Schedule E Form 990 or 990 EZInstructions for Schedule a Form 990 InternalInstructions for Schedule a Form 990 InternalInstructi 2022

Understanding the Schedule E Form 990 or 990 EZ

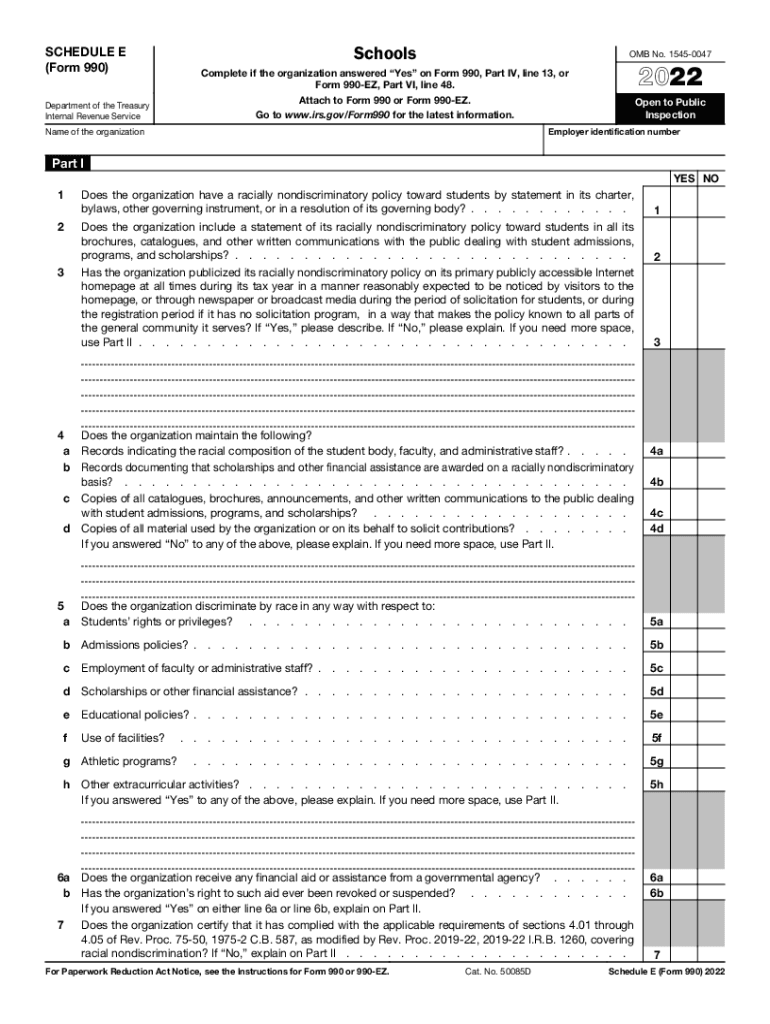

The Schedule E form is an essential component of the IRS Form 990 or 990 EZ, primarily used by tax-exempt organizations to report their income, expenses, and other financial information. This form is specifically designed to provide transparency regarding the organization's activities, ensuring compliance with IRS regulations. Organizations must include Schedule E when they have certain types of income, such as rental income or other non-operating revenue. Understanding the requirements and implications of this form is crucial for maintaining tax-exempt status.

Steps to Complete the Schedule E Form 990 or 990 EZ

Completing the Schedule E form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense reports. Next, follow these steps:

- Identify the type of income to report, such as rental income or investment income.

- Fill out the appropriate sections of the form, detailing the sources and amounts of income.

- Calculate any allowable deductions related to the reported income.

- Review the completed form for accuracy and ensure all required information is included.

- Submit the form along with the main Form 990 or 990 EZ by the filing deadline.

Legal Use of the Schedule E Form 990 or 990 EZ

The Schedule E form holds legal significance as it aids in maintaining compliance with IRS regulations. Properly completing and submitting this form helps organizations demonstrate their accountability and transparency in financial reporting. An accurate Schedule E can protect organizations from potential audits or penalties related to misreporting income. It is essential to understand the legal implications of the information provided and ensure that all entries are truthful and complete.

Filing Deadlines and Important Dates

Organizations must be aware of the filing deadlines for the Schedule E form to avoid penalties. Generally, the Form 990 or 990 EZ, along with Schedule E, is due on the 15th day of the fifth month after the end of the organization's fiscal year. For example, if the fiscal year ends on December 31, the forms would be due on May 15 of the following year. Organizations can apply for an extension, but it is crucial to file the extension request before the original deadline.

IRS Guidelines for Schedule E Form 990 or 990 EZ

The IRS provides specific guidelines for completing the Schedule E form, which organizations must follow to ensure compliance. These guidelines include instructions on what types of income must be reported, how to calculate allowable deductions, and the necessary documentation to support the reported figures. Organizations should refer to the IRS instructions for Form 990 and Schedule E for detailed information on compliance and reporting standards.

Examples of Using the Schedule E Form 990 or 990 EZ

Organizations may encounter various scenarios that necessitate the use of Schedule E. For instance, a nonprofit that rents out a portion of its facilities for events must report the rental income on Schedule E. Similarly, an organization that receives interest income from investments would also need to include this information. Understanding these examples helps organizations recognize when and how to utilize the Schedule E form effectively.

Quick guide on how to complete 2020 schedule e form 990 or 990 ezinstructions for schedule a form 990 2021internalinstructions for schedule a form 990

Complete Schedule E Form 990 Or 990 EZInstructions For Schedule A Form 990 InternalInstructions For Schedule A Form 990 InternalInstructi effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Schedule E Form 990 Or 990 EZInstructions For Schedule A Form 990 InternalInstructions For Schedule A Form 990 InternalInstructi on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Schedule E Form 990 Or 990 EZInstructions For Schedule A Form 990 InternalInstructions For Schedule A Form 990 InternalInstructi with ease

- Obtain Schedule E Form 990 Or 990 EZInstructions For Schedule A Form 990 InternalInstructions For Schedule A Form 990 InternalInstructi and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to secure your changes.

- Select your preferred method to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign Schedule E Form 990 Or 990 EZInstructions For Schedule A Form 990 InternalInstructions For Schedule A Form 990 InternalInstructi and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule e form 990 or 990 ezinstructions for schedule a form 990 2021internalinstructions for schedule a form 990

Create this form in 5 minutes!

People also ask

-

What is Form 990 Schedule E?

Form 990 Schedule E is a tax form used by nonprofit organizations to report information regarding their compensation and other payments to individuals, including staff and contractors. Understanding Form 990 Schedule E is essential for ensuring compliance with IRS regulations and maintaining transparency in financial reporting.

-

How does airSlate SignNow assist with Form 990 Schedule E?

airSlate SignNow simplifies the process of preparing and signing documents related to Form 990 Schedule E. With its user-friendly interface, organizations can easily create, send, and eSign necessary forms and schedules, ensuring that all information is accurate and submitted on time.

-

Is there a cost associated with using airSlate SignNow for Form 990 Schedule E?

Yes, airSlate SignNow offers various subscription plans that cater to different organizational needs. These plans are designed to be cost-effective, allowing users to access features that help manage Form 990 Schedule E documentation efficiently while staying within budget.

-

What features does airSlate SignNow offer for managing Form 990 Schedule E?

airSlate SignNow provides features such as template creation, collaborative editing, and real-time tracking for documents related to Form 990 Schedule E. These tools streamline the workflow, making it easier for nonprofits to prepare and maintain compliance with their tax forms.

-

Can airSlate SignNow integrate with other tools to manage Form 990 Schedule E?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, such as CRMs and accounting software, to facilitate the management of Form 990 Schedule E. These integrations enhance productivity and ensure that all relevant data is synchronized for accurate reporting.

-

What are the benefits of using airSlate SignNow for Form 990 Schedule E documentation?

Using airSlate SignNow for Form 990 Schedule E documentation provides several benefits, including enhanced security, ease of access, and improved compliance management. This ensures that organizations can focus on their charitable missions while maintaining accurate and timely reporting.

-

Is it easy to eSign documents for Form 990 Schedule E with airSlate SignNow?

Absolutely! airSlate SignNow's eSigning feature is designed for ease of use, allowing users to sign documents for Form 990 Schedule E quickly and securely. This reduces the time spent on paperwork and accelerates the submission process.

Get more for Schedule E Form 990 Or 990 EZInstructions For Schedule A Form 990 InternalInstructions For Schedule A Form 990 InternalInstructi

- Nj legal documents 497319577 form

- Essential legal life documents for new parents new jersey form

- General power of attorney for care and custody of child or children new jersey form

- Small business accounting package new jersey form

- New jersey procedures form

- Nj revocation form

- Nj statutory form

- Newly divorced individuals package new jersey form

Find out other Schedule E Form 990 Or 990 EZInstructions For Schedule A Form 990 InternalInstructions For Schedule A Form 990 InternalInstructi

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word