About Form 8824Internal Revenue Service IRS Gov 2013

What is the About Form 8824Internal Revenue Service IRS gov

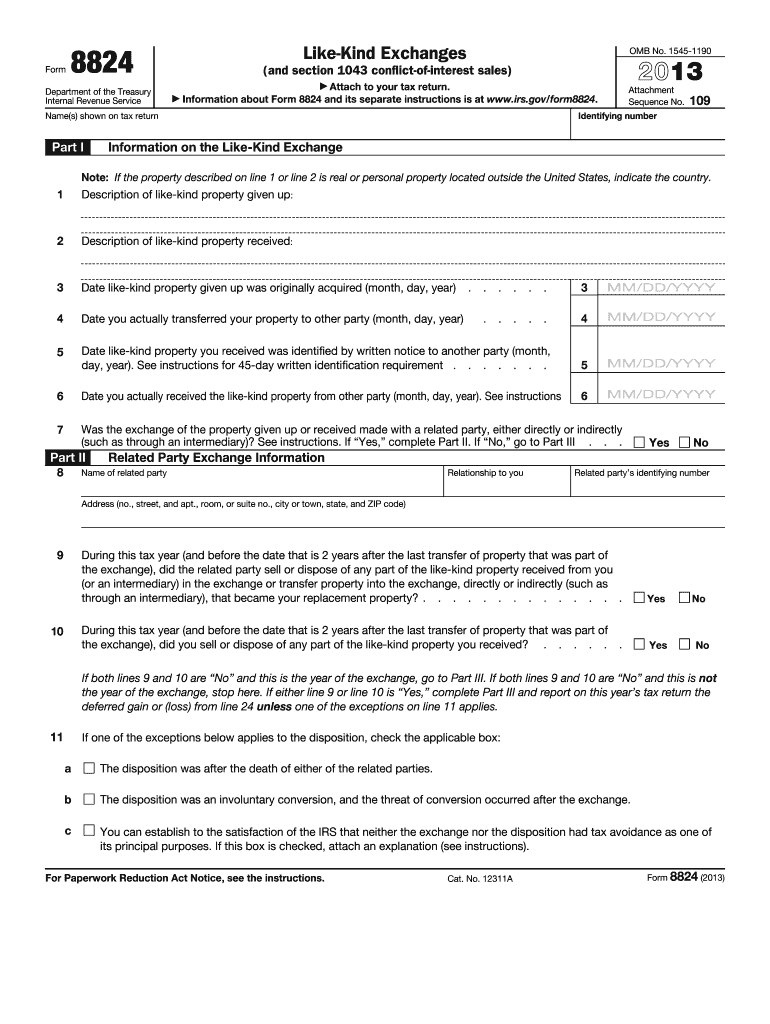

The About Form 8824 is a document issued by the Internal Revenue Service (IRS) that is used to report like-kind exchanges of property. This form is essential for taxpayers who wish to defer recognition of capital gains on the exchange of certain types of property. It provides a means for individuals and businesses to report the details of their exchanges, ensuring compliance with tax regulations. The form outlines the requirements and conditions under which a like-kind exchange can occur, making it a vital tool for tax planning and reporting.

How to use the About Form 8824Internal Revenue Service IRS gov

Using the About Form 8824 involves several steps to ensure accurate reporting of a like-kind exchange. Taxpayers must first determine if their exchange qualifies under IRS guidelines. Once eligibility is established, the form should be filled out with detailed information about the properties exchanged, including their fair market values and the dates of the exchange. It is important to provide accurate and complete information to avoid potential issues with the IRS. After completing the form, it should be submitted along with the taxpayer's annual tax return.

Steps to complete the About Form 8824Internal Revenue Service IRS gov

Completing the About Form 8824 requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation related to the properties involved in the exchange.

- Determine the fair market value of both the relinquished and acquired properties.

- Fill out the form, providing details such as the property descriptions, dates of the exchange, and any related costs.

- Review the completed form for accuracy and completeness.

- Submit the form with your tax return or as required by IRS guidelines.

Legal use of the About Form 8824Internal Revenue Service IRS gov

The legal use of the About Form 8824 is governed by IRS regulations concerning like-kind exchanges. This form must be used correctly to ensure that taxpayers can defer capital gains taxes on qualifying property exchanges. Failure to use the form appropriately may result in penalties or the disallowance of the tax deferral. It is essential for taxpayers to understand the legal implications of their exchanges and ensure compliance with all IRS requirements when filing Form 8824.

Required Documents

To complete the About Form 8824, taxpayers must gather several key documents, including:

- Purchase agreements or contracts for the properties involved.

- Appraisals or assessments to establish fair market values.

- Any prior tax returns that may relate to the properties exchanged.

- Documentation of any additional costs associated with the exchange.

Filing Deadlines / Important Dates

Filing deadlines for the About Form 8824 align with the taxpayer's annual tax return deadlines. Typically, individuals must file their tax returns by April fifteenth of the following year. If an extension is filed, the form must still be submitted by the extended deadline. It is crucial to keep track of these dates to avoid penalties and ensure compliance with IRS regulations.

Quick guide on how to complete about form 8824internal revenue service irsgov

Effortlessly prepare About Form 8824Internal Revenue Service IRS gov on any device

Digital document management has become increasingly popular among organizations and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly with no holdups. Manage About Form 8824Internal Revenue Service IRS gov on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign About Form 8824Internal Revenue Service IRS gov seamlessly

- Locate About Form 8824Internal Revenue Service IRS gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign About Form 8824Internal Revenue Service IRS gov and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8824internal revenue service irsgov

Create this form in 5 minutes!

How to create an eSignature for the about form 8824internal revenue service irsgov

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is Form 8824 and why is it important?

Form 8824, as outlined by the Internal Revenue Service (IRS) on IRS.gov, is used to report like-kind exchanges of real estate. This form is crucial for taxpayers to defer taxes on profits from the exchange of property. Understanding About Form 8824Internal Revenue Service IRS gov helps ensure compliance with tax regulations.

-

How can airSlate SignNow assist with Form 8824?

With airSlate SignNow, businesses can easily prepare and sign Form 8824 electronically. The intuitive platform streamlines the document workflow, allowing users to focus on their investments rather than paperwork. Learn more About Form 8824Internal Revenue Service IRS gov to enhance your filing experience.

-

Is there a cost associated with using airSlate SignNow for Form 8824?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effective solution ensures that you get value for your investment while managing important IRS forms like Form 8824. For more details, check out How About Form 8824Internal Revenue Service IRS gov can be managed efficiently.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time notifications. These tools help users manage Forms like 8824 effectively, saving time and reducing errors. Learn more About Form 8824Internal Revenue Service IRS gov on our platform.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration enhances the experience of managing Form 8824, ensuring that all necessary documents are accessible in one place. Understanding About Form 8824Internal Revenue Service IRS gov can help you simplify your entire tax process.

-

What are the benefits of using airSlate SignNow for electronic signatures?

Utilizing airSlate SignNow for electronic signatures brings a host of benefits such as enhanced security, faster processing times, and increased convenience. This is particularly beneficial for handling sensitive documents like Form 8824. To dive deeper into About Form 8824Internal Revenue Service IRS gov, check our resources.

-

How does airSlate SignNow ensure compliance with IRS requirements?

airSlate SignNow is designed to meet the compliance standards set forth by the IRS, including those applicable to Form 8824. We prioritize the security and authenticity of electronic signatures to safeguard your transactions. Get informed About Form 8824Internal Revenue Service IRS gov, and ensure your compliance with confidence.

Get more for About Form 8824Internal Revenue Service IRS gov

Find out other About Form 8824Internal Revenue Service IRS gov

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe