Form433 B OIC Rev 4 Collection Information Statement for Businesses 2022

What is the Form 433-B OIC Rev 4 Collection Information Statement For Businesses

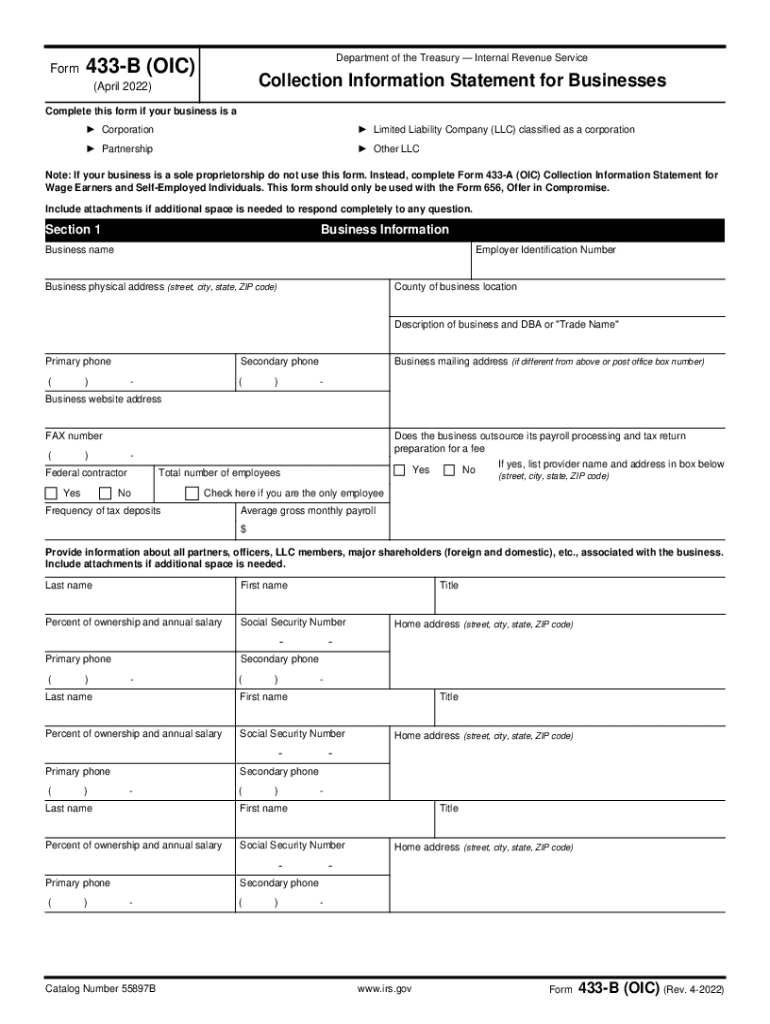

The Form 433-B OIC Rev 4 is a crucial document used by businesses to provide the Internal Revenue Service (IRS) with detailed financial information. This form is specifically designed for businesses seeking to settle their tax debts through an Offer in Compromise (OIC). By submitting this form, businesses can demonstrate their financial situation, including assets, income, expenses, and liabilities, allowing the IRS to evaluate their eligibility for tax relief. Understanding the purpose of this form is essential for any business facing tax challenges.

Steps to Complete the Form 433-B OIC Rev 4 Collection Information Statement For Businesses

Completing the Form 433-B OIC Rev 4 requires careful attention to detail. Here are the key steps:

- Gather Financial Information: Collect all necessary financial documents, including bank statements, profit and loss statements, and balance sheets.

- Fill Out the Form: Provide accurate information about your business's assets, liabilities, income, and expenses. Ensure that all sections are completed thoroughly.

- Review and Verify: Double-check all entries for accuracy. Inaccurate information can lead to delays or denials.

- Sign and Date: Ensure that the form is signed by an authorized representative of the business.

- Submit the Form: Choose your submission method, whether online, by mail, or in person, and ensure it is sent to the correct IRS address.

Legal Use of the Form 433-B OIC Rev 4 Collection Information Statement For Businesses

The legal use of the Form 433-B OIC Rev 4 is governed by IRS regulations. This form must be completed accurately to ensure compliance with tax laws. It serves as a formal request for the IRS to consider an Offer in Compromise based on the financial information provided. When used correctly, it can protect the business from further collection actions while the IRS reviews the offer. Understanding the legal implications of this form is vital for any business seeking tax relief.

Eligibility Criteria for the Form 433-B OIC Rev 4 Collection Information Statement For Businesses

To qualify for submitting the Form 433-B OIC Rev 4, businesses must meet specific eligibility criteria set by the IRS. These criteria include:

- The business must be current on all required tax filings.

- The business must demonstrate an inability to pay the full tax liability.

- The offer must be reasonable based on the business's financial situation.

- The business must not be in bankruptcy proceedings.

Meeting these criteria is essential for a successful application for tax relief through the OIC process.

Required Documents for the Form 433-B OIC Rev 4 Collection Information Statement For Businesses

When submitting the Form 433-B OIC Rev 4, businesses must provide several supporting documents to substantiate their financial claims. Required documents typically include:

- Recent bank statements for all business accounts.

- Profit and loss statements for the past year.

- Balance sheets detailing assets and liabilities.

- Documentation of any outstanding debts or obligations.

Providing comprehensive documentation helps the IRS assess the business's financial situation accurately.

IRS Guidelines for Form 433-B OIC Rev 4 Collection Information Statement For Businesses

The IRS provides specific guidelines for completing and submitting the Form 433-B OIC Rev 4. These guidelines include:

- Instructions on how to accurately fill out each section of the form.

- Information on acceptable methods of submission, including online and mail options.

- Details on the review process and potential timelines for receiving a response.

Following these guidelines is crucial to ensure that the form is processed efficiently and correctly.

Quick guide on how to complete form433 b oic rev 4 2022 collection information statement for businesses

Effortlessly manage Form433 B OIC Rev 4 Collection Information Statement For Businesses on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle Form433 B OIC Rev 4 Collection Information Statement For Businesses on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to change and electronically sign Form433 B OIC Rev 4 Collection Information Statement For Businesses with ease

- Find Form433 B OIC Rev 4 Collection Information Statement For Businesses and click on Get Form to begin.

- Utilize our tools to fill out your document effectively.

- Emphasize essential sections of your documents or conceal sensitive details using specific tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal authority as a conventional handwritten signature.

- Review all information carefully and then click the Done button to store your updates.

- Select your preferred method to send your form—via email, text message (SMS), invite link, or download it directly to your computer.

Wave goodbye to lost or misfiled documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and electronically sign Form433 B OIC Rev 4 Collection Information Statement For Businesses to ensure smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form433 b oic rev 4 2022 collection information statement for businesses

Create this form in 5 minutes!

People also ask

-

What is the 433b 2019 business document process?

The 433b 2019 business document process simplifies the way businesses handle essential documentation. With airSlate SignNow, you can create, send, and eSign these documents effortlessly. This streamlined approach saves time and reduces errors in your business operations.

-

How does airSlate SignNow support the 433b 2019 business filings?

airSlate SignNow provides robust features to assist with 433b 2019 business filings. Its eSignature capabilities ensure that all documents are legally binding and compliant. Additionally, our platform allows for easy tracking and management of these important filings.

-

What are the pricing options for airSlate SignNow regarding 433b 2019 business?

Pricing for airSlate SignNow varies based on the features you need for your 433b 2019 business operations. We offer flexible plans that cater to small businesses and enterprises alike. Our cost-effective solutions make it easy for companies to adopt eSigning without breaking the bank.

-

What features does airSlate SignNow offer for 433b 2019 business users?

For users focused on 433b 2019 business documentation, airSlate SignNow offers features like customizable templates, automated workflows, and real-time tracking. These features enhance the efficiency of sending and signing documents, ensuring a smoother operation for your business needs.

-

How can airSlate SignNow enhance my 433b 2019 business operations?

airSlate SignNow can signNowly enhance your 433b 2019 business operations by automating the documentation process. This reduces manual errors and speeds up turnaround times. The user-friendly interface ensures that all team members can easily adopt the platform, improving productivity.

-

Can airSlate SignNow integrate with other tools for my 433b 2019 business?

Yes, airSlate SignNow seamlessly integrates with various tools that are essential for running your 433b 2019 business. Whether you use CRM systems, project management tools, or cloud storage solutions, our platform connects with them effortlessly to create a cohesive work environment.

-

Is airSlate SignNow secure for handling 433b 2019 business documents?

Absolutely! airSlate SignNow employs top-tier security measures to protect all 433b 2019 business documents. With encryption and compliance with industry standards, you can confidently manage sensitive information without worrying about data bsignNowes.

Get more for Form433 B OIC Rev 4 Collection Information Statement For Businesses

Find out other Form433 B OIC Rev 4 Collection Information Statement For Businesses

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online