Inst 1040 Schedule C 2022

What is the Inst 1040 Schedule C

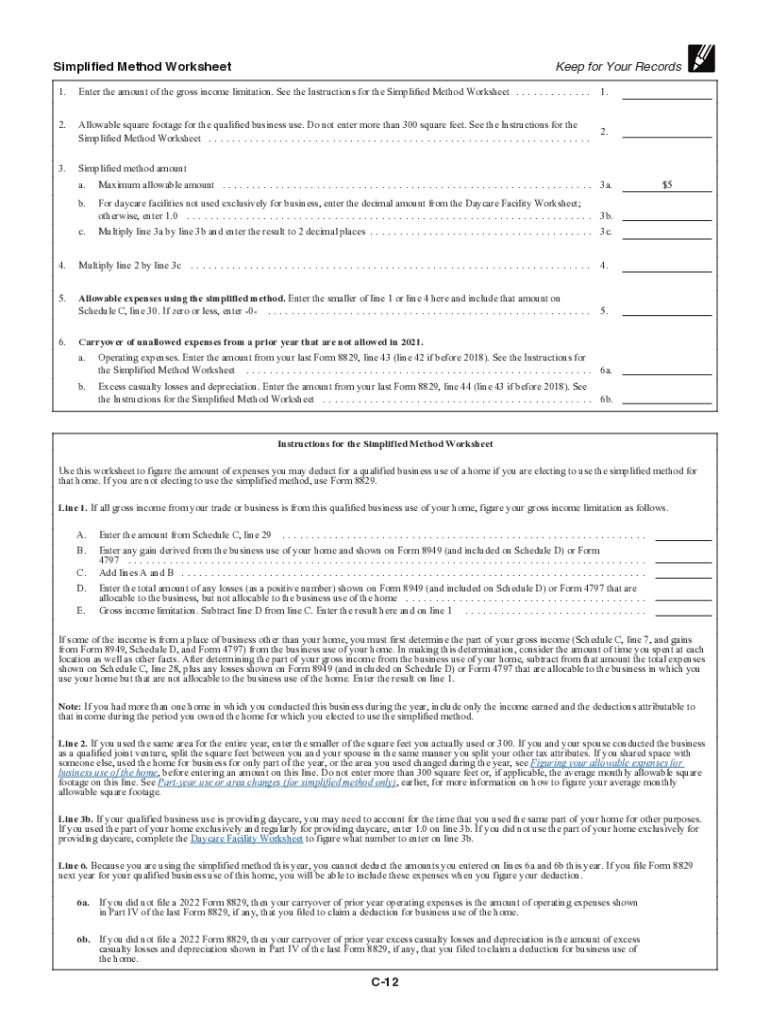

The Inst 1040 Schedule C is a crucial tax form used by sole proprietors in the United States to report income or loss from their business activities. This form is part of the individual income tax return process and is essential for self-employed individuals to accurately calculate their taxable income. By detailing business earnings and expenses, the Inst 1040 Schedule C helps taxpayers determine their net profit or loss, which is then reported on their Form 1040. Understanding this form is vital for compliance with IRS regulations and effective tax management.

How to use the Inst 1040 Schedule C

Using the Inst 1040 Schedule C involves several steps to ensure accurate reporting of your business income and expenses. First, gather all relevant financial documents, including income statements, receipts for expenses, and any other records that reflect your business operations. Next, complete the form by entering your business information, including the name, address, and type of business. Report your total income, followed by your business expenses, which may include costs such as supplies, wages, and utilities. Finally, calculate your net profit or loss and transfer this information to your Form 1040. It is important to keep a copy of the completed form for your records.

Steps to complete the Inst 1040 Schedule C

Completing the Inst 1040 Schedule C requires careful attention to detail. Here are the steps to follow:

- Step 1: Gather all necessary financial documents, including income records and expense receipts.

- Step 2: Fill in your business information, including the name and address of your business.

- Step 3: Report your gross receipts or sales from the business.

- Step 4: List all deductible business expenses in the appropriate categories.

- Step 5: Calculate your net profit or loss by subtracting total expenses from total income.

- Step 6: Transfer the net profit or loss to your Form 1040.

Legal use of the Inst 1040 Schedule C

The legal use of the Inst 1040 Schedule C is governed by IRS regulations. To ensure compliance, it is important to accurately report all income and expenses associated with your business. Misreporting can lead to penalties or audits. Additionally, using a reliable eSignature platform to sign and submit your forms electronically can enhance the legal validity of your submissions. Compliance with eSignature laws, such as the ESIGN Act, further ensures that your electronic documents are legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Inst 1040 Schedule C align with the overall tax return deadlines set by the IRS. Typically, the deadline for submitting your Form 1040, along with the Schedule C, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, if you need more time, you can file for an extension, which generally allows an additional six months. However, it is important to note that while an extension gives you more time to file, it does not extend the time to pay any taxes owed.

Examples of using the Inst 1040 Schedule C

Examples of using the Inst 1040 Schedule C include various scenarios where individuals report income from self-employment. For instance, a freelance graphic designer would use this form to report income earned from client projects and deduct related expenses such as software subscriptions and office supplies. Similarly, a small business owner operating a local bakery would report sales revenue and deduct costs like ingredients, utilities, and wages paid to employees. Each example illustrates the versatility of the Inst 1040 Schedule C in capturing the financial activities of diverse business operations.

Quick guide on how to complete inst 1040 schedule c

Prepare Inst 1040 Schedule C effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly without delays. Manage Inst 1040 Schedule C on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The easiest way to modify and electronically sign Inst 1040 Schedule C without hassle

- Obtain Inst 1040 Schedule C and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Inst 1040 Schedule C to ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct inst 1040 schedule c

Create this form in 5 minutes!

People also ask

-

What is Inst 1040 Schedule C?

Inst 1040 Schedule C is a form used by sole proprietors to report their income and expenses for self-employment. It is an essential document for calculating net profit or loss from business operations, making it vital for tax filing. Understanding how to complete Inst 1040 Schedule C can help taxpayers ensure they don't miss any deductions.

-

How does airSlate SignNow help with Inst 1040 Schedule C?

airSlate SignNow streamlines the process of creating and managing Inst 1040 Schedule C documents. With our platform, users can easily eSign forms, ensuring faster and more efficient submissions. By using airSlate SignNow, businesses can stay organized and compliant when handling tax-related documents.

-

Is airSlate SignNow affordable for small businesses needing Inst 1040 Schedule C?

Yes, airSlate SignNow is a cost-effective solution ideal for small businesses that need to manage Inst 1040 Schedule C documentation. Our pricing plans are designed to fit budgets of all sizes, without compromising on features. This affordability allows even the smallest ventures to access essential signing solutions.

-

What features does airSlate SignNow offer for Inst 1040 Schedule C management?

airSlate SignNow provides several key features for Inst 1040 Schedule C management, including document templates, electronic signatures, and easy tracking of document status. Users can ensure that all signatures are collected efficiently, which enhances the overall workflow. This makes preparing and submitting the Inst 1040 Schedule C quicker and easier.

-

Can airSlate SignNow integrate with accounting software for Inst 1040 Schedule C?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing for seamless data transfer when handling Inst 1040 Schedule C forms. This integration eliminates the need for manual data entry and reduces the chances of errors. Such connections ensure you stay organized while managing your taxes.

-

What are the benefits of using airSlate SignNow for Inst 1040 Schedule C?

Using airSlate SignNow for Inst 1040 Schedule C comes with numerous benefits such as increased efficiency, reduced paperwork, and secure document management. Better organization means that businesses can meet deadlines more easily. Additionally, electronic signatures provide an added layer of security and authenticity.

-

Is it easy to navigate airSlate SignNow when managing Inst 1040 Schedule C?

Yes, airSlate SignNow is designed with an intuitive user interface, making it easy for anyone to navigate while preparing Inst 1040 Schedule C forms. You don't have to be tech-savvy to use our platform effectively. This ease of use helps users focus on their business rather than struggling with the software.

Get more for Inst 1040 Schedule C

- Quitclaim deed from husband and wife to an individual illinois form

- Illinois deed to form

- Illinois foreclosure form

- Architect mechanics lien notice and claim corporation or llc illinois form

- Quitclaim deed trust 497306044 form

- Illinois warranty 497306045 form

- Contractors verified statement of labor and materials and amount due mechanic liens corporation or llc illinois form

- Illinois renunciation and disclaimer of real property interest illinois form

Find out other Inst 1040 Schedule C

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online