About Form 8824, Like Kind ExchangesInternal Revenue Service 2020

What is Form 8824?

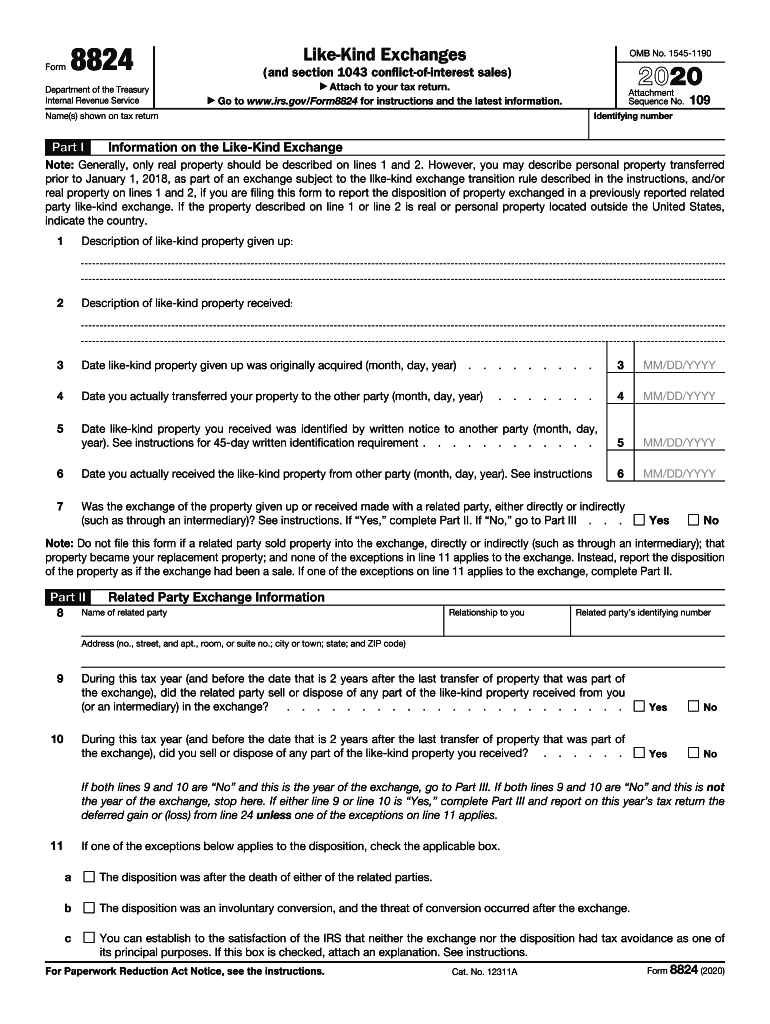

Form 8824, also known as the Like-Kind Exchanges form, is a document used by taxpayers in the United States to report exchanges of real property that qualify as like-kind exchanges under Internal Revenue Code Section 1031. This form allows individuals and businesses to defer paying capital gains taxes on the exchange of certain types of property, provided that the properties exchanged are of similar nature or character.

Steps to Complete Form 8824

Completing Form 8824 involves several key steps:

- Identify the properties involved in the exchange, ensuring they meet the criteria for like-kind exchanges.

- Provide detailed information about the relinquished property, including its fair market value and the date of the exchange.

- Document the replacement property, noting its fair market value and the date it was acquired.

- Calculate any gain or loss from the exchange and report it accurately on the form.

- Complete the necessary sections regarding any cash received or debt relief as part of the exchange.

IRS Guidelines for Form 8824

The IRS provides specific guidelines for completing Form 8824 to ensure compliance with tax laws. Taxpayers must adhere to the rules set forth in the Internal Revenue Code, including the definition of like-kind property and the timing of the exchange. It is essential to keep thorough records of the transaction, including appraisals and any related documentation, as the IRS may request this information during an audit.

Filing Deadlines for Form 8824

Form 8824 must be filed with the taxpayer's annual income tax return. The deadline for filing typically aligns with the due date of the tax return, which is usually April 15 for individual taxpayers. If additional time is needed, taxpayers can file for an extension, but it is important to ensure that Form 8824 is submitted by the extended deadline to avoid penalties.

Required Documents for Form 8824

When completing Form 8824, taxpayers should gather the following documents:

- Documentation proving the ownership and value of the relinquished property.

- Records of the replacement property, including purchase agreements and closing statements.

- Any appraisals or valuations that support the fair market values reported on the form.

- Evidence of any liabilities assumed or cash exchanged during the transaction.

Eligibility Criteria for Like-Kind Exchanges

To qualify for the benefits of a like-kind exchange reported on Form 8824, certain eligibility criteria must be met. The properties involved must be held for investment or productive use in a trade or business. Additionally, both the relinquished and replacement properties must be located within the United States and must meet the like-kind property requirements set by the IRS.

Quick guide on how to complete about form 8824 like kind exchangesinternal revenue service

Prepare About Form 8824, Like Kind ExchangesInternal Revenue Service seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, as you can access the correct form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Handle About Form 8824, Like Kind ExchangesInternal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign About Form 8824, Like Kind ExchangesInternal Revenue Service effortlessly

- Find About Form 8824, Like Kind ExchangesInternal Revenue Service and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign About Form 8824, Like Kind ExchangesInternal Revenue Service and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8824 like kind exchangesinternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the about form 8824 like kind exchangesinternal revenue service

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is form 8824 and why is it important?

Form 8824 is a document used for reporting like-kind exchanges of property under IRS guidelines. It is essential for taxpayers looking to defer capital gains taxes when swapping similar types of assets. Understanding form 8824 can help you capitalize on tax-saving opportunities.

-

How can airSlate SignNow help me manage form 8824?

With airSlate SignNow, you can easily create, send, and eSign your form 8824 documents. The platform's intuitive interface simplifies the process, ensuring that you can complete your tax filings efficiently and securely. This makes managing your essential tax documents like form 8824 straightforward.

-

Is there a cost associated with using airSlate SignNow to handle form 8824?

Yes, airSlate SignNow offers a variety of pricing plans tailored to fit different business needs. By subscribing, you can access features that streamline the signing and management of important documents such as form 8824, making it a cost-effective solution for your eSigning needs.

-

What features does airSlate SignNow offer for form 8824?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time tracking for your form 8824 documents. These features ensure that your documents are always compliant and accessible, signNowly reducing the time spent on paperwork.

-

Can I integrate airSlate SignNow with other tools for managing form 8824?

Absolutely! airSlate SignNow supports integrations with a variety of third-party applications, allowing you to streamline the entire process of managing form 8824. You can connect it with CRMs, cloud storage services, and more, enhancing your workflow efficiency.

-

How does eSigning improve the handling of form 8824?

ESigning with airSlate SignNow enhances the handling of form 8824 by making the process faster and more secure. With electronic signatures, you eliminate the delays associated with printing and mailing documents, ensuring that important paperwork gets processed quickly.

-

What security measures does airSlate SignNow have for form 8824?

airSlate SignNow prioritizes the security of your documents, including form 8824, by employing encryption and secure cloud storage. This means your sensitive tax information is protected against unauthorized access, making it safe to manage your documents online.

Get more for About Form 8824, Like Kind ExchangesInternal Revenue Service

- Wa notice default form

- Wa garnishee form

- Judgment against form

- Washington satisfaction judgment form

- Wa garnishee order form

- Limited liability company 497429325 form

- Renunciation and disclaimer of property from life insurance or annuity contract washington form

- Release of lien claim mechanics liens individual washington form

Find out other About Form 8824, Like Kind ExchangesInternal Revenue Service

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement