About Form 8824, Like Kind ExchangesInternal RevenueForms and Instructions PDFIncorrect Tax Return Taxpayer Advocate ServiceCont 2022

Understanding Form 8824: Like-Kind Exchanges

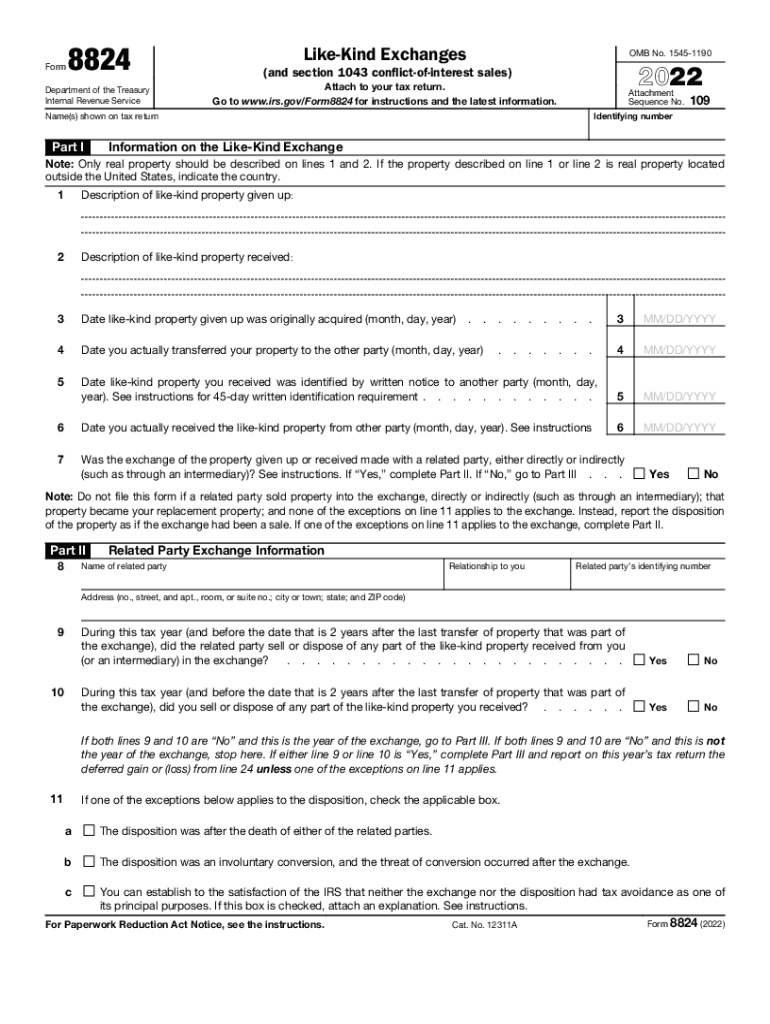

Form 8824 is utilized by taxpayers to report like-kind exchanges of real property under Internal Revenue Code Section 1031. This form allows individuals and businesses to defer paying capital gains taxes on the exchange of similar properties. The primary purpose of the form is to document the details of the exchange, including the properties involved, the dates of the exchange, and any gain or loss realized. Properly completing Form 8824 ensures compliance with IRS regulations and helps taxpayers maximize their tax benefits.

Steps to Complete Form 8824

Filling out Form 8824 involves several key steps to ensure accuracy and compliance. Start by gathering necessary information about the properties exchanged, including their fair market values and the dates of acquisition and exchange. The form requires specific details such as:

- Identification of the relinquished and replacement properties

- Calculation of the realized gain or loss

- Documentation of any boot received in the exchange

After collecting the required information, carefully complete each section of the form, ensuring that all figures are accurate. Review the form for any errors before submitting it with your tax return.

IRS Guidelines for Form 8824

The IRS provides specific guidelines for completing Form 8824, which are crucial for taxpayers to follow. These guidelines outline the eligibility criteria for like-kind exchanges, the types of properties that qualify, and the necessary documentation required to support the exchange. Taxpayers must ensure that both the relinquished and replacement properties are held for productive use in a trade or business or for investment purposes. Additionally, the IRS emphasizes the importance of adhering to timelines for identifying and acquiring replacement properties to maintain the tax-deferral benefits.

Required Documents for Filing Form 8824

When filing Form 8824, certain documents must be prepared and submitted to support the information provided on the form. These documents include:

- Closing statements for both the relinquished and replacement properties

- Appraisals or valuations of the properties involved

- Any relevant correspondence with the IRS regarding the exchange

Having these documents readily available not only facilitates the completion of the form but also helps in case of an audit or review by the IRS.

Penalties for Non-Compliance with Form 8824

Failure to comply with the requirements of Form 8824 can result in significant penalties. Taxpayers who do not accurately report like-kind exchanges may face penalties for underreporting income or failing to file the form altogether. Additionally, if the IRS determines that a taxpayer did not qualify for the tax deferral, they may be liable for back taxes, interest, and additional penalties. It is essential to ensure that all information is correct and that the form is filed in a timely manner to avoid these consequences.

Digital vs. Paper Version of Form 8824

Taxpayers have the option to complete Form 8824 either digitally or on paper. The digital version offers several advantages, including ease of use and the ability to automatically calculate totals. Additionally, eFiling can expedite the processing time for tax returns. However, some taxpayers may prefer the traditional paper method for various reasons, such as personal comfort or lack of access to technology. Regardless of the method chosen, it is important to ensure that the form is filled out correctly and submitted on time.

Quick guide on how to complete about form 8824 like kind exchangesinternal revenueforms and instructions pdfincorrect tax return taxpayer advocate

Effortlessly Prepare About Form 8824, Like Kind ExchangesInternal RevenueForms And Instructions PDFIncorrect Tax Return Taxpayer Advocate ServiceCont on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, alter, and eSign your documents swiftly without delays. Manage About Form 8824, Like Kind ExchangesInternal RevenueForms And Instructions PDFIncorrect Tax Return Taxpayer Advocate ServiceCont on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest method to modify and eSign About Form 8824, Like Kind ExchangesInternal RevenueForms And Instructions PDFIncorrect Tax Return Taxpayer Advocate ServiceCont effortlessly

- Find About Form 8824, Like Kind ExchangesInternal RevenueForms And Instructions PDFIncorrect Tax Return Taxpayer Advocate ServiceCont and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign About Form 8824, Like Kind ExchangesInternal RevenueForms And Instructions PDFIncorrect Tax Return Taxpayer Advocate ServiceCont and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8824 like kind exchangesinternal revenueforms and instructions pdfincorrect tax return taxpayer advocate

Create this form in 5 minutes!

People also ask

-

What is the 8824 2020 latest form used for?

The 8824 2020 latest form is used for reporting like-kind exchanges of property. It is essential for taxpayers who want to defer gains from the sale of property by reinvesting proceeds in similar assets. Utilizing airSlate SignNow can streamline the process of submitting this form, making it easier to manage your compliance.

-

How can airSlate SignNow help with the 8824 2020 latest form?

AirSlate SignNow offers a user-friendly platform that allows you to easily eSign and send documents, including the 8824 2020 latest form. With its digital solution, you can efficiently gather signatures and ensure your documents are securely stored and shared, facilitating a smoother transaction process.

-

What features are included with airSlate SignNow for the 8824 2020 latest?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, which can be particularly useful when handling the 8824 2020 latest form. These tools allow you to manage your documents effectively, ensuring you meet all deadlines and requirements.

-

Is there a cost associated with using airSlate SignNow for the 8824 2020 latest?

Yes, there is a cost associated with airSlate SignNow, but it is designed to be cost-effective compared to traditional methods of document management. Pricing plans are flexible and scalable, allowing businesses to select a package that fits their needs while efficiently handling forms like the 8824 2020 latest.

-

Can airSlate SignNow integrate with other software for the 8824 2020 latest?

Absolutely! AirSlate SignNow offers integration with various software solutions, enhancing the usability for managing the 8824 2020 latest form. These integrations can help streamline processes by connecting your eSignature needs with your existing applications, making document management seamless.

-

What are the benefits of using airSlate SignNow for the 8824 2020 latest?

Using airSlate SignNow for the 8824 2020 latest form provides numerous benefits, including quick turnaround times and enhanced document security. By utilizing electronic signatures, you reduce paper waste and improve compliance, ultimately saving time and lowering costs for your business.

-

How secure is airSlate SignNow for handling the 8824 2020 latest form?

AirSlate SignNow employs top-notch security protocols to ensure that your documents, including the 8824 2020 latest form, are protected. With features like data encryption and secure access controls, you can trust that sensitive information remains confidential and safe from unauthorized access.

Get more for About Form 8824, Like Kind ExchangesInternal RevenueForms And Instructions PDFIncorrect Tax Return Taxpayer Advocate ServiceCont

- Electrical contract for contractor new york form

- Sheetrock drywall contract for contractor new york form

- Flooring contract template 497321098 form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract new york form

- Notice of intent to enforce forfeiture provisions of contact for deed new york form

- Final notice of forfeiture and request to vacate property under contract for deed new york form

- Buyers request for accounting from seller under contract for deed new york form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed new york form

Find out other About Form 8824, Like Kind ExchangesInternal RevenueForms And Instructions PDFIncorrect Tax Return Taxpayer Advocate ServiceCont

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online