Www Irs Govpubirs Pdf2021 Schedule E Form 990 Internal Revenue Service 2021

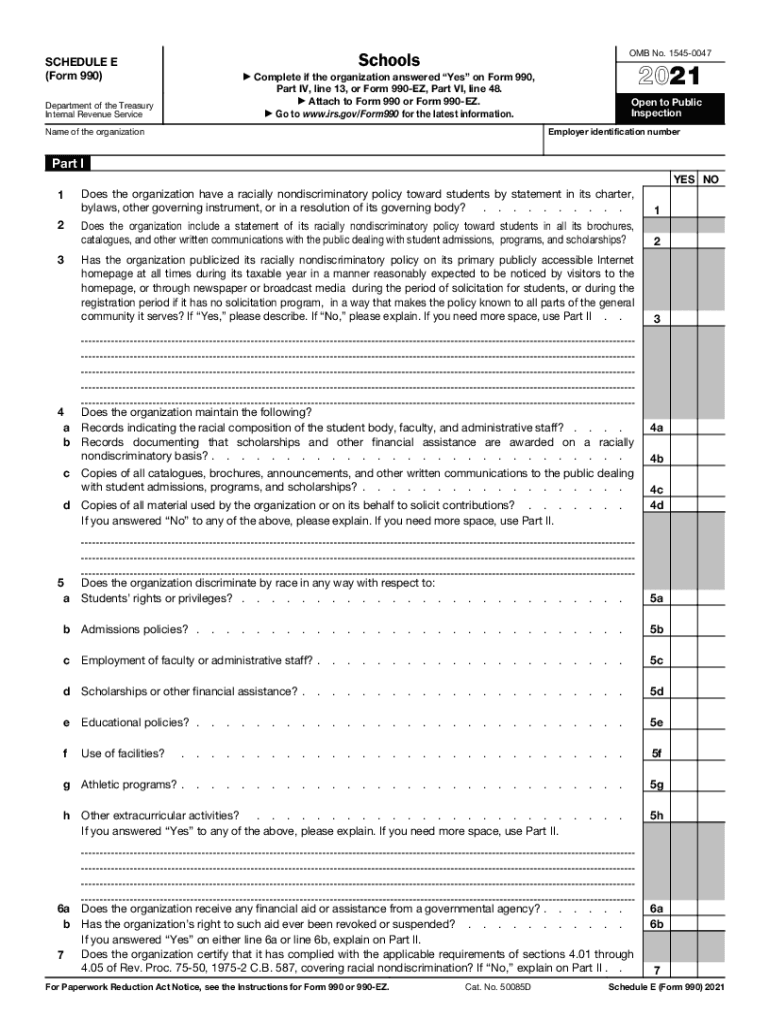

What is the IRS 990 Schedule E Form?

The IRS 990 Schedule E form is a supplemental document that nonprofit organizations must file with their annual IRS Form 990. This form is specifically designed to report information about the organization's income from various sources, including investments and other revenue-generating activities. Understanding the purpose of Schedule E is crucial for organizations to ensure compliance with federal tax regulations and to provide transparency regarding their financial activities.

Key Elements of the IRS 990 Schedule E Form

Several key elements are essential for completing the IRS 990 Schedule E form accurately:

- Income Reporting: Organizations must detail their income sources, including contributions, grants, and investment income.

- Expense Tracking: The form requires a breakdown of expenses related to income-generating activities, ensuring that organizations report their financial activities comprehensively.

- Program Services: Nonprofits must describe how their income supports their mission and program services, highlighting the impact of their financial activities.

Steps to Complete the IRS 990 Schedule E Form

Completing the IRS 990 Schedule E form involves several steps to ensure accuracy and compliance:

- Gather all relevant financial documents, including income statements and expense reports.

- Fill out the income section, detailing all sources of revenue received during the fiscal year.

- Complete the expense section, categorizing expenses related to the reported income.

- Review the form for accuracy, ensuring all figures are correct and supported by documentation.

- Submit the completed form along with the main IRS Form 990 by the specified deadline.

Legal Use of the IRS 990 Schedule E Form

The IRS 990 Schedule E form must be completed and filed in accordance with federal tax laws. This form serves as a legal document that provides transparency about a nonprofit's financial activities. Nonprofits must ensure that the information reported is accurate and complete, as discrepancies can lead to penalties or loss of tax-exempt status. Compliance with the legal requirements surrounding the form is essential for maintaining the organization's credibility and trust with stakeholders.

Filing Deadlines for the IRS 990 Schedule E Form

Organizations must be aware of the filing deadlines for the IRS 990 Schedule E form to avoid penalties. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. If the organization operates on a calendar year basis, the deadline would be May fifteenth. Extensions may be available, but organizations must file the appropriate forms to request additional time.

Form Submission Methods

The IRS 990 Schedule E form can be submitted through various methods:

- Online Filing: Many organizations choose to file electronically using approved software that simplifies the process and ensures compliance.

- Mail Submission: Organizations can also print the completed form and mail it to the IRS at the designated address for their region.

- In-Person Filing: While less common, some organizations may opt to deliver their forms directly to an IRS office.

Quick guide on how to complete wwwirsgovpubirs pdf2021 schedule e form 990 internal revenue service

Effortlessly Prepare Www irs govpubirs pdf2021 Schedule E Form 990 Internal Revenue Service on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers a sustainable alternative to traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Www irs govpubirs pdf2021 Schedule E Form 990 Internal Revenue Service on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related processes today.

How to Modify and eSign Www irs govpubirs pdf2021 Schedule E Form 990 Internal Revenue Service with Ease

- Obtain Www irs govpubirs pdf2021 Schedule E Form 990 Internal Revenue Service and click on Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Www irs govpubirs pdf2021 Schedule E Form 990 Internal Revenue Service while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2021 schedule e form 990 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 schedule e form 990 internal revenue service

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

How to generate an e-signature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an e-signature for a PDF on Android devices

People also ask

-

What is the 990 schedule e used for?

The 990 schedule e is used by organizations to report specific information about their professional fundraising services. It is an essential part of the Form 990 submission that provides transparency on how organizations interact with their donors and manage fundraising activities.

-

How can airSlate SignNow assist with preparing the 990 schedule e?

AirSlate SignNow streamlines the process of preparing the 990 schedule e by allowing you to electronically sign and manage documents efficiently. With its user-friendly interface, you can gather necessary signatures quickly, ensuring accurate and timely submissions.

-

What are the pricing options for using airSlate SignNow for the 990 schedule e?

AirSlate SignNow offers various pricing plans to accommodate different business needs, which can include support for preparing the 990 schedule e. These plans are designed to provide scalable solutions for organizations of all sizes, allowing you to choose the one that best fits your budget.

-

Does airSlate SignNow integrate with accounting software for 990 schedule e submissions?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage the information needed for the 990 schedule e. This integration streamlines the documentation process, allowing for efficient transfers of data between platforms.

-

What are the benefits of using airSlate SignNow for the 990 schedule e?

Using airSlate SignNow for the 990 schedule e offers numerous benefits, including enhanced collaboration, faster document turnaround times, and increased security for sensitive information. Additionally, its cost-effective solutions help organizations save time and resources.

-

Is there customer support available for questions about the 990 schedule e?

Yes, airSlate SignNow provides robust customer support to assist with any inquiries related to the 990 schedule e. Our knowledgeable team is available to help you navigate the platform and address any questions you may have regarding your document management.

-

Can airSlate SignNow help with eSigning documents related to the 990 schedule e?

Absolutely! AirSlate SignNow is designed for easy electronic signing, which is particularly beneficial for documents related to the 990 schedule e. You can securely collect signatures from multiple parties, ensuring that your submissions are complete and compliant.

Get more for Www irs govpubirs pdf2021 Schedule E Form 990 Internal Revenue Service

- District of columbia installments fixed rate promissory note secured by commercial real estate district of columbia form

- Notice of option for recording district of columbia form

- Dc attorney form

- Essential legal life documents for baby boomers district of columbia form

- District of columbia legal 497301756 form

- District of columbia legal 497301757 form

- District of columbia legal 497301758 form

- District of columbia general 497301759 form

Find out other Www irs govpubirs pdf2021 Schedule E Form 990 Internal Revenue Service

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile