Schedule E Form 990 or 990 EZ Schools 2015

What is the Schedule E Form 990 or 990 EZ Schools

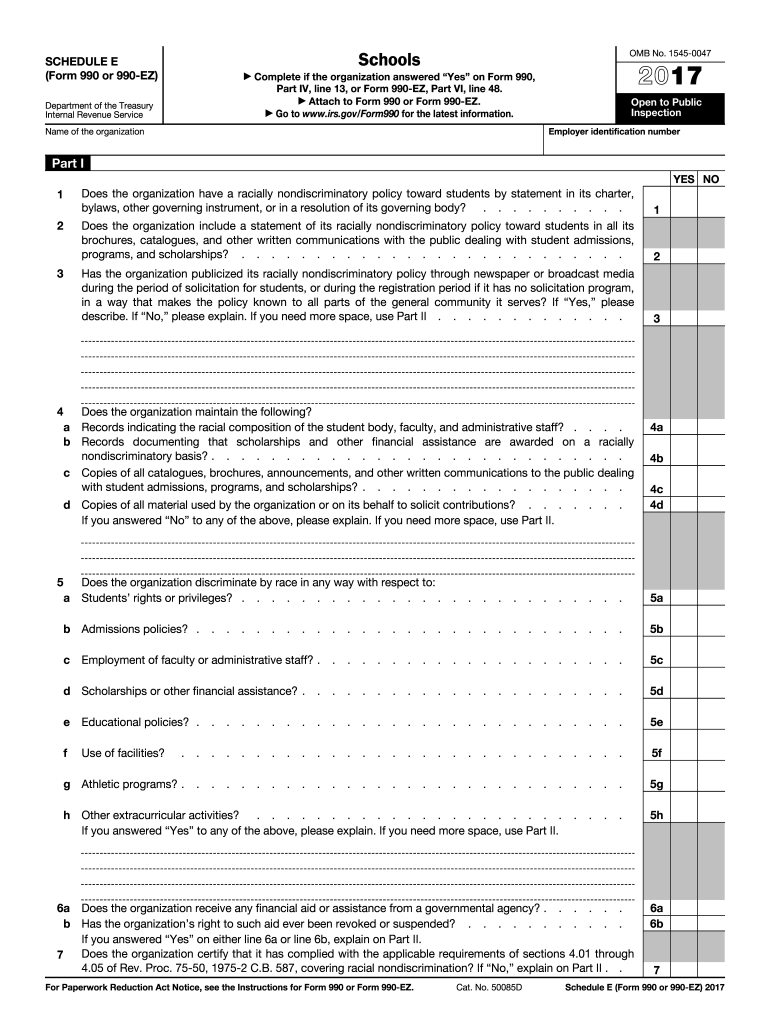

The Schedule E Form 990 or 990 EZ Schools is a tax form used by educational institutions in the United States to report their financial information to the Internal Revenue Service (IRS). This form is essential for schools that operate as tax-exempt organizations under section 501(c)(3) of the Internal Revenue Code. It provides a comprehensive overview of the school’s revenue, expenses, and net assets, helping the IRS assess compliance with tax regulations. The form is designed to ensure transparency and accountability in the financial operations of educational institutions.

How to use the Schedule E Form 990 or 990 EZ Schools

Using the Schedule E Form 990 or 990 EZ Schools involves several key steps. First, gather all necessary financial data, including income statements, balance sheets, and any relevant supporting documents. Next, complete the form by accurately entering financial figures in the designated sections. It's important to ensure that all information is precise and aligns with the school’s financial records. After filling out the form, review it for accuracy before submission. Schools can file the form electronically or by mail, depending on their preference and compliance requirements.

Steps to complete the Schedule E Form 990 or 990 EZ Schools

Completing the Schedule E Form 990 or 990 EZ Schools requires a systematic approach. Follow these steps:

- Collect financial documents, including revenue sources, expenses, and prior year’s tax returns.

- Fill in the basic information about the school, such as its name, address, and Employer Identification Number (EIN).

- Report total revenue, detailing income from tuition, donations, grants, and other sources.

- Document expenses, categorizing them into operational costs, salaries, and other expenditures.

- Calculate net assets and ensure that all figures are consistent with the school’s financial statements.

- Review the completed form for any errors or omissions before submission.

Legal use of the Schedule E Form 990 or 990 EZ Schools

The legal use of the Schedule E Form 990 or 990 EZ Schools is governed by IRS regulations. Schools must ensure that the information provided is truthful and complete to avoid penalties. The form serves as a legal document that can be audited by the IRS, making accuracy crucial. Schools should also retain copies of the submitted forms and supporting documents for their records. Compliance with the legal requirements not only helps in maintaining tax-exempt status but also fosters trust with stakeholders, including donors and the community.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule E Form 990 or 990 EZ Schools are critical to ensure compliance with IRS regulations. Typically, the form is due on the fifteenth day of the fifth month after the end of the school’s fiscal year. For schools operating on a calendar year basis, this means the form is usually due by May 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Schools may also request an extension, but it is essential to file the extension request before the original deadline.

Required Documents

To successfully complete the Schedule E Form 990 or 990 EZ Schools, several documents are required. These include:

- Financial statements, including income statements and balance sheets.

- Previous year’s tax returns for reference.

- Documentation of revenue sources, such as tuition, grants, and donations.

- Records of expenses, including payroll, operational costs, and other expenditures.

Having these documents readily available ensures a smoother and more accurate completion of the form.

Quick guide on how to complete 2018 schedule e form 990 or 990 ez schools

Complete Schedule E Form 990 Or 990 EZ Schools effortlessly on any device

Online document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documentation, as you can obtain the required form and securely store it online. airSlate SignNow provides all the resources necessary to create, alter, and eSign your documents swiftly without delays. Handle Schedule E Form 990 Or 990 EZ Schools on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Schedule E Form 990 Or 990 EZ Schools seamlessly

- Locate Schedule E Form 990 Or 990 EZ Schools and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this task.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your edits.

- Select your preferred method for delivering your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and eSign Schedule E Form 990 Or 990 EZ Schools and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 schedule e form 990 or 990 ez schools

Create this form in 5 minutes!

How to create an eSignature for the 2018 schedule e form 990 or 990 ez schools

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the Schedule E Form 990 Or 990 EZ Schools?

The Schedule E Form 990 Or 990 EZ Schools is a supplemental report required by the IRS for educational institutions to disclose financial information. This form is crucial for schools seeking to maintain tax-exempt status and communicate their financial activities transparently.

-

How can airSlate SignNow assist with completing the Schedule E Form 990 Or 990 EZ Schools?

airSlate SignNow offers a streamlined platform that simplifies the process of completing and signing the Schedule E Form 990 Or 990 EZ Schools. With its user-friendly interface, schools can easily fill out, review, and eSign the form, ensuring compliance and accuracy in their reporting.

-

What are the pricing options for airSlate SignNow when handling the Schedule E Form 990 Or 990 EZ Schools?

airSlate SignNow provides affordable pricing plans tailored to the needs of schools managing the Schedule E Form 990 Or 990 EZ Schools. The cost-effective solution ensures that educational institutions can meet their compliance needs without overspending.

-

What features does airSlate SignNow offer for managing the Schedule E Form 990 Or 990 EZ Schools?

airSlate SignNow boasts features such as document templates, automated reminders, and secure eSignature options to facilitate the management of the Schedule E Form 990 Or 990 EZ Schools. These tools help schools efficiently handle their paperwork while maintaining compliance with IRS regulations.

-

Is airSlate SignNow compliant with IRS standards for the Schedule E Form 990 Or 990 EZ Schools?

Yes, airSlate SignNow is designed to be compliant with IRS standards for submitting the Schedule E Form 990 Or 990 EZ Schools. Our solution ensures that your documents are handled securely and legally, allowing schools to focus on their educational mission.

-

Can I integrate airSlate SignNow with other tools to facilitate the Schedule E Form 990 Or 990 EZ Schools process?

Absolutely! airSlate SignNow offers various integrations with popular tools to enhance the efficiency of managing the Schedule E Form 990 Or 990 EZ Schools. This allows schools to streamline their administrative tasks and improve overall productivity.

-

What are the benefits of using airSlate SignNow for the Schedule E Form 990 Or 990 EZ Schools?

Using airSlate SignNow for the Schedule E Form 990 Or 990 EZ Schools provides numerous benefits, including time savings, enhanced accuracy, and improved document security. Our platform enables schools to efficiently navigate the complexities of IRS reporting.

Get more for Schedule E Form 990 Or 990 EZ Schools

Find out other Schedule E Form 990 Or 990 EZ Schools

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later