Wisconsin 3k 1 Form 2017

What is the Wisconsin 3K 1 Form

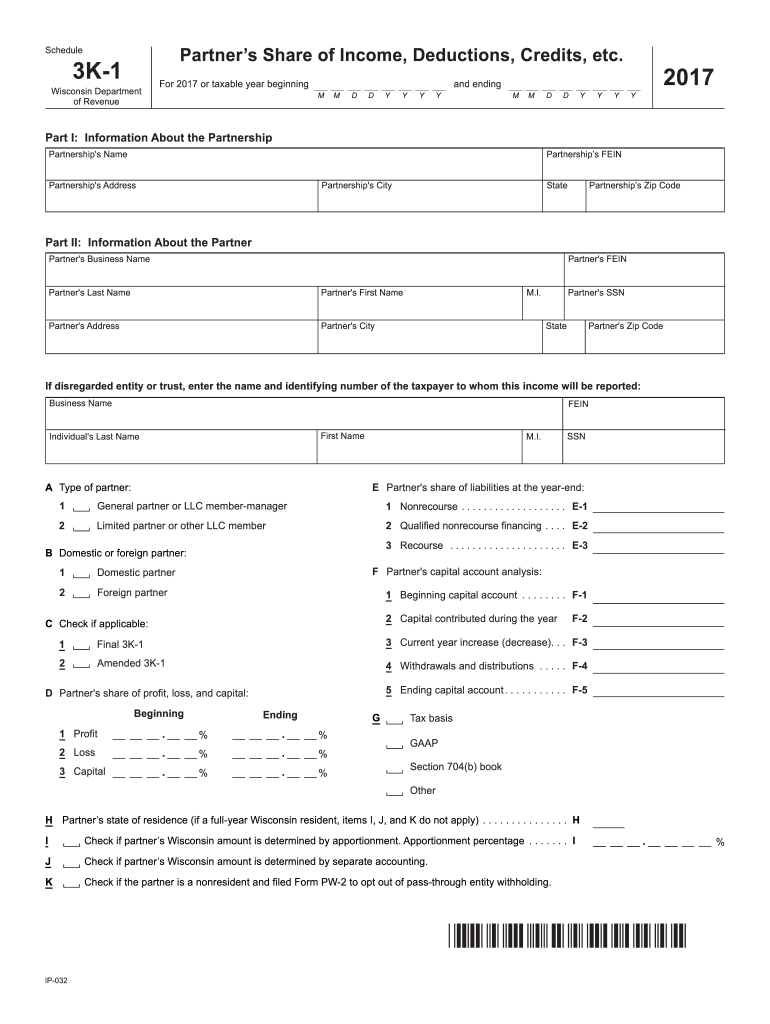

The Wisconsin 3K 1 Form is a tax document used primarily for reporting income, deductions, and credits for partnerships and certain pass-through entities in Wisconsin. This form is essential for individuals and businesses to accurately report their income to the state, ensuring compliance with Wisconsin tax laws. It provides a detailed breakdown of each partner's share of the income, which is crucial for personal tax filings.

How to use the Wisconsin 3K 1 Form

To effectively use the Wisconsin 3K 1 Form, individuals must first gather all necessary financial information related to their partnership or entity. This includes income statements, expense records, and any relevant tax documents. Once the form is filled out, it should be distributed to each partner, allowing them to report their share of income on their personal tax returns. It is important to ensure that all information is accurate and complete to avoid issues with the Wisconsin Department of Revenue.

Steps to complete the Wisconsin 3K 1 Form

Completing the Wisconsin 3K 1 Form involves several key steps:

- Gather all relevant financial documents, including income and expense records.

- Fill out the form with accurate information regarding each partner's share of income and deductions.

- Review the completed form for accuracy to ensure compliance with state tax regulations.

- Distribute copies of the form to each partner for their records and tax filings.

- Retain a copy of the form for your records in case of future audits or inquiries.

Legal use of the Wisconsin 3K 1 Form

The Wisconsin 3K 1 Form must be used in accordance with state tax laws to ensure its legal validity. This includes adhering to deadlines for submission and accurately reporting all income and deductions. Failure to comply with these regulations can result in penalties or audits by the Wisconsin Department of Revenue. Therefore, it is essential to understand the legal implications of using this form and to maintain accurate records.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin 3K 1 Form are typically aligned with the state’s tax return deadlines. Generally, partnerships must file this form by the 15th day of the third month following the end of their fiscal year. It is important to stay updated on any changes to these deadlines, as they can vary from year to year. Marking these dates on a calendar can help ensure timely submission.

Form Submission Methods

The Wisconsin 3K 1 Form can be submitted in various ways, providing flexibility for businesses and individuals. Options include:

- Online submission through the Wisconsin Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate state office.

- In-person submission at local tax offices, if preferred.

Choosing the right submission method can depend on personal preference and the specific requirements of the partnership.

Quick guide on how to complete wisconsin 3k 1 2017 2019 form

Your assistance manual on preparing your Wisconsin 3k 1 Form

If you're wondering how to complete and submit your Wisconsin 3k 1 Form, here are some brief instructions to simplify your tax processing.

To begin, all you need to do is register your airSlate SignNow account to revolutionize how you handle paperwork online. airSlate SignNow is an incredibly intuitive and efficient document solution that allows you to modify, create, and finalize your tax documents seamlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures and return to make changes as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and easy sharing.

Follow these steps to finish your Wisconsin 3k 1 Form in just a few moments:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to open your Wisconsin 3k 1 Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and fix any errors.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting in writing can lead to increased errors and delayed refunds. Before e-filing your taxes, make sure to verify the IRS website for submission rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin 3k 1 2017 2019 form

FAQs

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the wisconsin 3k 1 2017 2019 form

How to create an eSignature for the Wisconsin 3k 1 2017 2019 Form in the online mode

How to generate an electronic signature for the Wisconsin 3k 1 2017 2019 Form in Chrome

How to create an electronic signature for signing the Wisconsin 3k 1 2017 2019 Form in Gmail

How to make an electronic signature for the Wisconsin 3k 1 2017 2019 Form right from your smart phone

How to create an electronic signature for the Wisconsin 3k 1 2017 2019 Form on iOS

How to make an eSignature for the Wisconsin 3k 1 2017 2019 Form on Android

People also ask

-

What is the Wisconsin 3k 1 Form?

The Wisconsin 3k 1 Form is a crucial document for businesses in Wisconsin that need to report income. It is specifically designed for partnerships and LLCs to summarize income, deductions, and credits. Using airSlate SignNow, you can easily complete and eSign the Wisconsin 3k 1 Form online.

-

How much does airSlate SignNow cost for managing the Wisconsin 3k 1 Form?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. The cost-effective solution allows seamless handling of the Wisconsin 3k 1 Form with the option for monthly or annual subscriptions. Always check our website for the latest pricing details.

-

What features does airSlate SignNow provide for the Wisconsin 3k 1 Form?

airSlate SignNow provides features like document templates, electronic signatures, and secure cloud storage specifically for the Wisconsin 3k 1 Form. Additionally, it offers tracking capabilities and integration with various software to make document management efficient. These features ensure hassle-free completion and submission of your forms.

-

Can I integrate airSlate SignNow with other systems for the Wisconsin 3k 1 Form?

Yes, airSlate SignNow allows seamless integration with many third-party applications, enhancing your experience with the Wisconsin 3k 1 Form. You can connect it with CRM systems, cloud storage, and other productivity tools. This ensures that you can handle your documentation needs efficiently.

-

Is airSlate SignNow secure for handling the Wisconsin 3k 1 Form?

Absolutely, airSlate SignNow prioritizes security and complies with industry standards to protect your data. When handling sensitive documents like the Wisconsin 3k 1 Form, you can trust our encryption protocols and secure cloud environment. Your peace of mind is our top priority.

-

What are the benefits of using airSlate SignNow for the Wisconsin 3k 1 Form?

Using airSlate SignNow for the Wisconsin 3k 1 Form enhances efficiency and reduces paper clutter. The easy-to-use interface and eSigning capabilities allow for quick document turnaround. Additionally, businesses can store, manage, and retrieve their forms effortlessly, saving time and resources.

-

Can I access the Wisconsin 3k 1 Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to manage the Wisconsin 3k 1 Form on the go. Whether you’re using a smartphone or tablet, you can fill out, sign, and send your forms seamlessly. This flexibility caters to busy professionals who need to stay productive.

Get more for Wisconsin 3k 1 Form

- Invoiceblankdis pdf da form 2064 jan 1982

- New mexico rpd 41338 form

- Lesson 2 skills practice unbiased and biased samples form

- Periodic table scavenger hunt highmark charter school blogs hmcharterschool form

- Form 3520

- Certification of trust florida form

- Service terms and conditions agreement template form

- Service termination letter agreement template form

Find out other Wisconsin 3k 1 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors