Form 8824 Like Kind Exchanges and Section 1043 Conflict of Interest Sales 2024

Understanding Form 8824 for Like-Kind Exchanges

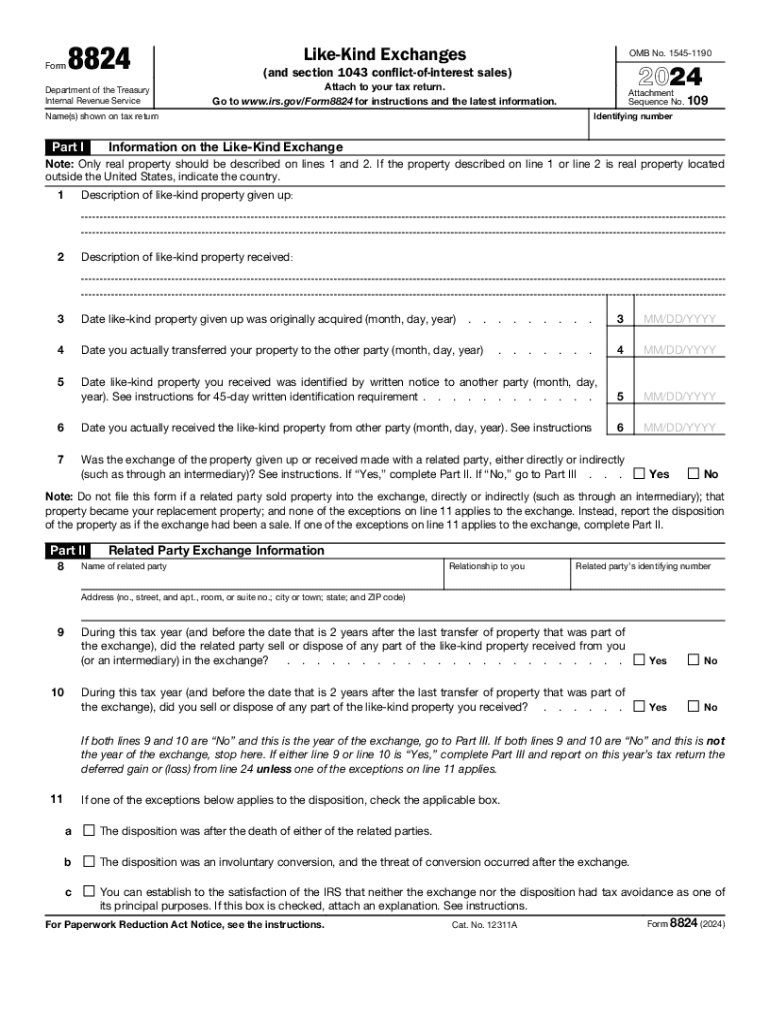

Form 8824 is a crucial document used by taxpayers in the United States to report like-kind exchanges under Section 1031 of the Internal Revenue Code. A like-kind exchange allows individuals or businesses to defer paying capital gains taxes on the exchange of similar types of property. This form is essential for documenting the details of the exchange, ensuring compliance with IRS regulations, and facilitating the tax deferral process. It is important to understand the specific requirements and implications of using this form to maximize its benefits.

Steps to Complete Form 8824

Completing Form 8824 involves several key steps. First, gather all necessary information regarding the properties involved in the exchange, including their fair market values and the dates of acquisition and exchange. Next, fill out the form by providing details such as the description of the properties, the nature of the exchange, and any boot received, which refers to cash or other non-like-kind property involved in the transaction. Ensure that all calculations regarding gain or loss are accurate, as these will affect your tax liability. Finally, review the completed form for accuracy before submission.

IRS Guidelines for Form 8824

The IRS provides specific guidelines for completing Form 8824. These guidelines include instructions on what qualifies as a like-kind exchange, the types of properties eligible for deferral, and how to report any boot received during the exchange. Taxpayers must also be aware of the timelines for identifying replacement properties and completing the exchange to meet IRS requirements. Adhering to these guidelines is crucial to avoid penalties and ensure the successful deferral of capital gains taxes.

Examples of Using Form 8824

Understanding practical applications of Form 8824 can clarify its use. For instance, if a taxpayer exchanges a rental property for another rental property, they would report this transaction on Form 8824. Another example includes exchanging raw land for a commercial building. In both cases, accurately reporting the details of the exchange on Form 8824 is essential to qualify for tax deferral. These examples illustrate the versatility of like-kind exchanges and the importance of proper documentation.

Eligibility Criteria for Like-Kind Exchanges

To qualify for a like-kind exchange and utilize Form 8824, certain eligibility criteria must be met. The properties exchanged must be held for investment or productive use in a trade or business. Both properties must be of like-kind, meaning they are similar in nature, though they do not need to be identical. Additionally, the exchange must occur within specific timeframes set by the IRS, which includes identifying replacement properties within 45 days and completing the exchange within 180 days. Meeting these criteria is essential for deferring taxes on the exchange.

Required Documents for Form 8824

When completing Form 8824, several documents are necessary to support the information provided. These may include closing statements from the transactions, appraisals of the properties, and any agreements related to the exchange. Keeping thorough records of these documents is vital, as they may be needed for IRS verification or in the event of an audit. Proper documentation ensures compliance and helps substantiate the claims made on the form.

Create this form in 5 minutes or less

Find and fill out the correct form 8824 like kind exchanges and section 1043 conflict of interest sales

Create this form in 5 minutes!

How to create an eSignature for the form 8824 like kind exchanges and section 1043 conflict of interest sales

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8824 and how can airSlate SignNow help?

Form 8824 is used to report like-kind exchanges of property. With airSlate SignNow, you can easily fill out, sign, and send form 8824 electronically, streamlining the process and ensuring compliance with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for form 8824?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that simplify the completion and signing of form 8824, making it a cost-effective solution for your document management.

-

What features does airSlate SignNow offer for managing form 8824?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document tracking specifically for form 8824. These tools enhance efficiency and ensure that your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for form 8824?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 8824 alongside your existing workflows. This integration helps streamline your processes and enhances productivity.

-

How does airSlate SignNow ensure the security of my form 8824?

Security is a top priority for airSlate SignNow. We use advanced encryption and secure cloud storage to protect your form 8824 and other sensitive documents, ensuring that your information remains confidential and safe.

-

Can I access form 8824 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage form 8824 on the go. This flexibility ensures that you can complete and sign documents anytime, anywhere.

-

What are the benefits of using airSlate SignNow for form 8824?

Using airSlate SignNow for form 8824 offers numerous benefits, including faster processing times, reduced paperwork, and enhanced collaboration. Our platform simplifies the signing process, making it easier for you to manage your documents efficiently.

Get more for Form 8824 Like Kind Exchanges and Section 1043 Conflict of interest Sales

- Dpss income verification form

- Nc d410 form

- Eqp 1735 1 form

- Gdca exam form online application

- Mainstreet organization of realtors residential lease agreement form

- Term law clerk to united states magistrate judge joseph form

- Form 8880 credit for qualified retirement savings contributions 765770210

- Silver antelope award nomination form

Find out other Form 8824 Like Kind Exchanges and Section 1043 Conflict of interest Sales

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document