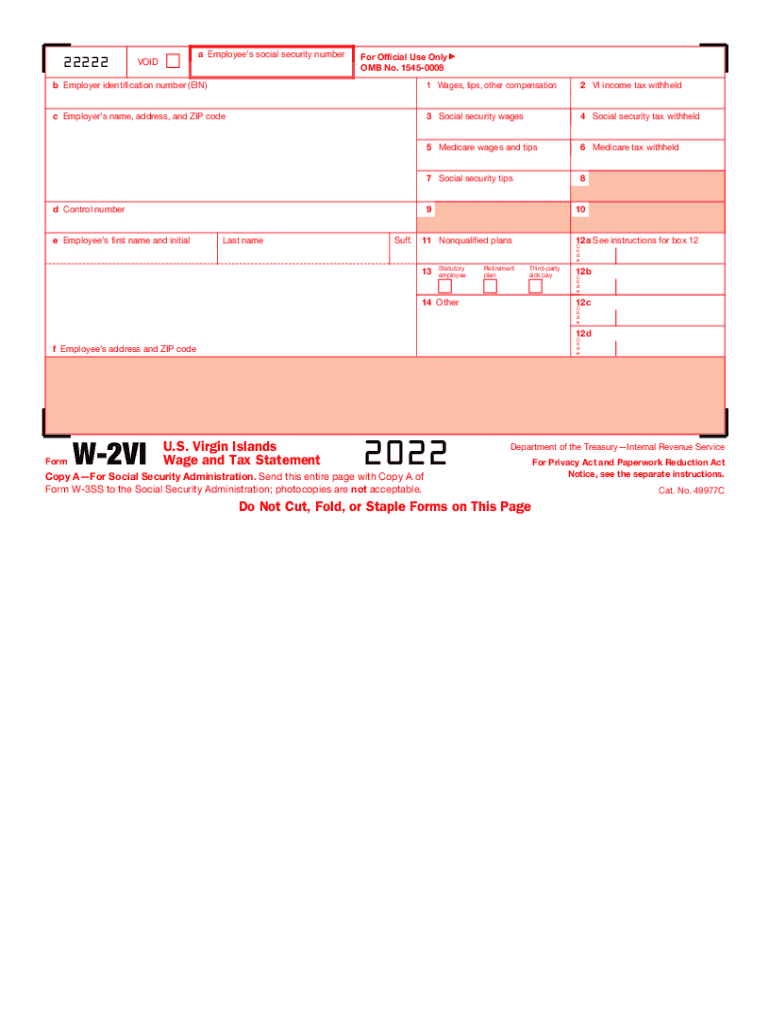

W2 Attention You May File Forms W 2 and W 3 Electronically on the 2022

What makes the w2 attention you may file forms w 2 and w 3 electronically on the legally valid?

As the society ditches in-office work, the execution of paperwork increasingly happens online. The w2 attention you may file forms w 2 and w 3 electronically on the isn’t an exception. Dealing with it utilizing electronic means is different from doing this in the physical world.

An eDocument can be viewed as legally binding given that particular requirements are satisfied. They are especially vital when it comes to stipulations and signatures associated with them. Typing in your initials or full name alone will not ensure that the organization requesting the form or a court would consider it performed. You need a trustworthy tool, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - key legal frameworks for eSignatures.

How to protect your w2 attention you may file forms w 2 and w 3 electronically on the when completing it online?

Compliance with eSignature regulations is only a fraction of what airSlate SignNow can offer to make document execution legal and secure. In addition, it offers a lot of possibilities for smooth completion security wise. Let's quickly run through them so that you can stay assured that your w2 attention you may file forms w 2 and w 3 electronically on the remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy regulations in the USA and Europe.

- Dual-factor authentication: provides an extra layer of security and validates other parties identities through additional means, such as an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the information securely to the servers.

Submitting the w2 attention you may file forms w 2 and w 3 electronically on the with airSlate SignNow will give better confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete w2 attention you may file forms w 2 and w 3 electronically on the

Prepare W2 Attention You May File Forms W 2 And W 3 Electronically On The easily on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage W2 Attention You May File Forms W 2 And W 3 Electronically On The on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to alter and eSign W2 Attention You May File Forms W 2 And W 3 Electronically On The effortlessly

- Locate W2 Attention You May File Forms W 2 And W 3 Electronically On The and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign W2 Attention You May File Forms W 2 And W 3 Electronically On The and maintain outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w2 attention you may file forms w 2 and w 3 electronically on the

Create this form in 5 minutes!

People also ask

-

What is a fillable W 2 form 2017?

A fillable W 2 form 2017 is a digital version of the IRS Form W-2 that enables employers to easily enter employee wage information and tax details. This form is designed for easy completion and submission, ensuring compliance with IRS regulations while saving time and reducing errors.

-

How does airSlate SignNow help in filling out a W 2 form 2017?

airSlate SignNow offers a user-friendly platform that allows you to create and complete a fillable W 2 form 2017 with ease. You can fill in necessary fields electronically, sign the document, and send it directly to your employees or the IRS, all in a secure environment.

-

Is there a cost associated with using airSlate SignNow for the fillable W 2 form 2017?

Yes, airSlate SignNow provides various pricing plans to accommodate different business needs. Our pricing is competitive and offers great value for the features, including access to fillable W 2 form 2017 functionalities, unlimited signing, and document management.

-

Can I save and store a completed fillable W 2 form 2017 in airSlate SignNow?

Absolutely! Once you complete the fillable W 2 form 2017, you can save it securely within your airSlate SignNow account. This allows for easy access and retrieval, maintaining compliance without the hassle of physical paperwork.

-

What are the benefits of using an electronic fillable W 2 form 2017 over traditional paper forms?

Using a fillable W 2 form 2017 electronically streamlines the process, reduces the chance of errors, and speeds up submission times. Additionally, electronic forms are environmentally friendly and easily editable, allowing for instant updates if needed.

-

Does airSlate SignNow integrate with other software for managing the fillable W 2 form 2017?

Yes, airSlate SignNow integrates seamlessly with a variety of business applications, such as payroll and HR software. This means you can manage and automate your workflow around the fillable W 2 form 2017 with ease, enhancing overall efficiency.

-

Is it possible to send the fillable W 2 form 2017 directly to my employees through airSlate SignNow?

Yes, you can easily send the completed fillable W 2 form 2017 directly to your employees using airSlate SignNow. The platform ensures that the delivery is secure and that your employees can access their forms quickly and conveniently.

Get more for W2 Attention You May File Forms W 2 And W 3 Electronically On The

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form new mexico

- Unconditional lien final payment form

- Quitclaim deed from husband and wife to llc new mexico form

- Warranty deed from husband and wife to llc new mexico form

- New mexico judgment form

- Nm assignment form

- Report of mediation new mexico form

- Letter from landlord to tenant as notice to remove wild animals in premises new mexico form

Find out other W2 Attention You May File Forms W 2 And W 3 Electronically On The

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF