Instructions for Schedule C Irsgov Form 2014

What is the Instructions For Schedule C Irsgov Form

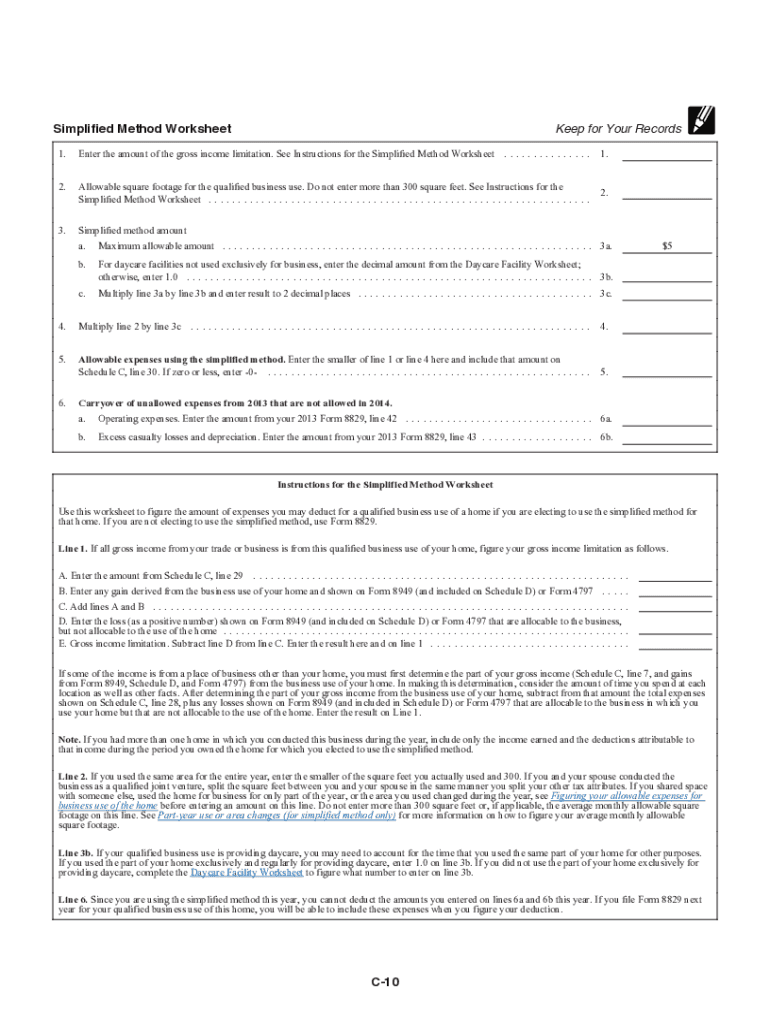

The Instructions for Schedule C IRS.gov Form is a crucial document for self-employed individuals and sole proprietors. It provides detailed guidance on how to report income or loss from a business you operated or a profession you practiced as a sole proprietor. This form is essential for accurately calculating your taxable income, ensuring compliance with federal tax regulations, and determining your eligibility for various deductions.

Steps to complete the Instructions For Schedule C Irsgov Form

Completing the Instructions for Schedule C IRS.gov Form involves several key steps:

- Gather all necessary financial records, including income statements and expense receipts.

- Review the form's sections, which include information about your business, income, and expenses.

- Fill in your business details, such as the name, address, and type of business operated.

- Report your total income and list all deductible expenses, ensuring you categorize them correctly.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Ensure all information is accurate and complete before submission.

How to use the Instructions For Schedule C Irsgov Form

Using the Instructions for Schedule C IRS.gov Form effectively requires understanding its layout and requirements. Begin by reading the introductory sections to familiarize yourself with the purpose of the form. Follow the step-by-step instructions provided for each section, ensuring you accurately report all income and expenses. Utilize any worksheets or additional resources mentioned in the instructions to assist with calculations. This approach helps ensure that your submission is thorough and compliant with IRS standards.

Legal use of the Instructions For Schedule C Irsgov Form

The legal use of the Instructions for Schedule C IRS.gov Form is essential for maintaining compliance with tax laws. This form must be completed accurately to avoid potential penalties or audits by the IRS. It is legally binding, meaning that the information provided must be truthful and reflective of your actual business activities. Misrepresentation or errors can lead to legal consequences, including fines or additional tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions for Schedule C IRS.gov Form typically align with the annual tax return deadlines. For most taxpayers, this means the form must be submitted by April 15 of the following year. However, if you require an extension, you may file Form 4868 to extend your deadline by six months. It is crucial to stay informed about any changes in tax law that may affect these dates.

Required Documents

To complete the Instructions for Schedule C IRS.gov Form, you will need several key documents:

- Financial statements detailing income and expenses.

- Receipts for deductible business expenses.

- Records of any assets purchased for the business.

- Previous year’s tax return for reference.

- Any relevant business licenses or permits.

Quick guide on how to complete instructions for schedule c irsgov 2014 form

Complete Instructions For Schedule C Irsgov Form effortlessly on any device

Online document management has gained immense popularity among businesses and individuals alike. It presents an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Handle Instructions For Schedule C Irsgov Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Instructions For Schedule C Irsgov Form without any hassle

- Find Instructions For Schedule C Irsgov Form and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of the documents or redact sensitive information using features that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes just a few seconds and holds the same legal authority as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form-finding, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and eSign Instructions For Schedule C Irsgov Form and guarantee superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule c irsgov 2014 form

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule c irsgov 2014 form

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What are the Instructions For Schedule C Irsgov Form?

The Instructions For Schedule C Irsgov Form provide essential guidance on how to report income and expenses from a business you own. This form is crucial for sole proprietors and helps streamline the tax filing process. By following these instructions, you can accurately complete your Schedule C and avoid potential issues with the IRS.

-

How can airSlate SignNow help me with the Instructions For Schedule C Irsgov Form?

airSlate SignNow simplifies the process of sending and eSigning your Instructions For Schedule C Irsgov Form. Our platform allows you to upload your documents, add the necessary signatures, and securely send them to clients or partners. This efficiency not only saves time but also ensures that all your forms are completed accurately and in compliance with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for the Instructions For Schedule C Irsgov Form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet your business needs, including options for individuals and teams. By investing in our service, you gain access to features that enhance your document management experience, including eSignature capabilities for the Instructions For Schedule C Irsgov Form. Check our website for the latest pricing information and special offers.

-

What features does airSlate SignNow offer for managing the Instructions For Schedule C Irsgov Form?

airSlate SignNow includes numerous features that facilitate the management of the Instructions For Schedule C Irsgov Form, such as easy document upload, customizable templates, and secure eSignature options. Additionally, our user-friendly interface makes it simple to track the status of your documents and ensure timely submission. These features help you maintain compliance with IRS guidelines efficiently.

-

Can I integrate airSlate SignNow with other tools for handling the Instructions For Schedule C Irsgov Form?

Absolutely! airSlate SignNow seamlessly integrates with various productivity tools and applications, enhancing your workflow when dealing with the Instructions For Schedule C Irsgov Form. Whether you need to sync with cloud storage services or accounting software, our integrations ensure that you can manage your documents efficiently without disrupting your existing processes.

-

What are the benefits of using airSlate SignNow for the Instructions For Schedule C Irsgov Form?

Using airSlate SignNow for the Instructions For Schedule C Irsgov Form offers numerous benefits, including increased efficiency, cost savings, and enhanced security. By digitizing your document processes, you can reduce time spent on paperwork and minimize the risk of errors. Our platform also provides a secure environment, ensuring that your sensitive information remains protected throughout the signing process.

-

How secure is airSlate SignNow when handling the Instructions For Schedule C Irsgov Form?

airSlate SignNow prioritizes the security of your documents, including the Instructions For Schedule C Irsgov Form, by employing industry-standard encryption and security protocols. We adhere to strict compliance regulations, ensuring that your data is protected against unauthorized access. This commitment to security allows you to confidently manage your important documents without worry.

Get more for Instructions For Schedule C Irsgov Form

- Application for life time fishing linces for over 65 form

- 51a260 form

- The state of oregon follows the social security administration ssa guidelines for the filing of w 2 wage and form

- Or form or tm instructions 2019 fill out tax template

- Get the complete the fedex express pn transmission form using

- Form 10 ampquotnebraska and local sales and use tax return

- 941n nebraska income tax withholding return form

- Nebraska form 12n nebraska nonresident income tax agreement

Find out other Instructions For Schedule C Irsgov Form

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter