Schedule 3k 1 Form and how does it work?

The Wi Schedule 3k 1 Form is a tax form used in Wisconsin for reporting income from partnerships and S corporations. With airSlate SignNow, you can easily fill, sign, and send this form electronically, ensuring a streamlined process for both you and your partners. Our platform simplifies the handling of tax documents, making compliance more efficient.

-

How can I use airSlate SignNow to manage my Wi Schedule 3k 1 Form?

You can manage your Wi Schedule 3k 1 Form using airSlate SignNow by uploading the document, filling in the required information, and adding e-signatures. Our intuitive interface allows you to collaborate with others in real-time, ensuring all necessary parties can review and sign the form seamlessly. This saves you time and reduces the hassle of traditional paper forms.

-

Is there a cost associated with using airSlate SignNow for the Wi Schedule 3k 1 Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different needs. Our plans are cost-effective and designed to empower businesses to manage their documents, including the Wi Schedule 3k 1 Form, without breaking the bank. You can choose a plan that best suits your volume of document transactions and feature requirements.

-

What features does airSlate SignNow offer for the Wi Schedule 3k 1 Form?

airSlate SignNow provides a range of features for handling the Wi Schedule 3k 1 Form, including customizable templates, e-signatures, and secure cloud storage. Additionally, our platform allows for automated workflows, enabling you to send reminders and track the status of your forms. These features ensure that managing your tax documents is efficient and straightforward.

-

Can I integrate airSlate SignNow with other software for handling the Wi Schedule 3k 1 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including CRM and accounting systems, making it easy to handle the Wi Schedule 3k 1 Form alongside your other business processes. This integration helps streamline your workflow, ensuring that all your document management needs are met in one place.

-

What are the benefits of using airSlate SignNow for the Wi Schedule 3k 1 Form?

Using airSlate SignNow for the Wi Schedule 3k 1 Form offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance with tax regulations. Our platform's user-friendly design allows for quick completion and submission of the form, minimizing delays and errors. Additionally, the electronic signature feature provides a legally binding way to authorize documents.

-

Is airSlate SignNow secure for submitting the Wi Schedule 3k 1 Form?

Yes, airSlate SignNow prioritizes the security of your documents, including the Wi Schedule 3k 1 Form. Our platform employs advanced encryption and secure storage measures to protect sensitive information. You can confidently send and sign your tax documents, knowing they are safeguarded against unauthorized access.

Get more for Wi Schedule 3k 1 Form

- Kathryn b miller odharvard medical school department of form

- Mhcp provider manual minnesota department of human services form

- Outpatient physical occupational amp speech therapy pre form

- 2018 authorization and notification requirements ucare form

- Southeasthealth occupation medicine clinic form

- Nsd remittance report conley insurance group form

- Cid sethp form

- Magnolia claim form

Find out other Wi Schedule 3k 1 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors