Form433 B OIC Rev 4 Collection Information Statement for Businesses 2023

What is the Form 433 B OIC Rev 4 Collection Information Statement For Businesses

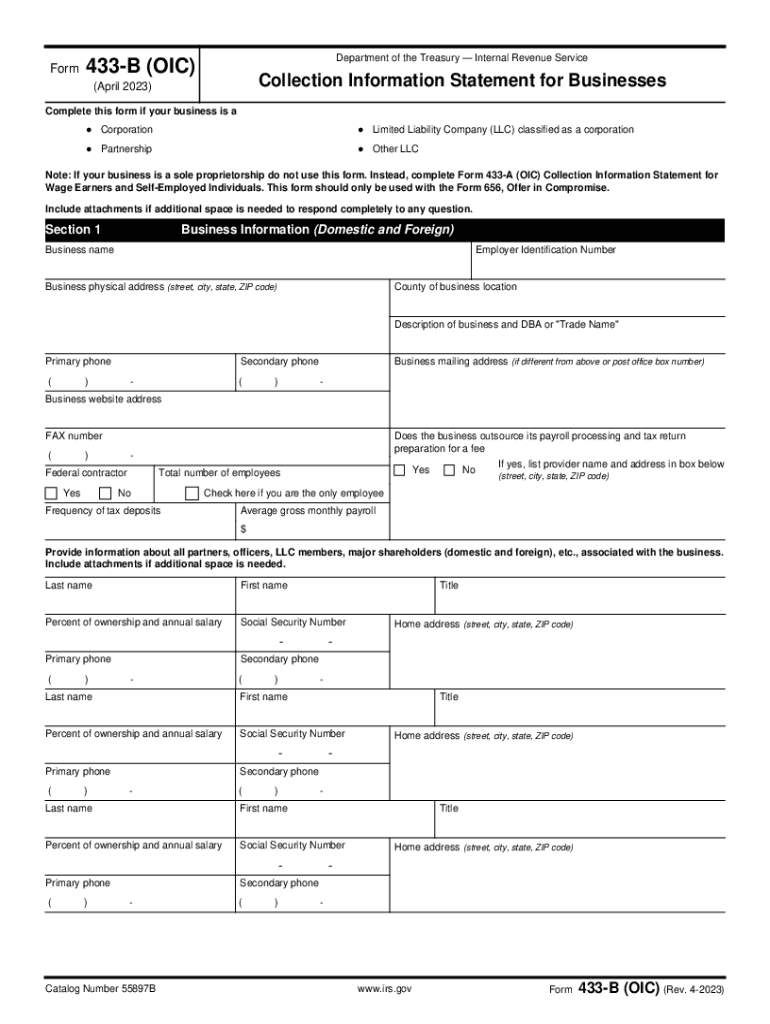

The Form 433 B OIC Rev 4 is a crucial document used by businesses to provide the Internal Revenue Service (IRS) with detailed financial information. This form is specifically designed for businesses that are seeking to settle their tax liabilities through an Offer in Compromise (OIC). The information collected on this form helps the IRS evaluate a business's ability to pay its tax debt and determine whether an offer to settle for less than the full amount owed is appropriate. The form requires comprehensive disclosure of income, expenses, assets, and liabilities, ensuring that the IRS has a clear picture of the business's financial situation.

Steps to complete the Form 433 B OIC Rev 4 Collection Information Statement For Businesses

Completing the Form 433 B OIC Rev 4 involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including bank statements, profit and loss statements, and tax returns. Next, fill out the form by providing detailed information about the business's income, expenses, assets, and liabilities. It's important to be thorough and honest, as any discrepancies can lead to delays or rejection of the offer. After completing the form, review it carefully for any errors before submitting it to the IRS. Finally, keep a copy of the completed form for your records.

Legal use of the Form 433 B OIC Rev 4 Collection Information Statement For Businesses

The legal use of the Form 433 B OIC Rev 4 is essential for businesses seeking to negotiate their tax liabilities with the IRS. This form must be filled out accurately and submitted as part of the Offer in Compromise process. The information provided is legally binding, meaning that any false statements can result in penalties or legal consequences. Additionally, the IRS uses this form to assess the legitimacy of the offer and the financial hardship the business may be experiencing. Therefore, ensuring compliance with all legal requirements is crucial for a successful outcome.

IRS Guidelines

The IRS has established specific guidelines for the submission and processing of the Form 433 B OIC Rev 4. These guidelines outline the necessary documentation, eligibility criteria, and the process for submitting the form. Businesses must adhere to these guidelines to ensure their application is considered. The IRS may require additional information or documentation during the review process, so it is important to respond promptly to any requests. Understanding these guidelines can significantly improve the chances of a successful Offer in Compromise.

Eligibility Criteria

To qualify for an Offer in Compromise using the Form 433 B OIC Rev 4, businesses must meet specific eligibility criteria set by the IRS. Generally, the business must be in compliance with all filing and payment requirements, and it should demonstrate an inability to pay the full tax liability. The IRS evaluates the business's financial situation, including income, expenses, and assets, to determine eligibility. Additionally, businesses that are currently undergoing bankruptcy proceedings may not be eligible to submit this form. Understanding these criteria is essential for businesses considering this option.

Form Submission Methods

The Form 433 B OIC Rev 4 can be submitted to the IRS through various methods. Businesses have the option to file the form online, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate IRS address, depending on the business's location and the specific tax situation. In some cases, businesses may also choose to deliver the form in person at their local IRS office. Each submission method has its own processing times and requirements, so it is important to choose the one that best suits the business's needs.

Quick guide on how to complete form433 b oic rev 4 collection information statement for businesses

Effortlessly prepare Form433 B OIC Rev 4 Collection Information Statement For Businesses on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form433 B OIC Rev 4 Collection Information Statement For Businesses on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

Steps to modify and electronically sign Form433 B OIC Rev 4 Collection Information Statement For Businesses effortlessly

- Find Form433 B OIC Rev 4 Collection Information Statement For Businesses and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form433 B OIC Rev 4 Collection Information Statement For Businesses to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form433 b oic rev 4 collection information statement for businesses

Create this form in 5 minutes!

How to create an eSignature for the form433 b oic rev 4 collection information statement for businesses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 433 B and why is it important?

IRS Form 433 B is a financial statement form used by businesses to provide the IRS with information about their income, expenses, and assets. It is crucial for tax negotiations, installment agreements, and offers in compromise. Completing this form accurately ensures compliance and can help you achieve a more favorable tax resolution.

-

How can airSlate SignNow help with the completion of IRS Form 433 B?

airSlate SignNow provides an easy-to-use platform for digitally filling out and eSigning IRS Form 433 B. Our solution simplifies the document management process, ensuring you can quickly complete the form and submit it to the IRS without delays. Plus, you can store and access your documents securely in one place.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore our features, including those for completing IRS Form 433 B. This trial provides an opportunity to experience our user-friendly interface and determine how well our solution fits your business needs before committing to a subscription.

-

What features does airSlate SignNow offer for IRS Form 433 B?

With airSlate SignNow, you can electronically fill out, eSign, and share IRS Form 433 B securely. Our platform includes features like document templates, real-time notifications, and advanced security measures to protect your information. These features streamline the process of preparing and submitting necessary tax forms.

-

How does airSlate SignNow ensure the security of IRS Form 433 B submissions?

Security is a top priority at airSlate SignNow. We use encryption and secure cloud storage to protect your IRS Form 433 B submissions and other sensitive documents. Additionally, our platform is compliant with industry standards to ensure that your data remains safe throughout the eSigning process.

-

Can I integrate airSlate SignNow with other software for managing IRS Form 433 B?

Absolutely! airSlate SignNow offers integrations with various software solutions, including CRM systems and document management tools. This allows you to seamlessly manage your IRS Form 433 B workflow alongside other business operations for improved efficiency and organization.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to meet the needs of different businesses. Whether you are a small business or a larger organization, you can find a plan that includes features to assist with IRS Form 433 B and other document management tasks. Visit our pricing page for more details on available options.

Get more for Form433 B OIC Rev 4 Collection Information Statement For Businesses

Find out other Form433 B OIC Rev 4 Collection Information Statement For Businesses

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free