Irs Form 433 a B 2019

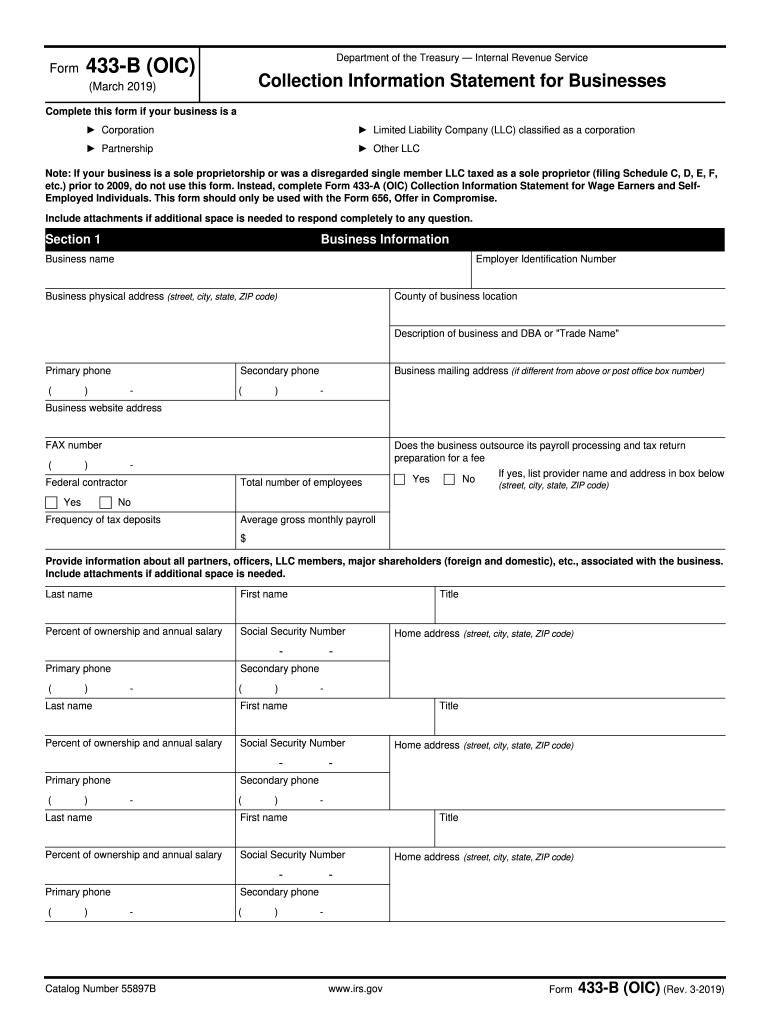

What is the IRS Form 433-B?

The IRS Form 433-B is a financial statement used by businesses to provide the Internal Revenue Service (IRS) with detailed information about their financial condition. This form is essential for businesses seeking to resolve tax liabilities through an Offer in Compromise (OIC) or to establish payment plans. It captures vital information such as income, expenses, assets, and liabilities, allowing the IRS to assess the taxpayer's ability to pay their tax debts. Understanding the purpose and structure of the 433-B form is crucial for any business navigating tax obligations.

Steps to Complete the IRS Form 433-B

Completing the IRS Form 433-B requires careful attention to detail. Here are the key steps:

- Gather Financial Information: Collect all necessary financial documents, including bank statements, profit and loss statements, and any relevant tax returns.

- Fill Out Personal Information: Provide accurate business and personal details, including the name of the business, Employer Identification Number (EIN), and contact information.

- Detail Income and Expenses: Clearly outline all sources of income and monthly expenses. This includes salaries, rent, utilities, and other operational costs.

- List Assets and Liabilities: Document all business assets such as property, equipment, and inventory, as well as liabilities like loans and credit obligations.

- Review for Accuracy: Ensure all information is complete and accurate to avoid delays or complications in processing.

Legal Use of the IRS Form 433-B

The IRS Form 433-B is legally binding when completed and submitted correctly. It serves as a formal declaration of a business's financial situation to the IRS. The information provided can affect the outcome of tax negotiations, including offers for reduced tax payments or installment agreements. Therefore, it is crucial to ensure that all data is truthful and complies with IRS regulations. Misrepresentation or inaccuracies can lead to penalties or denial of requests made using the form.

Required Documents for IRS Form 433-B

To complete the IRS Form 433-B, several supporting documents are necessary to substantiate the information provided. These may include:

- Recent bank statements

- Profit and loss statements for the past year

- Balance sheets

- Copies of any relevant tax returns

- Documentation of business expenses and liabilities

Having these documents ready will streamline the process and enhance the credibility of the information submitted to the IRS.

Form Submission Methods

The IRS Form 433-B can be submitted through various methods, depending on the taxpayer's preference and situation. Options include:

- Online Submission: Some taxpayers may have the option to submit the form electronically through the IRS website or authorized e-filing services.

- Mail: The completed form can be printed and mailed to the appropriate IRS address, which is typically specified in the form instructions.

- In-Person: Taxpayers may also choose to deliver the form in person at their local IRS office, ensuring direct communication with IRS representatives.

Eligibility Criteria for IRS Form 433-B

Eligibility for using the IRS Form 433-B typically applies to businesses facing tax liabilities. Criteria include:

- The business must be legally registered and operating.

- Tax liabilities must be owed to the IRS.

- The business should be in a position to negotiate payment options or an Offer in Compromise.

Understanding these criteria helps businesses determine if they can effectively use the form to address their tax issues.

Quick guide on how to complete form 433 b oic rev 3 2019 internal revenue service

Effortlessly Prepare Irs Form 433 A B on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your files swiftly without delays. Handle Irs Form 433 A B on any device through airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

Efficiently Modify and eSign Irs Form 433 A B with Ease

- Obtain Irs Form 433 A B and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow designed specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes necessitating printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Irs Form 433 A B to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 433 b oic rev 3 2019 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 433 b oic rev 3 2019 internal revenue service

How to make an electronic signature for your Form 433 B Oic Rev 3 2019 Internal Revenue Service in the online mode

How to create an eSignature for the Form 433 B Oic Rev 3 2019 Internal Revenue Service in Google Chrome

How to generate an eSignature for putting it on the Form 433 B Oic Rev 3 2019 Internal Revenue Service in Gmail

How to create an eSignature for the Form 433 B Oic Rev 3 2019 Internal Revenue Service straight from your smart phone

How to make an eSignature for the Form 433 B Oic Rev 3 2019 Internal Revenue Service on iOS

How to create an eSignature for the Form 433 B Oic Rev 3 2019 Internal Revenue Service on Android

People also ask

-

What is the 433 b form and why is it important?

The 433 b form is a critical document used to provide detailed financial information about a taxpayer's assets and liabilities. It's often required by the IRS for determining an individual's ability to pay taxes or resolve tax debts. Understanding the purpose and importance of the 433 b form is crucial for anyone navigating tax obligations.

-

How can airSlate SignNow help me with the 433 b form?

airSlate SignNow simplifies the process of completing and signing the 433 b form by providing an easy-to-use, secure platform for electronic signatures. You can efficiently fill out the form online and send it directly to recipients, streamlining your document management. This saves time and ensures that your forms are processed quickly.

-

What features does airSlate SignNow offer for handling the 433 b form?

airSlate SignNow includes a comprehensive set of features for managing the 433 b form, such as customizable templates, real-time tracking of document status, and reminders for signatures. These tools enhance efficiency and help ensure that all required information is accurately captured and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the 433 b form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. While there is a cost, the investment can lead to signNow time and resource savings when handling documents like the 433 b form. You can choose a plan that best fits your requirements and budget.

-

Can I integrate airSlate SignNow with other applications for processing the 433 b form?

Absolutely! airSlate SignNow allows for seamless integration with various applications, making it easier to handle the 433 b form alongside your existing software ecosystem. This integration capability enhances workflow efficiency and document handling across different platforms.

-

What are the benefits of using airSlate SignNow for the 433 b form?

Using airSlate SignNow for the 433 b form offers numerous benefits, including enhanced security, reduced paper usage, and quicker turnaround times for document processing. The platform also improves collaboration by allowing multiple parties to sign and edit documents in real time.

-

How secure is my information when using airSlate SignNow for the 433 b form?

airSlate SignNow takes security seriously, employing advanced encryption and compliance measures to protect your information while processing the 433 b form. You can rest assured that your sensitive data is kept safe from unauthorized access.

Get more for Irs Form 433 A B

- To bill of lading numbers issued to reissued to date date bl form

- Optional form 1164 claim for reimbursement for gsagov

- Get the abstract of offers construction pdffiller form

- 36701 standard and optional forms for use in contracting for

- Request for valuation service gsa form

- Standard on valuation of personal property iaao form

- Gsa regional employees form

- Gsa 176 gsagov form

Find out other Irs Form 433 A B

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast