SCHEDULE E Schools OMB No 1545 0047 Form 990 or 990 EZ 2020

What is the 990 Schedule E?

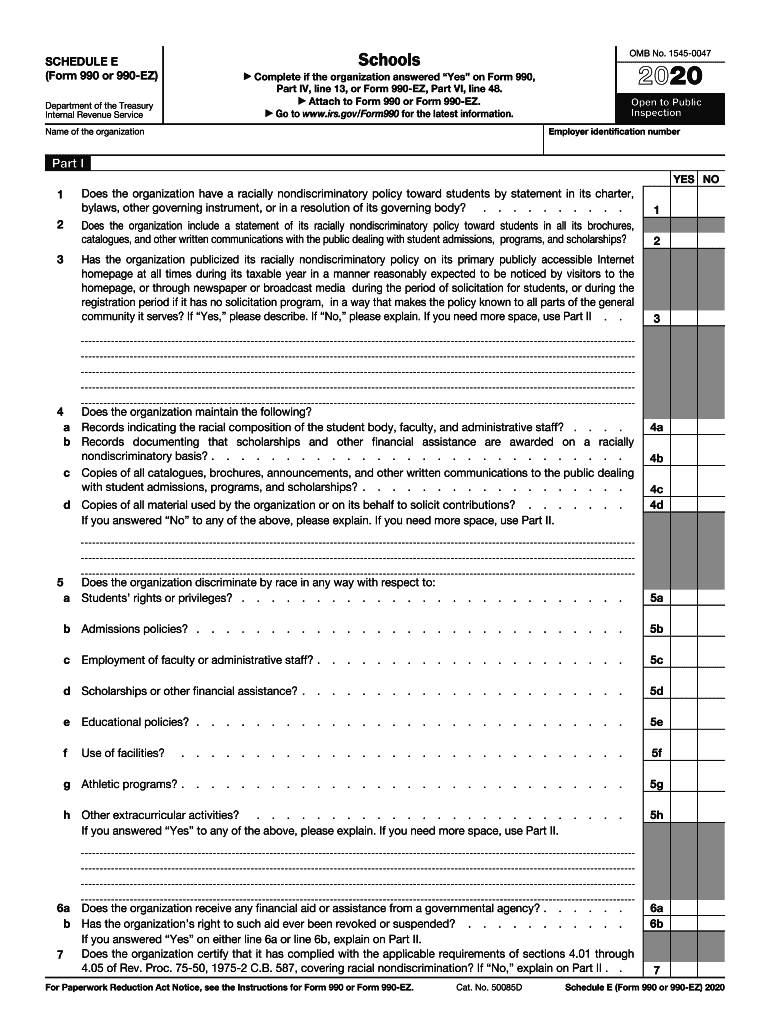

The 990 Schedule E is a form used by certain tax-exempt organizations in the United States to report information regarding their schools or educational programs. This form is part of the IRS Form 990 or 990-EZ, which tax-exempt organizations must file annually. Specifically, Schedule E provides details about the organization’s educational activities, including the number of students served, the types of programs offered, and the financial support received. Understanding this form is crucial for compliance with IRS regulations and for maintaining tax-exempt status.

How to Use the 990 Schedule E

Using the 990 Schedule E involves accurately reporting the educational activities of your organization. Begin by gathering all relevant information about your educational programs, including enrollment figures, program descriptions, and financial data. This information will be necessary to complete the form accurately. Once you have the data, fill out the form by following the instructions provided by the IRS. Ensure that all entries are clear and precise to avoid any potential issues during the review process.

Steps to Complete the 990 Schedule E

Completing the 990 Schedule E requires careful attention to detail. Follow these steps for a smooth process:

- Collect necessary data: Gather information about your educational programs, including student numbers and funding sources.

- Review IRS guidelines: Familiarize yourself with the specific instructions for Schedule E to ensure compliance.

- Fill out the form: Input the collected data into the appropriate sections of the form.

- Double-check entries: Review all information for accuracy and completeness before submission.

- Submit the form: File the completed Schedule E along with your Form 990 or 990-EZ by the designated deadline.

Legal Use of the 990 Schedule E

The 990 Schedule E is legally binding and must be completed in accordance with IRS regulations. Accurate reporting is essential to maintain your organization’s tax-exempt status. Failure to comply with the requirements can result in penalties or loss of tax-exempt status. It is important to ensure that all information provided is truthful and reflects the organization’s actual activities. Consulting with a tax professional can help navigate any complex legal aspects associated with this form.

Filing Deadlines for the 990 Schedule E

Filing deadlines for the 990 Schedule E align with the deadlines for Form 990 or 990-EZ. Typically, organizations must file these forms by the fifteenth day of the fifth month after the end of their fiscal year. For example, if your fiscal year ends on December thirty-first, the filing deadline would be May fifteenth of the following year. It is important to be aware of these deadlines to avoid late filing penalties.

Examples of Using the 990 Schedule E

Organizations often use the 990 Schedule E to report various educational activities. For instance, a nonprofit organization that runs a charter school would detail the number of students enrolled, the curriculum offered, and any funding received from grants or donations. Another example could be a community organization providing after-school programs, which would report on the number of participants and the types of services provided. These examples illustrate the diverse applications of the 990 Schedule E in documenting educational initiatives.

Quick guide on how to complete schedule e schools omb no 1545 0047 form 990 or 990 ez

Easily Prepare SCHEDULE E Schools OMB No 1545 0047 Form 990 Or 990 EZ on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle SCHEDULE E Schools OMB No 1545 0047 Form 990 Or 990 EZ on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign SCHEDULE E Schools OMB No 1545 0047 Form 990 Or 990 EZ

- Locate SCHEDULE E Schools OMB No 1545 0047 Form 990 Or 990 EZ and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as an old-fashioned ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign SCHEDULE E Schools OMB No 1545 0047 Form 990 Or 990 EZ and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule e schools omb no 1545 0047 form 990 or 990 ez

Create this form in 5 minutes!

How to create an eSignature for the schedule e schools omb no 1545 0047 form 990 or 990 ez

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is the 990 schedule e, and why is it important?

The 990 schedule e is a tax form that nonprofit organizations use to report their income, expenses, and financial activities. It is essential for maintaining compliance with IRS regulations and provides transparency to stakeholders about how funds are utilized.

-

How can airSlate SignNow simplify the process of filing the 990 schedule e?

airSlate SignNow streamlines the process of preparing and electronically signing the 990 schedule e. Our platform allows users to upload documents, get eSignatures quickly, and maintain an organized digital record, reducing the stress associated with tax season.

-

Is airSlate SignNow cost-effective for organizations needing to file the 990 schedule e?

Yes, airSlate SignNow offers competitive pricing plans that cater to various organizational needs, making it a cost-effective choice for those looking to file the 990 schedule e. With our services, you can save time and money on document management and eSigning.

-

What features does airSlate SignNow offer for managing 990 schedule e documents?

airSlate SignNow provides various features for managing 990 schedule e documents, including advanced security measures, collaboration tools, and automated workflows. These features enhance the efficiency of document handling and ensure that all necessary signatures are obtained promptly.

-

Can airSlate SignNow integrate with accounting software for 990 schedule e preparation?

Absolutely! airSlate SignNow can seamlessly integrate with popular accounting software, simplifying the preparation of the 990 schedule e. This integration allows users to pull relevant financial data directly into their forms, ensuring accuracy and saving time.

-

What are the benefits of using airSlate SignNow for eSigning the 990 schedule e?

Using airSlate SignNow for eSigning the 990 schedule e offers several benefits, including quick turnaround times, enhanced security, and easy document tracking. Our platform ensures that all signatures are legally binding and can be verified, giving you peace of mind.

-

How does airSlate SignNow ensure the security of my 990 schedule e documents?

AirSlate SignNow utilizes top-notch security protocols to protect your sensitive information when handling the 990 schedule e. We employ encryption, secure cloud storage, and access controls, ensuring that your documents remain confidential and safe from unauthorized access.

Get more for SCHEDULE E Schools OMB No 1545 0047 Form 990 Or 990 EZ

- Quitclaim deed from husband and wife to husband and wife wyoming form

- Wyoming husband form

- Wyoming revocation form

- Postnuptial property agreement wyoming wyoming form

- Amendment to postnuptial property agreement wyoming wyoming form

- Quitclaim deed from husband and wife to an individual wyoming form

- Warranty deed from husband and wife to an individual wyoming form

- Quitclaim deed trust to husband and wife wyoming form

Find out other SCHEDULE E Schools OMB No 1545 0047 Form 990 Or 990 EZ

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile