Form 433 B OIC Internal Revenue Service Irs 2014

What is the Form 433 B OIC Internal Revenue Service IRS

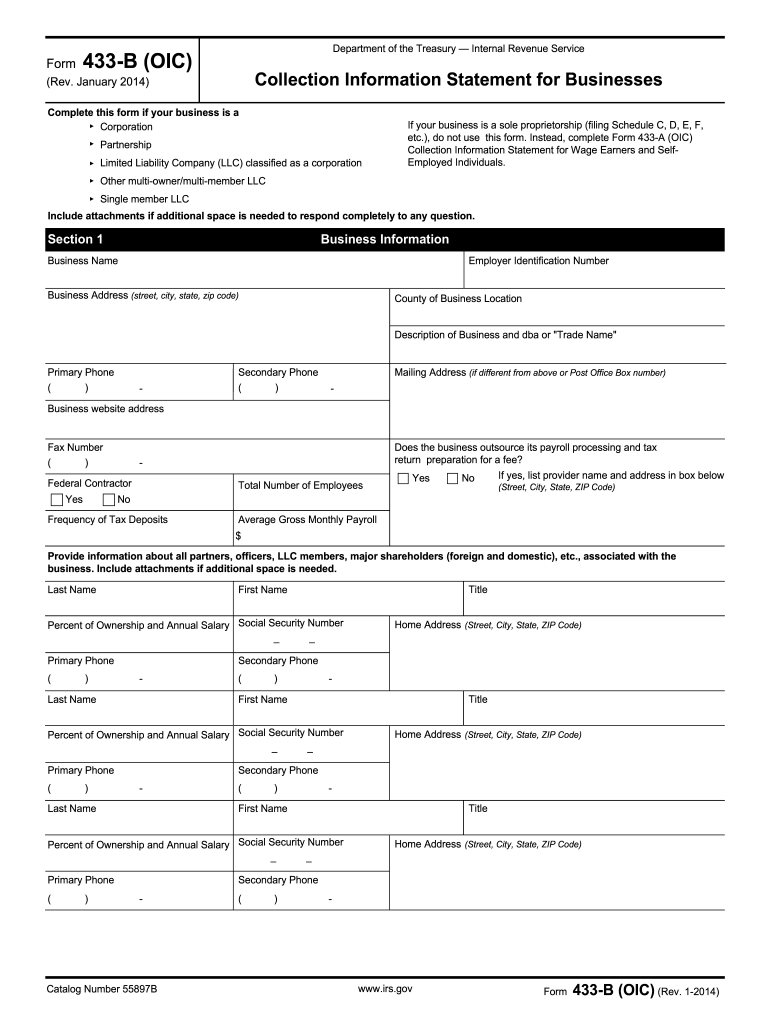

The Form 433 B OIC is a document used by businesses to provide the Internal Revenue Service (IRS) with detailed financial information when applying for an Offer in Compromise (OIC). This form helps the IRS assess a taxpayer's ability to pay their tax liabilities. It requires information about the business's income, expenses, assets, and liabilities. By completing this form accurately, businesses can demonstrate their financial situation and negotiate a potential settlement with the IRS.

How to use the Form 433 B OIC Internal Revenue Service IRS

Using the Form 433 B OIC involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and any other relevant financial records. Next, fill out the form with accurate and complete information regarding the business's financial status. It is crucial to ensure that all figures are correct, as inaccuracies can lead to delays or denials. Once completed, the form should be submitted to the IRS along with any required supporting documentation.

Steps to complete the Form 433 B OIC Internal Revenue Service IRS

Completing the Form 433 B OIC involves a systematic approach:

- Collect financial documents, including profit and loss statements and tax returns.

- Provide detailed information about the business's income sources and expenses.

- List all assets and liabilities accurately.

- Review the form for completeness and accuracy.

- Submit the form to the IRS along with any additional documentation required.

Legal use of the Form 433 B OIC Internal Revenue Service IRS

The legal use of the Form 433 B OIC is governed by IRS regulations. This form is legally binding when submitted correctly and can significantly impact a business's tax obligations. It is essential to comply with all IRS guidelines to ensure that the submission is valid. If the form is accepted, it can lead to a reduction in tax liability, making it a vital tool for businesses facing financial difficulties.

Eligibility Criteria

To qualify for submitting the Form 433 B OIC, businesses must meet specific eligibility criteria set by the IRS. These criteria include demonstrating an inability to pay the full tax liability and showing that the offer is in the best interest of both the taxpayer and the government. Additionally, businesses must be current on all filing and payment requirements to be considered for an OIC.

Required Documents

When submitting the Form 433 B OIC, several documents are required to support the application. These typically include:

- Recent bank statements

- Profit and loss statements

- Balance sheets

- Tax returns for the past three years

- Documentation of any outstanding debts

Providing these documents helps the IRS evaluate the business's financial situation accurately.

Quick guide on how to complete form 433 b oic internal revenue service irs

Complete Form 433 B OIC Internal Revenue Service Irs seamlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to locate the correct template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your files promptly without delays. Manage Form 433 B OIC Internal Revenue Service Irs on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

The simplest way to modify and eSign Form 433 B OIC Internal Revenue Service Irs effortlessly

- Locate Form 433 B OIC Internal Revenue Service Irs and then click Get Form to begin.

- Utilize the tools we offer to complete your template.

- Highlight pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Select how you wish to send your template, whether by email, text message (SMS), or invitation link, or save it to the computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document versions. airSlate SignNow meets your document management needs in just a few clicks from any gadget of your choosing. Modify and eSign Form 433 B OIC Internal Revenue Service Irs and ensure excellent communication at every phase of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 433 b oic internal revenue service irs

Create this form in 5 minutes!

How to create an eSignature for the form 433 b oic internal revenue service irs

How to create an electronic signature for the Form 433 B Oic Internal Revenue Service Irs in the online mode

How to create an electronic signature for the Form 433 B Oic Internal Revenue Service Irs in Google Chrome

How to make an electronic signature for signing the Form 433 B Oic Internal Revenue Service Irs in Gmail

How to generate an eSignature for the Form 433 B Oic Internal Revenue Service Irs straight from your mobile device

How to generate an electronic signature for the Form 433 B Oic Internal Revenue Service Irs on iOS

How to make an electronic signature for the Form 433 B Oic Internal Revenue Service Irs on Android OS

People also ask

-

What is 433 b oic and how does it relate to airSlate SignNow?

The 433 b oic is a provision that allows businesses to streamline document signing processes. airSlate SignNow fully supports this regulation, enabling companies to efficiently manage and eSign documents while remaining compliant. With user-friendly features, it becomes an ideal solution for businesses looking to implement the 433 b oic.

-

How does airSlate SignNow ensure compliance with the 433 b oic?

AirSlate SignNow complies with the 433 b oic by providing secure, legally binding electronic signatures. Our platform offers features such as audit trails and encryption, ensuring that all signatures meet industry standards. This guarantees that any signed document adheres to the compliance requirements set forth by the 433 b oic.

-

What pricing plans does airSlate SignNow offer for those interested in the 433 b oic?

AirSlate SignNow offers flexible pricing plans suitable for businesses of all sizes looking to utilize the 433 b oic. Our pricing is designed to be cost-effective, providing essential features at various price points. This ensures that businesses can choose a plan that best fits their needs while effectively managing their document workflows under the 433 b oic.

-

What key features does airSlate SignNow provide for the 433 b oic?

AirSlate SignNow includes several key features crucial for compliance with the 433 b oic, such as customizable templates, automated workflows, and secure sharing options. These features simplify the signing process and enhance productivity, allowing users to focus on core business tasks. Our easy-to-use interface ensures that anyone can navigate the platform with ease.

-

How can airSlate SignNow improve my business processes related to the 433 b oic?

By using airSlate SignNow, businesses can signNowly enhance their document signing processes related to the 433 b oic. Our platform automates repetitive tasks, reduces turnaround time, and minimizes paper usage. This leads to increased efficiency, allowing teams to close deals faster while remaining compliant with the 433 b oic.

-

Can airSlate SignNow integrate with other tools for 433 b oic compliance?

Yes, airSlate SignNow seamlessly integrates with various third-party applications that support compliance with the 433 b oic. These integrations enable users to sync their data and workflows effortlessly, improving overall efficiency. Whether it's CRM software or document management tools, our platform ensures your business operates smoothly.

-

What are the benefits of using airSlate SignNow for the 433 b oic?

The benefits of using airSlate SignNow for the 433 b oic include reduced operational costs, increased document security, and enhanced compliance. Our solution allows businesses to manage their signing processes with transparency and accountability, essential for meeting the requirements of the 433 b oic. This not only boosts productivity but also fosters trust with clients.

Get more for Form 433 B OIC Internal Revenue Service Irs

- Cohabitation agreement form

- Power of attorney for bank account form

- Ohio request for notice of commencement corporation form

- Expungement forms

- Texas bill of sale camper form

- Arizona quitclaim deed from individual to individual form

- How to write land agreement in nigeria form

- Arizona prenuptial premarital agreement without financial statements form

Find out other Form 433 B OIC Internal Revenue Service Irs

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free