Form N 884, Rev Credit for Employment of Hawaii Gov 2020

What is the Form N-884?

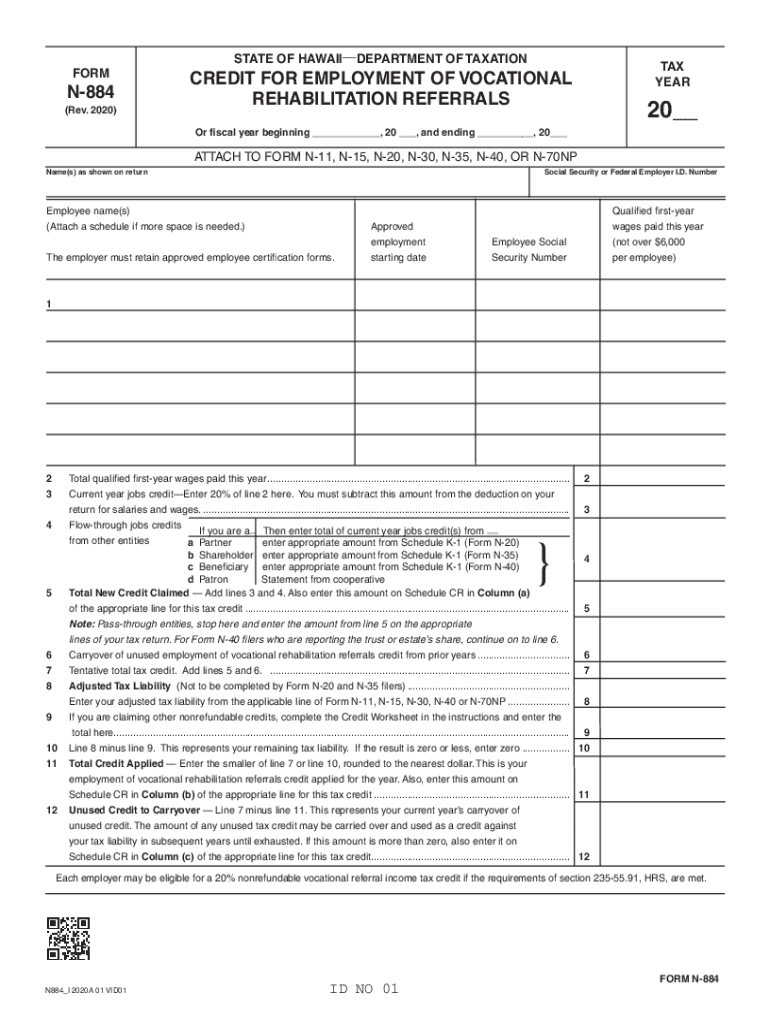

The Form N-884 is a tax document used in Hawaii, specifically designed for claiming the credit for employment of individuals with disabilities. This form is part of the state's efforts to encourage businesses to hire individuals who may face barriers to employment. The credit aims to reduce the financial burden on employers while promoting inclusivity in the workforce. Understanding the purpose and function of this form is essential for both employers and employees to ensure compliance and maximize available benefits.

Steps to Complete the Form N-884

Completing the Form N-884 requires careful attention to detail. Here are the steps involved:

- Gather necessary information about your business, including your Employer Identification Number (EIN).

- Identify the employee for whom you are claiming the credit, ensuring they meet the eligibility criteria.

- Fill out the required sections of the form, providing accurate details regarding the employment and disability status of the individual.

- Review the completed form for accuracy and completeness before submission.

- Submit the form according to the specified filing methods, either online or via mail.

Eligibility Criteria for Form N-884

To qualify for the credit claimed on the Form N-884, certain eligibility criteria must be met. Employers must ensure that:

- The employee has a documented disability.

- The employment is maintained for a minimum period as specified by state regulations.

- The business is in compliance with all relevant employment laws and regulations.

Understanding these criteria is crucial for businesses aiming to benefit from this tax credit while supporting inclusivity in the workplace.

Legal Use of the Form N-884

The Form N-884 must be used in accordance with state tax laws and regulations. It is essential for employers to adhere to the legal stipulations surrounding the credit for employment of individuals with disabilities. This includes ensuring that the information provided is accurate and that all eligibility requirements are met. Failure to comply with these legal aspects may result in penalties or disqualification from receiving the credit.

How to Obtain the Form N-884

The Form N-884 can be obtained through the official Hawaii Department of Taxation website. It is available in a fillable PDF format, allowing users to complete the form electronically. Additionally, physical copies can be requested from local tax offices for those who prefer to fill out the form by hand. Ensuring you have the correct and most recent version of the form is vital for accurate submissions.

Form Submission Methods

Employers have several options for submitting the Form N-884. The form can be submitted online through the Hawaii Department of Taxation's e-filing system, which offers a secure and efficient way to file. Alternatively, businesses may choose to mail the completed form to the appropriate tax office or deliver it in person. Each method has its own processing times, so employers should consider their needs when deciding how to submit the form.

Quick guide on how to complete form n 884 rev 2020 credit for employment of hawaiigov

Set Up Form N 884, Rev Credit For Employment Of Hawaii gov Effortlessly on Any Device

Managing documents online has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents quickly without delays. Manage Form N 884, Rev Credit For Employment Of Hawaii gov on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The Easiest Way to Modify and eSign Form N 884, Rev Credit For Employment Of Hawaii gov Without Stress

- Locate Form N 884, Rev Credit For Employment Of Hawaii gov and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your adjustments.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Form N 884, Rev Credit For Employment Of Hawaii gov and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 884 rev 2020 credit for employment of hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the form n 884 rev 2020 credit for employment of hawaiigov

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is the n 884 form used for?

The n 884 form is a document used for various tax-related purposes. It provides crucial information that supports the IRS in processing tax filings efficiently. Understanding how to fill out the n 884 correctly is essential for ensuring compliance.

-

How does airSlate SignNow simplify the signing process for the n 884?

AirSlate SignNow streamlines the signing process for the n 884 by allowing users to send and eSign documents electronically. This eliminates the delays associated with physical paperwork, making it easier to get approvals in a timely manner. Plus, users can track the status of their documents in real-time.

-

Is there a cost associated with using airSlate SignNow for the n 884?

Yes, airSlate SignNow offers subscription plans that cater to different business needs, including features for handling the n 884. The pricing is competitive and is designed to be cost-effective for businesses of all sizes. Additionally, the savings from faster processing can often outweigh the subscription costs.

-

What features does airSlate SignNow offer for the n 884?

AirSlate SignNow provides features such as electronic signatures, customizable templates for the n 884, and automated workflows. These capabilities enhance productivity and efficiency, allowing users to focus on more critical aspects of their business operations. Additionally, secure cloud storage ensures your documents remain safe.

-

Can I integrate airSlate SignNow with other software for handling the n 884?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage the n 884 alongside other business tools. Popular integrations include CRM systems and document management platforms. This makes it easier to maintain workflow continuity across your organization.

-

What are the benefits of using airSlate SignNow for processing the n 884?

Using airSlate SignNow for the n 884 offers numerous benefits, including time savings and improved accuracy. The electronic signing process reduces the time spent on paperwork, while automated reminders help ensure deadlines are met. Additionally, having everything stored securely in one place simplifies management.

-

Is airSlate SignNow secure for sending the n 884?

Yes, airSlate SignNow prioritizes security for all transactions, including those involving the n 884. The platform uses encryption to protect your documents and complies with the highest industry standards. This ensures that sensitive information remains confidential and secure.

Get more for Form N 884, Rev Credit For Employment Of Hawaii gov

Find out other Form N 884, Rev Credit For Employment Of Hawaii gov

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT