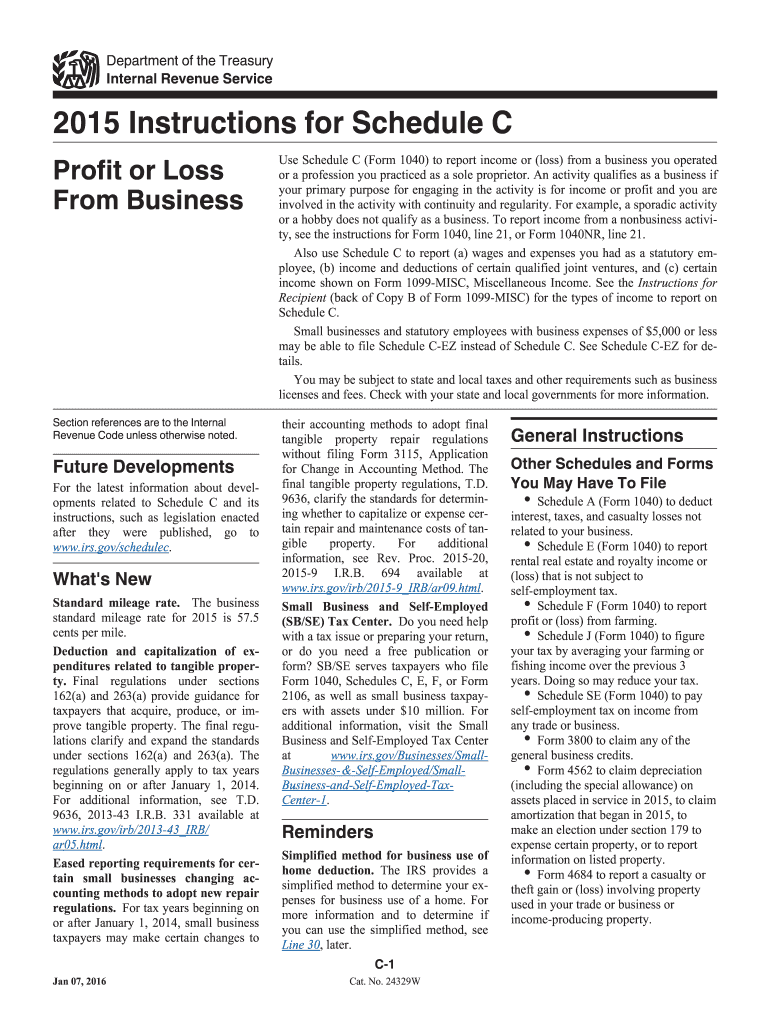

Instructions for Schedule C Irsgov Form 2015

What is the Instructions For Schedule C Irsgov Form

The Instructions for Schedule C IRS.gov form provide essential guidance for self-employed individuals and sole proprietors to report income and expenses from their business activities. This form is a critical component of the U.S. tax filing process, allowing taxpayers to detail their earnings, deductions, and overall profit or loss. Understanding these instructions is vital for accurate reporting and compliance with IRS regulations.

Steps to complete the Instructions For Schedule C Irsgov Form

Completing the Instructions for Schedule C IRS.gov form involves several key steps:

- Gather all necessary financial records, including income statements and receipts for expenses.

- Review the instructions carefully to understand the requirements for each section of the form.

- Begin filling out the form by reporting your business income in the designated section.

- Detail your business expenses, categorizing them appropriately as outlined in the instructions.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Review your completed form for accuracy before submission.

Legal use of the Instructions For Schedule C Irsgov Form

The legal use of the Instructions for Schedule C IRS.gov form is crucial for ensuring compliance with federal tax laws. When filled out correctly, this form serves as a legally binding document that reflects your business's financial activity. It is essential to maintain accurate records and provide truthful information, as discrepancies can lead to penalties or audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions for Schedule C IRS.gov form typically align with the annual tax return deadlines. For most taxpayers, the deadline is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about these dates to avoid late penalties and ensure timely submission.

Required Documents

To complete the Instructions for Schedule C IRS.gov form accurately, several documents are required:

- Income statements, including 1099 forms and sales records.

- Receipts for all business-related expenses.

- Bank statements that reflect business transactions.

- Previous year’s tax return for reference.

Examples of using the Instructions For Schedule C Irsgov Form

Examples of using the Instructions for Schedule C IRS.gov form include various scenarios faced by self-employed individuals. For instance, a freelance graphic designer would report income from clients and deduct expenses for software subscriptions and office supplies. Similarly, a small business owner would detail sales revenue and operational costs, such as rent and utilities, to accurately reflect their financial standing.

Quick guide on how to complete 2015 instructions for schedule c 2015 irsgov form

Complete Instructions For Schedule C Irsgov Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Instructions For Schedule C Irsgov Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to update and eSign Instructions For Schedule C Irsgov Form without breaking a sweat

- Obtain Instructions For Schedule C Irsgov Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with features that airSlate SignNow has specifically designed for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require you to print new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Update and eSign Instructions For Schedule C Irsgov Form to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 instructions for schedule c 2015 irsgov form

Create this form in 5 minutes!

How to create an eSignature for the 2015 instructions for schedule c 2015 irsgov form

How to generate an eSignature for the 2015 Instructions For Schedule C 2015 Irsgov Form online

How to create an eSignature for the 2015 Instructions For Schedule C 2015 Irsgov Form in Google Chrome

How to create an eSignature for signing the 2015 Instructions For Schedule C 2015 Irsgov Form in Gmail

How to generate an electronic signature for the 2015 Instructions For Schedule C 2015 Irsgov Form straight from your smartphone

How to make an electronic signature for the 2015 Instructions For Schedule C 2015 Irsgov Form on iOS

How to generate an eSignature for the 2015 Instructions For Schedule C 2015 Irsgov Form on Android OS

People also ask

-

What are the key features of airSlate SignNow for handling Instructions For Schedule C Irsgov Form?

airSlate SignNow offers a range of features tailored for managing Instructions For Schedule C Irsgov Form efficiently. Users can create, edit, and eSign documents quickly while ensuring compliance with IRS requirements. The platform also allows for easy sharing and collaboration, which simplifies the overall process.

-

How can airSlate SignNow help me complete Instructions For Schedule C Irsgov Form?

Using airSlate SignNow, you can easily complete Instructions For Schedule C Irsgov Form by accessing customizable templates. The platform guides you through the necessary steps, ensuring you include all the required information. Plus, the eSigning feature simplifies document finalization and submission.

-

Is there a free trial available for airSlate SignNow to test Instructions For Schedule C Irsgov Form features?

Yes, airSlate SignNow offers a free trial, allowing users to explore its features related to Instructions For Schedule C Irsgov Form before committing to a subscription. This trial provides access to all the essential tools needed for eSigning and document management, giving you a full understanding of its capabilities.

-

What is the pricing structure for airSlate SignNow focused on Instructions For Schedule C Irsgov Form?

The pricing for airSlate SignNow varies based on the plan you choose, catering to different business needs. Options are available for individuals, small teams, and larger enterprises that require advanced features for Managing Instructions For Schedule C Irsgov Form. Competitive pricing ensures businesses of all sizes can benefit from the solution.

-

Can I integrate airSlate SignNow with other software while working on Instructions For Schedule C Irsgov Form?

Absolutely! airSlate SignNow offers seamless integrations with a variety of software applications. This allows you to work efficiently on Instructions For Schedule C Irsgov Form by connecting with tools like CRM systems, cloud storage solutions, and accounting software, streamlining your workflow.

-

What benefits does airSlate SignNow provide for completing Instructions For Schedule C Irsgov Form?

Using airSlate SignNow for Instructions For Schedule C Irsgov Form offers multiple benefits, including enhanced accuracy and efficiency in document handling. The platform reduces human error through guided workflows and allows for real-time collaboration. Furthermore, the eSigning feature accelerates the approval process, saving valuable time.

-

Is airSlate SignNow secure for managing Instructions For Schedule C Irsgov Form?

Yes, airSlate SignNow prioritizes security for all documents, including Instructions For Schedule C Irsgov Form. The platform uses encryption and adheres to industry standards to ensure your sensitive information remains protected. You can confidently send and sign documents, knowing that your data is secure.

Get more for Instructions For Schedule C Irsgov Form

- Editable pdf petition for injunction for protection against repeat violence form

- Domestic violence report form

- Family law form 12 980

- Hawaii petition for ex parte temporary restraining 2009 form

- Instructions for joint petition for dissolution of marriage without children in mn form

- Div402 form

- Mn div403 form

- Form 8862 sp rev december information to claim earned income credit after disallowance spanish version 794716308

Find out other Instructions For Schedule C Irsgov Form

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form