Schedule I 990 Ez 2017

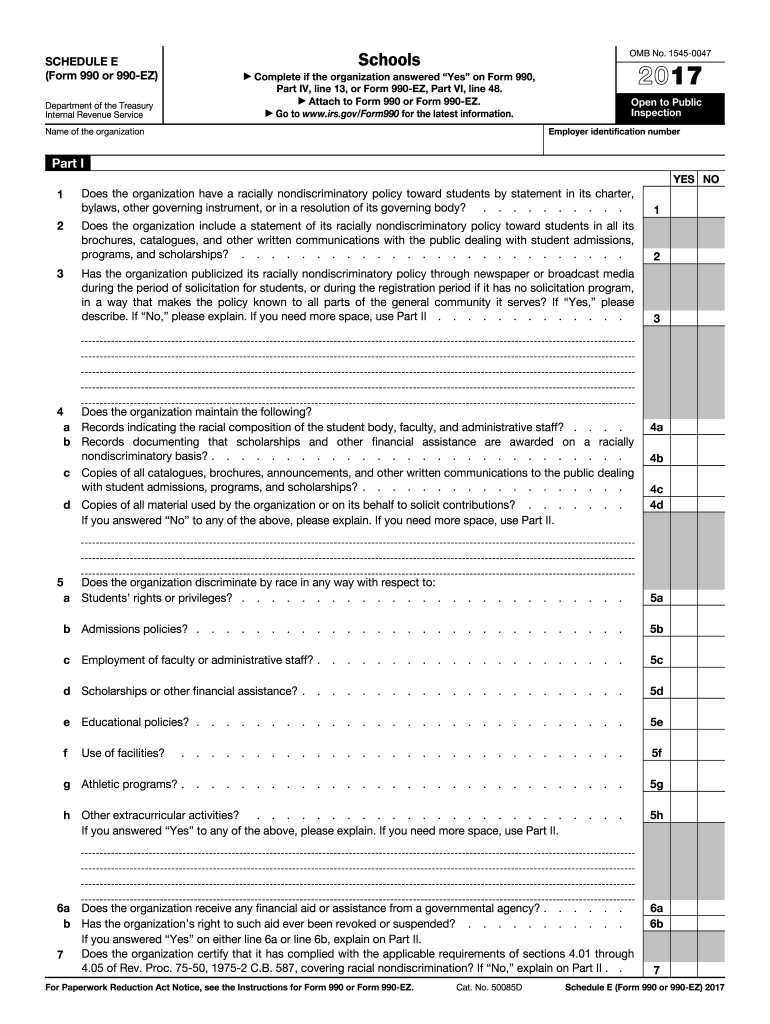

What is the IRS 990 Schedule E?

The IRS 990 Schedule E is a supplemental form used by tax-exempt organizations to report information about their income, expenses, and activities related to certain types of investments. This schedule is part of the larger Form 990, which is the annual information return required for tax-exempt organizations in the United States. Schedule E specifically focuses on reporting income from investments in partnerships, joint ventures, and similar entities. It helps the IRS assess the financial activities of these organizations and ensures compliance with federal tax regulations.

Steps to Complete the IRS 990 Schedule E

Completing the IRS 990 Schedule E involves several key steps:

- Gather necessary financial records, including income statements and partnership agreements.

- Identify all partnerships and joint ventures in which the organization is involved.

- Report income and expenses related to each partnership or joint venture, ensuring accuracy in figures.

- Complete all required fields on the form, paying attention to any specific instructions provided by the IRS.

- Review the completed schedule for accuracy and completeness before submission.

Legal Use of the IRS 990 Schedule E

The IRS 990 Schedule E must be used in accordance with federal tax laws. Organizations must file this schedule if they have income from partnerships or joint ventures. Failure to report this information can lead to penalties and potential loss of tax-exempt status. It is crucial for organizations to ensure that all reported information is accurate and complies with IRS guidelines to avoid legal complications.

Filing Deadlines / Important Dates

Organizations must adhere to specific deadlines when filing the IRS 990 Schedule E. Generally, Form 990, including all schedules, is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this typically means a May 15 deadline. Extensions may be available, but organizations should ensure that all forms are submitted timely to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The IRS 990 Schedule E can be submitted through various methods. Organizations may file electronically using approved e-filing software, which can streamline the process and reduce errors. Alternatively, organizations can submit the form by mail. If opting for mail submission, it is essential to send the form to the correct IRS address based on the organization’s location and type. In-person submission is generally not available for this form.

Required Documents

When completing the IRS 990 Schedule E, organizations must have several documents on hand to ensure accurate reporting. These include:

- Partnership agreements and contracts.

- Income statements detailing revenue from partnerships.

- Expense reports related to partnership activities.

- Prior year’s Form 990 and schedules for reference.

Having these documents readily available can facilitate a smoother completion process and help maintain compliance with IRS requirements.

Quick guide on how to complete 2016 990 e 2017 2018 form

Discover the most efficient method to complete and endorse your Schedule I 990 Ez

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior approach to completing and signing your Schedule I 990 Ez and associated forms for public services. Our advanced electronic signature solution equips you with everything required to manage paperwork swiftly and meet official standards - comprehensive PDF editing, management, security, signing, and sharing capabilities all readily available in a user-friendly platform.

Only a few steps are needed to finalize your Schedule I 990 Ez:

- Upload the editable template to the editor using the Get Form button.

- Identify the information you need to include in your Schedule I 990 Ez.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to complete the fields with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly important or Obscure fields that are no longer relevant.

- Click Sign to generate a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and conclude your work with the Done button.

Store your completed Schedule I 990 Ez in the Documents section of your profile, download it, or export it to your preferred cloud storage. Our tool also provides versatile form sharing options. There's no need to print out your documents when you can send them directly to the appropriate public office - use email, fax, or request a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 2016 990 e 2017 2018 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can I fill out the SSC CHSL 2017 form while waiting for the 2016 results?

Yes you can.By now you should have started preparing also.We motivate students to crack govt exams while working.Join our YouTube channel SSC PATHSHALA and enjoy learning like never before.Classroom Program for English Mains: Classroom Program for English Mains - YouTube

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

Create this form in 5 minutes!

How to create an eSignature for the 2016 990 e 2017 2018 form

How to generate an eSignature for the 2016 990 E 2017 2018 Form in the online mode

How to make an eSignature for the 2016 990 E 2017 2018 Form in Chrome

How to create an eSignature for putting it on the 2016 990 E 2017 2018 Form in Gmail

How to make an electronic signature for the 2016 990 E 2017 2018 Form straight from your mobile device

How to make an electronic signature for the 2016 990 E 2017 2018 Form on iOS devices

How to generate an eSignature for the 2016 990 E 2017 2018 Form on Android

People also ask

-

What is the Schedule I 990 Ez form and why is it important?

The Schedule I 990 Ez form is a part of the IRS Form 990 series that provides essential financial information for tax-exempt organizations. It's important because it helps organizations report their revenue, expenses, and net assets, ensuring compliance with federal tax regulations.

-

How can airSlate SignNow help with filling out the Schedule I 990 Ez?

airSlate SignNow simplifies the process of filling out the Schedule I 990 Ez by allowing users to create, edit, and eSign documents easily. With its intuitive interface, you can quickly input necessary information and ensure that your form is accurate and compliant.

-

What features does airSlate SignNow offer for Schedule I 990 Ez preparation?

airSlate SignNow offers features such as document templates, eSignature capabilities, and real-time collaboration for Schedule I 990 Ez preparation. These tools streamline the process, making it easier for organizations to complete their tax forms efficiently.

-

Is airSlate SignNow a cost-effective solution for managing the Schedule I 990 Ez?

Yes, airSlate SignNow is a cost-effective solution for managing the Schedule I 990 Ez, offering various pricing plans that cater to different organizational needs. By using airSlate SignNow, you can save time and money while ensuring compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other software for my Schedule I 990 Ez filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and document management software, which can be particularly beneficial when filing the Schedule I 990 Ez. These integrations help streamline your workflow and keep all relevant data organized.

-

What are the benefits of using airSlate SignNow for the Schedule I 990 Ez?

Using airSlate SignNow for the Schedule I 990 Ez provides several benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. The platform's user-friendly features allow teams to collaborate effectively, ensuring timely submission of tax documents.

-

Does airSlate SignNow provide support for Schedule I 990 Ez queries?

Yes, airSlate SignNow offers customer support to assist users with any queries regarding the Schedule I 990 Ez. Whether you need help with the software or have questions about tax compliance, our support team is ready to assist.

Get more for Schedule I 990 Ez

Find out other Schedule I 990 Ez

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe