Schedule 3K 1 Partner's Share of Income, Deductions, Credits, Etc 2020

What is the Schedule 3K-1 Partner's Share of Income, Deductions, Credits, Etc.

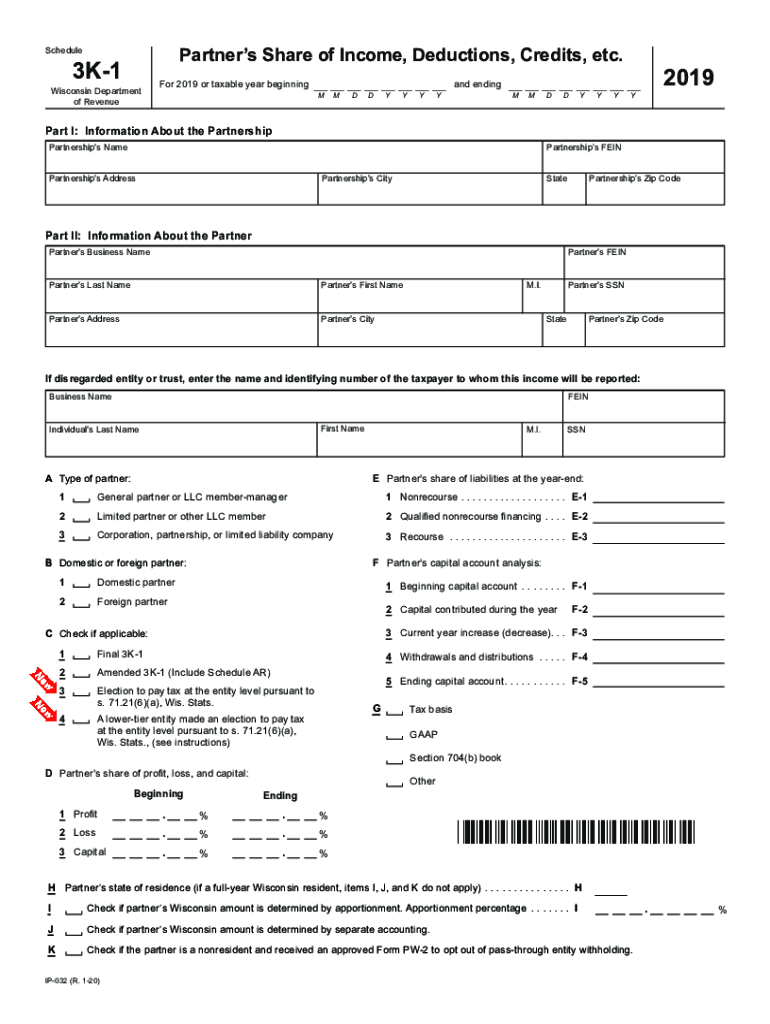

The Schedule 3K-1 is a crucial tax document used to report a partner's share of income, deductions, credits, and other relevant tax items from a partnership. This form is essential for partners in a partnership to accurately report their income on their personal tax returns. Each partner receives a Schedule 3K-1 that details their specific share of the partnership's financial activity, ensuring that all income and deductions are accounted for in compliance with IRS regulations.

Steps to Complete the Schedule 3K-1

Completing the Schedule 3K-1 involves several key steps to ensure accuracy and compliance. Partners should follow these guidelines:

- Gather necessary information: Collect all relevant financial documents related to the partnership's income and expenses.

- Fill in partner details: Input personal information, including the partner's name, address, and taxpayer identification number.

- Report income: Enter the partner's share of income from the partnership, including ordinary business income and other income types.

- Detail deductions and credits: Accurately list all deductions and credits applicable to the partner, ensuring they align with partnership records.

- Review and file: Double-check all entries for accuracy before submitting the Schedule 3K-1 along with the partner's tax return.

Legal Use of the Schedule 3K-1

The Schedule 3K-1 is legally binding and must be filled out accurately to comply with IRS regulations. It serves as a formal declaration of a partner's financial involvement in a partnership. Misreporting or failing to file can lead to penalties or audits. Therefore, it is essential for partners to ensure that all information is correct and that the form is submitted timely with their personal tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 3K-1 typically align with the tax return deadlines for partnerships. Partnerships must provide each partner with their Schedule 3K-1 by March 15 of each year. Partners should ensure they receive this form in time to include it with their individual tax returns, which are due on April 15. It is important to be aware of these dates to avoid any potential penalties for late filing.

Required Documents

To complete the Schedule 3K-1 accurately, partners will need various documents, including:

- Partnership tax return (Form 1065).

- Financial statements from the partnership.

- Records of any distributions received from the partnership.

- Documentation of any deductions or credits claimed by the partnership.

Examples of Using the Schedule 3K-1

Partners may encounter various scenarios when using the Schedule 3K-1. For example, a partner in a real estate investment partnership would report rental income and related expenses on their Schedule 3K-1. Similarly, a partner involved in a service-based partnership would report income from services rendered, along with any applicable deductions for expenses incurred in the course of business. Each partner's unique financial situation will dictate how the Schedule 3K-1 is utilized in their tax filings.

Quick guide on how to complete 2019 schedule 3k 1 partners share of income deductions credits etc

Easily prepare Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc on any device

The management of online documents has gained popularity among businesses and individuals alike. It presents a suitable eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc effortlessly

- Obtain Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and then click the Done button to save your changes.

- Choose how you would like to share your form, either via email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow addresses your document management needs with just a few clicks from any selected device. Modify and eSign Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 schedule 3k 1 partners share of income deductions credits etc

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule 3k 1 partners share of income deductions credits etc

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What are the wisconsin 3k 1 instructions for using airSlate SignNow?

The wisconsin 3k 1 instructions for airSlate SignNow involve a step-by-step process to effectively sign your documents electronically. This includes accessing the platform, uploading your documents, and using the eSignature tools provided. Following these instructions ensures a smooth and compliant signing experience.

-

How much does airSlate SignNow cost for the wisconsin 3k 1 instructions?

The pricing for airSlate SignNow offers various plans that cater to different business sizes and needs, including compliance with the wisconsin 3k 1 instructions. You can choose a monthly or yearly subscription that suits your budget and unlocks all the essential features. Look for promotional rates that may be available for new users.

-

What features does airSlate SignNow offer related to wisconsin 3k 1 instructions?

airSlate SignNow provides a robust set of features that facilitate the wisconsin 3k 1 instructions, including customizable templates, real-time collaboration, and secure eSigning capabilities. Furthermore, the platform supports document tracking and reminders to keep your signing process organized and efficient. These features enhance user experience and ensure compliance.

-

What are the benefits of using airSlate SignNow for wisconsin 3k 1 instructions?

Using airSlate SignNow for your wisconsin 3k 1 instructions streamlines the signing process, saving you time and reducing paper waste. It also enhances security through advanced encryption and authentication measures. Ultimately, this results in increased productivity and a smoother workflow for your business.

-

Can airSlate SignNow integrate with other software while following wisconsin 3k 1 instructions?

Yes, airSlate SignNow offers integration capabilities with various software platforms while adhering to the wisconsin 3k 1 instructions. This enables you to connect your existing applications for seamless data transfer and enhanced functionality. Integrations with CRM, cloud storage, and project management tools can signNowly boost your productivity.

-

Is airSlate SignNow user-friendly for those needing wisconsin 3k 1 instructions?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy to follow the wisconsin 3k 1 instructions even for those with little technical background. The platform features an intuitive interface and provides helpful tutorials and customer support to guide you through the eSigning process without any hassle.

-

What type of documents can I manage with the wisconsin 3k 1 instructions on airSlate SignNow?

You can manage a wide variety of documents using the wisconsin 3k 1 instructions on airSlate SignNow, including contracts, agreements, and forms. Whether for personal or business use, the platform supports all document types you may need to sign digitally. Ensure your documents are compliant and easily processed through the airSlate SignNow system.

Get more for Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc

- Limited power of attorney where you specify powers with sample powers included vermont form

- Limited power of attorney for stock transactions and corporate powers vermont form

- Special durable power of attorney for bank account matters vermont form

- Vermont small business startup package vermont form

- Vermont property management package vermont form

- New resident guide vermont form

- Satisfaction release or cancellation of mortgage by corporation vermont form

- Satisfaction release or cancellation of mortgage by individual vermont form

Find out other Schedule 3K 1 Partner's Share Of Income, Deductions, Credits, Etc

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter