Form 8824 2018

What is the Form 8824

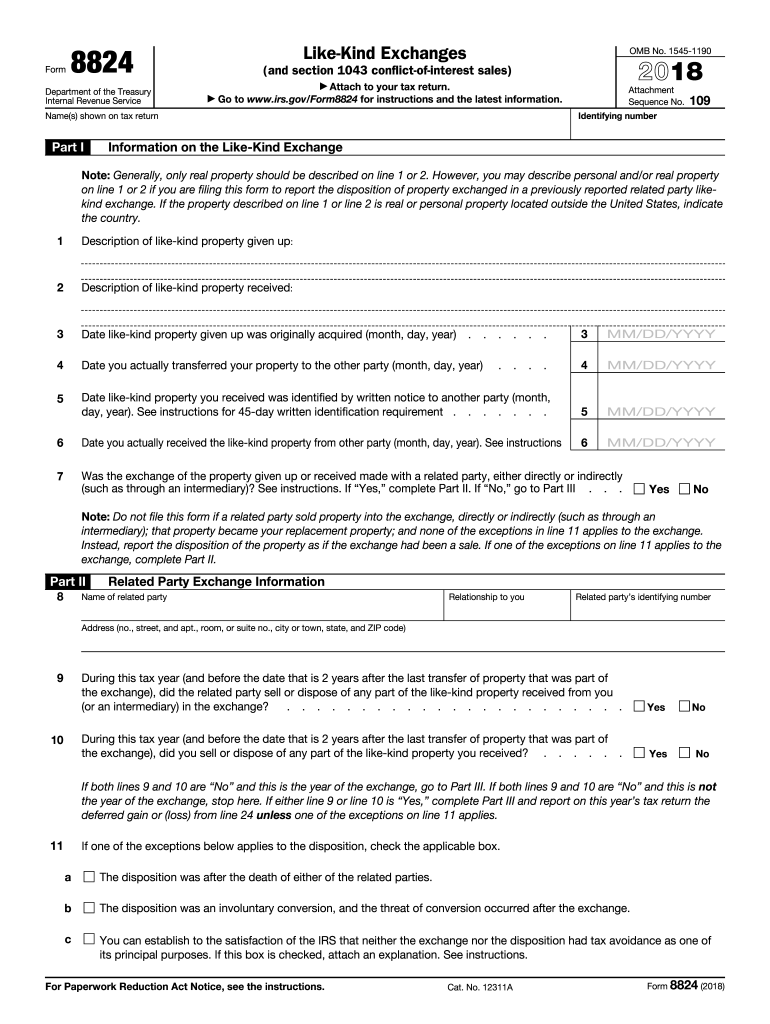

The Form 8824, also known as the Like-Kind Exchange form, is a tax document used by individuals and businesses in the United States to report exchanges of like-kind property. This form is essential for taxpayers who wish to defer paying capital gains taxes on the exchange of certain types of property, such as real estate. The IRS requires this form to ensure that taxpayers comply with the rules governing like-kind exchanges, as outlined in Section 1031 of the Internal Revenue Code.

How to use the Form 8824

To effectively use the Form 8824, taxpayers must first determine if their property qualifies for a like-kind exchange. This involves identifying the properties involved in the exchange and ensuring they meet the IRS criteria. Once eligibility is confirmed, the taxpayer must accurately complete the form, detailing the properties exchanged, the dates of the exchange, and any additional information required by the IRS. Proper completion of this form is crucial for deferring tax liability.

Steps to complete the Form 8824

Completing the Form 8824 involves several key steps:

- Gather necessary information about the properties involved in the exchange, including their fair market values and acquisition dates.

- Fill out the form, ensuring that all sections are completed accurately, including details about the relinquished and received properties.

- Attach any required documentation, such as closing statements or appraisals, to support the information provided on the form.

- Review the completed form for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8824. Taxpayers should refer to the IRS instructions for Form 8824 to understand the requirements and ensure compliance. These guidelines cover eligibility criteria, the definition of like-kind property, and the reporting process. Following these instructions is vital to avoid potential penalties or issues with the IRS.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 8824. Generally, the form must be filed with the taxpayer's annual tax return. For most individuals, this deadline falls on April 15 of the following year. However, if the taxpayer is granted an extension for filing their tax return, the Form 8824 must be submitted by the extended deadline. Keeping track of these dates is essential to ensure timely compliance.

Required Documents

When completing the Form 8824, certain documents are required to substantiate the information provided. These may include:

- Closing statements for the properties exchanged.

- Appraisals or valuations of the properties involved.

- Any agreements or contracts related to the exchange.

Having these documents ready can facilitate a smoother filing process and help avoid complications with the IRS.

Quick guide on how to complete irs 8824 2018 2019 form

Discover the simplest method to complete and endorse your Form 8824

Are you still spending time preparing your official documents in hard copy instead of online? airSlate SignNow offers a superior way to complete and endorse your Form 8824 and associated forms for public services. Our intelligent electronic signature solution equips you with everything required to manage documents efficiently and in compliance with official standards - robust PDF editing, managing, securing, endorsing, and sharing tools all available within an easy-to-navigate interface.

Only a few steps are required to finalize the completion and endorsement of your Form 8824:

- Insert the editable template into the editor using the Get Form button.

- Review the details you need to include in your Form 8824.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Conceal sections that are irrelevant.

- Press Sign to create a legally binding electronic signature using your preferred method.

- Include the Date next to your signature and finalize your task with the Done button.

Store your completed Form 8824 in the Documents folder in your profile, download it, or transfer it to your chosen cloud storage. Our solution also allows for versatile file sharing. There’s no need to print your templates when you need to forward them to the relevant public office - accomplish this via email, fax, or by requesting a USPS delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct irs 8824 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the irs 8824 2018 2019 form

How to generate an eSignature for your Irs 8824 2018 2019 Form online

How to generate an eSignature for the Irs 8824 2018 2019 Form in Chrome

How to generate an eSignature for signing the Irs 8824 2018 2019 Form in Gmail

How to make an electronic signature for the Irs 8824 2018 2019 Form right from your smart phone

How to generate an electronic signature for the Irs 8824 2018 2019 Form on iOS

How to make an electronic signature for the Irs 8824 2018 2019 Form on Android

People also ask

-

What is a form 8824 pdf and how do I use it?

The form 8824 PDF, also known as the Like-Kind Exchange form, is utilized for reporting like-kind exchanges to the IRS. You can easily download and fill out the form 8824 PDF using airSlate SignNow, which allows you to complete and eSign it efficiently. Make sure to include accurate information to ensure compliance with tax regulations.

-

How can airSlate SignNow help with my form 8824 pdf?

airSlate SignNow streamlines the process of generating, editing, and eSigning your form 8824 PDF. You can quickly upload the document, collaborate with others, and securely send it for signatures. These features ensure a smooth workflow, reducing the time it takes to finalize your form.

-

Is there a cost associated with using the form 8824 pdf through airSlate SignNow?

airSlate SignNow offers a range of pricing plans that accommodate various business needs, from individuals to large organizations. You can start with a free trial to assess how the form 8824 PDF functionalities meet your requirements. After the trial, choose a plan that suits your volume and customization needs.

-

What features does airSlate SignNow provide for managing form 8824 pdf?

Among the key features for managing form 8824 PDF, airSlate SignNow provides customizable templates, advanced editing, and secure eSigning options. You can also track document status in real-time and get notifications when your form is signed. This enhances productivity and ensures your submissions are timely.

-

Can I integrate airSlate SignNow with other tools for handling my form 8824 pdf?

Yes, airSlate SignNow can integrate with various popular tools like Google Drive, Dropbox, and CRM systems. This allows you to streamline the management of your form 8824 PDF among different platforms. The integrations enhance your workflow, making it easy to access and share documents where needed.

-

How secure is my form 8824 pdf when using airSlate SignNow?

Security is a top priority for airSlate SignNow, and all documents, including your form 8824 PDF, are protected with bank-level encryption. Additionally, the platform ensures compliance with regulations such as GDPR and HIPAA. You can rest assured that your sensitive information is safe from unauthorized access.

-

What benefits do I gain by using airSlate SignNow for my form 8824 pdf?

Using airSlate SignNow for your form 8824 PDF offers several benefits, including increased efficiency and reduced paperwork. The ability to eSign documents eliminates the need for printing and scanning, thus saving time and resources. Moreover, you can access your forms anytime, anywhere, which enhances flexibility with your workflow.

Get more for Form 8824

- Tax form 8965

- Ch 600 request to modifyterminate civil harassment restraining order fillable editable and saveable california judicial council form

- University institution form

- Standard form 1199a

- Compound words form

- Out of zone request virginia beach form

- Neawater form

- Stock vesting agreement template form

Find out other Form 8824

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free