Form 433 B OIC Rev 4 2020

What is the Form 433 B OIC Rev 4

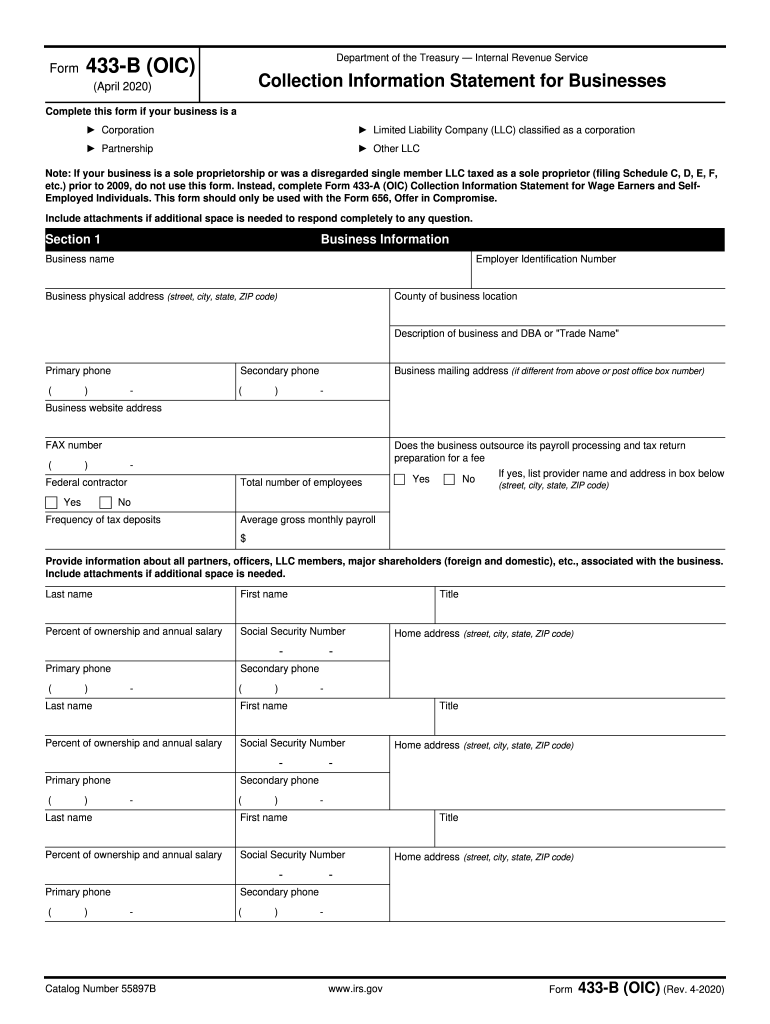

The Form 433 B OIC Rev 4 is a crucial document used by businesses and self-employed individuals to provide the Internal Revenue Service (IRS) with detailed financial information. This form is specifically designed for those applying for an Offer in Compromise (OIC), which allows taxpayers to settle their tax debts for less than the full amount owed. The form requires comprehensive disclosure of assets, liabilities, income, and expenses to help the IRS assess the taxpayer's financial situation accurately.

Steps to Complete the Form 433 B OIC Rev 4

Completing the Form 433 B OIC Rev 4 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including bank statements, pay stubs, and any other relevant financial records. Next, fill out the form by providing detailed information about your business's income, expenses, and assets. Be sure to include all required signatures and dates. After completing the form, review it thoroughly for any errors or omissions before submission.

Eligibility Criteria

To qualify for an Offer in Compromise using the Form 433 B OIC Rev 4, taxpayers must meet specific eligibility criteria established by the IRS. This includes demonstrating an inability to pay the full tax liability, proving that settling for less is in the best interest of both the taxpayer and the IRS, and providing accurate financial information. Additionally, taxpayers must be current with all filing and payment obligations to be considered for the OIC program.

Legal Use of the Form 433 B OIC Rev 4

The legal use of the Form 433 B OIC Rev 4 is essential for ensuring that the information provided is valid and can be used effectively in negotiations with the IRS. This form must be completed honestly and accurately, as any discrepancies can lead to penalties or rejection of the OIC application. Understanding the legal implications of the information disclosed is crucial, as it may affect the taxpayer's standing with the IRS and their ability to resolve outstanding tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 433 B OIC Rev 4 are critical to ensure timely processing of the Offer in Compromise application. Taxpayers should be aware of the specific dates related to their tax year and any extensions that may apply. It is advisable to submit the form as early as possible to allow for any potential delays in processing. Keeping track of these important dates can help avoid complications and ensure compliance with IRS requirements.

Form Submission Methods

The Form 433 B OIC Rev 4 can be submitted to the IRS through various methods, including online submission, mail, or in-person delivery at designated IRS offices. Each method has its own set of guidelines and processing times. Taxpayers should choose the submission method that best suits their needs while ensuring that they retain proof of submission, particularly for mail-in applications, to avoid issues with lost documents.

Quick guide on how to complete form 433 b oic rev 4 2020

Easily Prepare Form 433 B OIC Rev 4 on Any Device

Digital document management has become increasingly favored by both companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents quickly and efficiently. Manage Form 433 B OIC Rev 4 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign Form 433 B OIC Rev 4 with ease

- Obtain Form 433 B OIC Rev 4 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and electronically sign Form 433 B OIC Rev 4 and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 433 b oic rev 4 2020

Create this form in 5 minutes!

How to create an eSignature for the form 433 b oic rev 4 2020

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is Form 433 B OIC Rev 4 and how is it used?

Form 433 B OIC Rev 4 is a financial statement used by taxpayers to provide the IRS with detailed information regarding their financial situation when applying for an Offer in Compromise (OIC). This form helps the IRS assess whether a taxpayer can pay their tax debts in full or if they qualify for a reduced settlement amount. By accurately completing Form 433 B OIC Rev 4, you can increase your chances of a successful OIC application.

-

How does airSlate SignNow simplify the process of submitting Form 433 B OIC Rev 4?

airSlate SignNow streamlines the submission of Form 433 B OIC Rev 4 by allowing you to fill out, sign, and send the document electronically. With its user-friendly interface, you can easily upload your completed form, add signatures, and send it directly to the IRS or your tax professional. This reduces the hassle of physical paperwork and ensures your form is submitted promptly.

-

Is there a cost associated with using airSlate SignNow for Form 433 B OIC Rev 4?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for individuals and teams. The cost of using airSlate SignNow to manage your Form 433 B OIC Rev 4 will depend on the features you choose, such as document templates and integrations. However, many users find that the cost is offset by the time saved and increased efficiency in managing their documents.

-

What features does airSlate SignNow offer for managing Form 433 B OIC Rev 4?

airSlate SignNow provides a range of features to enhance your experience with Form 433 B OIC Rev 4, including secure electronic signatures, document templates, and customizable workflows. You can also track the status of your documents, set reminders, and collaborate with others seamlessly. These features help ensure that your Form 433 B OIC Rev 4 is handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for Form 433 B OIC Rev 4 processing?

Absolutely! airSlate SignNow offers integrations with various software applications, including CRM systems and cloud storage platforms, to facilitate the processing of Form 433 B OIC Rev 4. This means you can connect your existing tools for a more streamlined workflow, making it easier to manage your documents and stay organized throughout the OIC application process.

-

How can airSlate SignNow benefit my business when handling Form 433 B OIC Rev 4?

By using airSlate SignNow for Form 433 B OIC Rev 4, your business can save time and reduce administrative burdens associated with document management. The electronic signature feature allows for faster approvals and eliminates the need for printing, scanning, and mailing documents. This efficiency can lead to quicker resolution times for tax issues, ultimately benefiting your bottom line.

-

Is airSlate SignNow secure for submitting sensitive documents like Form 433 B OIC Rev 4?

Yes, airSlate SignNow prioritizes the security of your documents, including Form 433 B OIC Rev 4. The platform uses industry-standard encryption and compliance protocols to protect your sensitive information. This ensures that your data remains confidential and secure throughout the entire signing and submission process.

Get more for Form 433 B OIC Rev 4

- Notary public application checklist cyberdrive illinois form

- Required document matrix coloradogov colorado form

- Yield to emergency vehicles construction workers and funeral form

- Services for state employees and elected officials illinois form

- Online catalog illinois secretary of state form

- Print reset freedom of information act request form office of the illinois secretary of state date requestor s name company

- Boe 267 a form

- Service retirement election application service retirement election application form

Find out other Form 433 B OIC Rev 4

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure