Form 8824 IRS 2005

What is the Form 8824 IRS

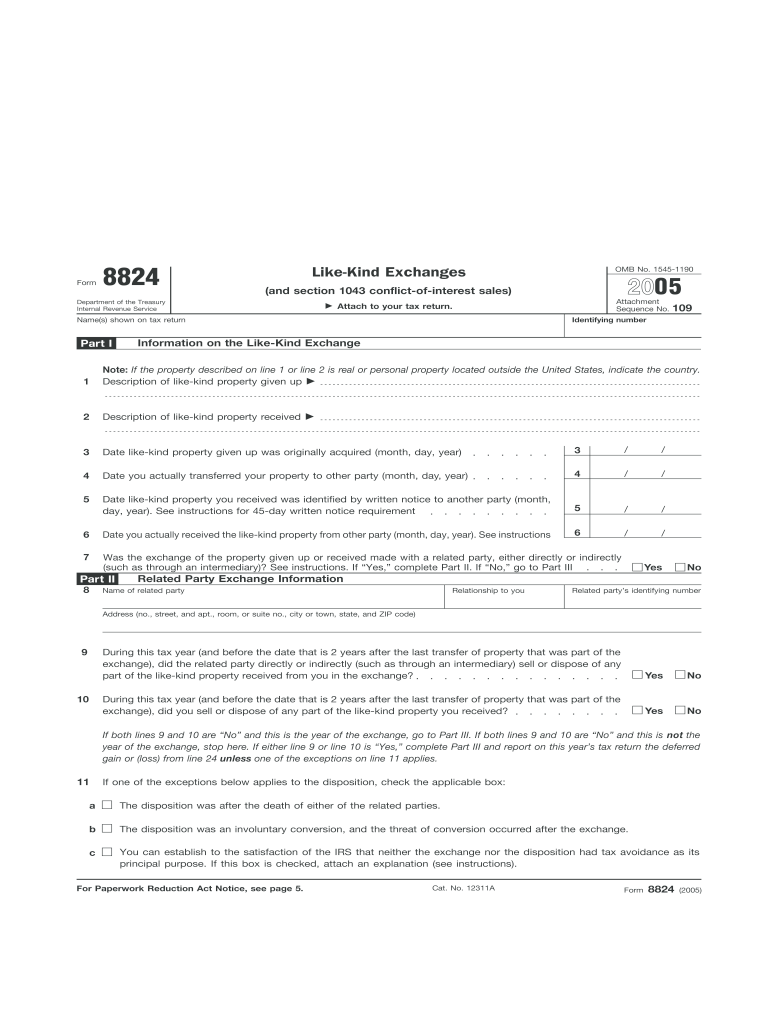

The Form 8824, also known as the Like-Kind Exchange form, is utilized by taxpayers in the United States to report like-kind exchanges of real property. This form is essential for individuals and businesses that wish to defer capital gains taxes on the exchange of similar properties. The IRS allows this deferral under specific conditions, making the Form 8824 a crucial part of tax planning for property owners. It is important to understand the requirements and implications of using this form to ensure compliance with IRS regulations.

How to use the Form 8824 IRS

Using the Form 8824 involves several steps to accurately report your like-kind exchange. First, you must gather relevant information about the properties involved in the exchange, including their fair market values and the dates of acquisition and transfer. Next, you will need to complete the form by providing details such as the nature of the exchange, the identification of the properties, and any adjustments to basis. Finally, ensure that you attach the completed Form 8824 to your tax return for the year in which the exchange occurred. Proper usage of this form can help you take advantage of tax benefits while remaining compliant with IRS guidelines.

Steps to complete the Form 8824 IRS

Completing the Form 8824 requires careful attention to detail. Here are the steps to follow:

- Gather information about both the relinquished and replacement properties.

- Determine the fair market value of each property at the time of the exchange.

- Fill out the form, including sections for property descriptions, dates of exchange, and any gain or loss realized.

- Calculate any adjustments to basis and report them accurately.

- Review the completed form for accuracy and completeness.

- Attach the Form 8824 to your federal tax return for the applicable tax year.

Legal use of the Form 8824 IRS

The legal use of Form 8824 is governed by IRS regulations regarding like-kind exchanges. To qualify for tax deferral, the properties exchanged must be held for productive use in a trade or business or for investment purposes. Additionally, the properties must be of a similar nature or character, which is a key requirement for the exchange to be considered like-kind. Understanding these legal stipulations is essential to ensure that the use of Form 8824 is compliant with IRS laws and to avoid potential penalties.

Required Documents

When completing the Form 8824, certain documents are necessary to support your claims. These may include:

- Closing statements for both the relinquished and replacement properties.

- Appraisals or market analyses to establish fair market values.

- Documentation of any debt relief or additional cash involved in the exchange.

- Records of any improvements made to the properties before the exchange.

Having these documents readily available will facilitate a smoother completion of the form and help substantiate your claims during any IRS review.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with Form 8824. Generally, the form must be filed with your federal income tax return for the year in which the exchange occurred. The standard deadline for individual tax returns is April 15, unless it falls on a weekend or holiday, in which case the deadline may be extended. If you require additional time, you may file for an extension, but it is important to ensure that the Form 8824 is submitted by the extended deadline to avoid penalties.

Quick guide on how to complete form 8824 2005 irs

Complete Form 8824 IRS effortlessly on any device

Online document administration has become popular with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without any delays. Manage Form 8824 IRS on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The easiest way to edit and eSign Form 8824 IRS without any hassle

- Obtain Form 8824 IRS and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8824 IRS and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8824 2005 irs

Create this form in 5 minutes!

How to create an eSignature for the form 8824 2005 irs

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is Form 8824 IRS and why do I need it?

Form 8824 IRS is the Like-Kind Exchange form used for reporting the exchange of properties held for investment or business purposes. Completing this form is essential for tax purposes, as it allows you to defer capital gains taxes on the exchange. Using airSlate SignNow, you can easily eSign and send your Form 8824 IRS securely.

-

How does airSlate SignNow simplify the submission of Form 8824 IRS?

airSlate SignNow streamlines the submission process of Form 8824 IRS by providing a user-friendly interface for document signing and sharing. With features like templates and reminders, you can efficiently manage your forms and ensure timely submissions. This helps you focus on important tax matters rather than paperwork.

-

Is there a cost to use airSlate SignNow for filing Form 8824 IRS?

Yes, airSlate SignNow offers different pricing plans designed to suit various business needs. The pricing is competitive and reflects the value of our features, including unlimited document signing and secure storage. You can choose a plan that best fits your requirements for managing Form 8824 IRS.

-

Can I integrate airSlate SignNow with other software for managing Form 8824 IRS?

Absolutely! airSlate SignNow seamlessly integrates with numerous software applications, enhancing your workflow for managing Form 8824 IRS. Integrations with accounting software and cloud storage options make it easy to keep all related documents organized and accessible.

-

What security features does airSlate SignNow provide for Form 8824 IRS?

airSlate SignNow prioritizes your data security with features such as encryption, secure document storage, and user authentication. These measures ensure that your Form 8824 IRS and any related documents remain confidential and protected from unauthorized access.

-

Can I track the status of my Form 8824 IRS submissions with airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities that allow you to monitor the status of your Form 8824 IRS submissions in real-time. This feature keeps you informed about when documents are viewed, signed, or returned, ensuring you stay on top of your filing process.

-

What types of businesses can benefit from using airSlate SignNow for Form 8824 IRS?

Any business that engages in real estate transactions or investments can benefit from using airSlate SignNow for Form 8824 IRS. Whether you're an individual taxpayer or part of a larger enterprise, our solution caters to various needs, simplifying your document management and filing processes.

Get more for Form 8824 IRS

- Owners or sellers affidavit of no liens illinois form

- Illinois affidavit status form

- Complex will with credit shelter marital trust for large estates illinois form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts where 497306332 form

- Marital legal separation and property settlement agreement minor children no joint property or debts where divorce action filed 497306333 form

- Marital legal separation and property settlement agreement minor children no joint property or debts effective immediately 497306334 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts where 497306335 form

- Marital legal separation form

Find out other Form 8824 IRS

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement