Form N 884, Rev Forms 2016

What is the Form N-884, Rev Forms

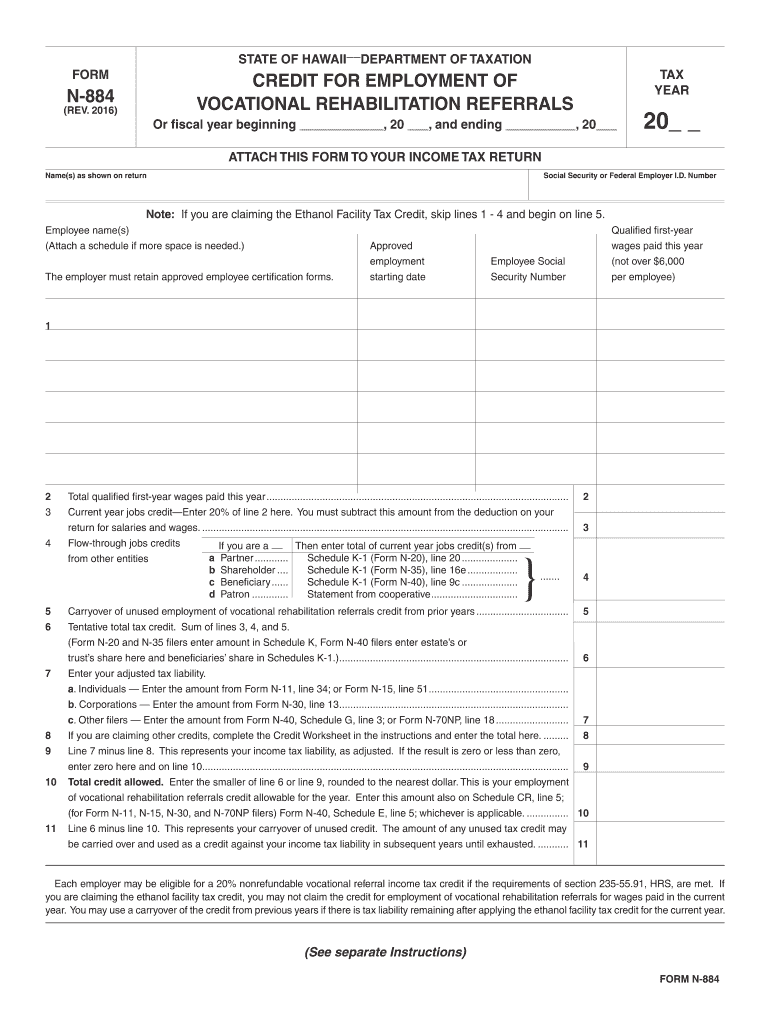

The Form N-884, Rev is a specific document used for tax-related purposes within the United States. This form is designed to assist individuals in reporting certain tax information accurately to the IRS. It includes sections where filers can input personal details, financial data, and other relevant information required by the IRS. Understanding the purpose of this form is crucial for ensuring compliance with federal tax regulations.

Steps to complete the Form N-884, Rev Forms

Completing the Form N-884, Rev involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including personal identification and financial records. Next, carefully fill out each section of the form, ensuring that all information is accurate and up to date. Pay special attention to the specific instructions provided with the form, as these may vary based on individual circumstances. After filling out the form, review it thoroughly for any errors before signing and dating where required.

How to obtain the Form N-884, Rev Forms

The Form N-884, Rev can be obtained from the official IRS website or through authorized tax preparation services. It is important to ensure that you are using the most current version of the form, as older versions may not be accepted by the IRS. Additionally, many tax software programs also provide access to this form, allowing for easier completion and submission.

Legal use of the Form N-884, Rev Forms

The legal use of the Form N-884, Rev is governed by IRS regulations. This form must be filled out and submitted in accordance with the guidelines set forth by the IRS to ensure that it is legally valid. Using the form for its intended purpose and following all instructions is essential to avoid penalties or issues with tax compliance. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal implications of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form N-884, Rev are critical to ensure compliance with IRS regulations. Typically, tax forms must be submitted by April 15 of each year, unless an extension has been filed. It is important to be aware of any specific deadlines related to the Form N-884, Rev, as failing to meet these dates can result in penalties or delays in processing. Keeping a calendar of important tax dates can help in managing timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Form N-884, Rev can be submitted through various methods, including online filing, mailing a physical copy, or delivering it in person to the appropriate IRS office. Online submission is often the fastest and most efficient method, allowing for quicker processing times. If choosing to mail the form, ensure it is sent to the correct address as specified by the IRS to avoid delays. In-person submissions may be suitable for those who require immediate confirmation of receipt.

Quick guide on how to complete form n 884 rev 2016 forms 2016

Your assistance manual on how to prepare your Form N 884, Rev Forms

If you are curious about how to develop and submit your Form N 884, Rev Forms, here are a few concise guidelines to facilitate your tax submission process.

To start, you simply need to register for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and robust document solution that enables you to modify, create, and finalize your tax paperwork with ease. With its editing tool, you can alternate between text, checkboxes, and electronic signatures, and return to change details whenever necessary. Optimize your tax administration with enhanced PDF editing, eSigning, and straightforward sharing options.

Follow the steps below to complete your Form N 884, Rev Forms in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; sift through various versions and schedules.

- Click Get form to access your Form N 884, Rev Forms in our editor.

- Complete the necessary fillable fields with your information (text, figures, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and fix any mistakes.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Please keep in mind that submitting in paper form can lead to return errors and delay refunds. Naturally, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form n 884 rev 2016 forms 2016

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

How do I fill UPSC 2016 form?

Below some steps are given to apply online NDA 2017 application form, follow given below steps:Go to the website.Then click on part-1 registration and enter details like name, education qualification, date of birth and other required details.complete part-1 of online registration.Select the fee payment mode.Then go to part-1 registration of NDA Exam and upload scanned signature and photo in the prescribed format.Take print out of application forms after completing part-2 registration.Generate bank challan and then make payment of application fee. After fee payment check your application status by entering your registration number and date of birth.For more details you will check How to fill NDA Application Form.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do I fill TMISAT 2016 form?

The forms are available on TMI's website from December onwards as far as I know.Tolani EducationThe instructions are very clear on it, if you still have doubts then you can email the college your querries on anything, they will get back to you in 3 days.

-

Can I fill out the SSC CHSL 2017 form while waiting for the 2016 results?

Yes you can.By now you should have started preparing also.We motivate students to crack govt exams while working.Join our YouTube channel SSC PATHSHALA and enjoy learning like never before.Classroom Program for English Mains: Classroom Program for English Mains - YouTube

-

Must I have to fill various application forms for various colleges before NEET 2016 result?

you can fill the forms only after they are out..so wait until any guidelines are clarified by CBSE and the honorable SC..

Create this form in 5 minutes!

How to create an eSignature for the form n 884 rev 2016 forms 2016

How to create an eSignature for the Form N 884 Rev 2016 Forms 2016 in the online mode

How to generate an eSignature for the Form N 884 Rev 2016 Forms 2016 in Google Chrome

How to make an eSignature for putting it on the Form N 884 Rev 2016 Forms 2016 in Gmail

How to create an electronic signature for the Form N 884 Rev 2016 Forms 2016 right from your smart phone

How to make an electronic signature for the Form N 884 Rev 2016 Forms 2016 on iOS

How to generate an eSignature for the Form N 884 Rev 2016 Forms 2016 on Android

People also ask

-

What is Form N 884, Rev Forms and who needs it?

Form N 884, Rev Forms is an essential document used primarily for certain business and financial transactions. It is beneficial for individuals or businesses needing to formalize agreements efficiently while ensuring compliance with legal requirements.

-

How does airSlate SignNow streamline the completion of Form N 884, Rev Forms?

airSlate SignNow offers a user-friendly platform that simplifies completing Form N 884, Rev Forms through seamless document editing and electronic signatures. This reduces paperwork and speeds up the process, making it ideal for busy professionals.

-

Is there a cost associated with using airSlate SignNow for Form N 884, Rev Forms?

Yes, airSlate SignNow provides flexible pricing plans that cater to various business needs. Users can take advantage of a cost-effective solution for managing Form N 884, Rev Forms with features that enhance workflow efficiency.

-

What features does airSlate SignNow offer for managing Form N 884, Rev Forms?

airSlate SignNow includes features like customizable templates, electronic signatures, and real-time tracking for Form N 884, Rev Forms. These features signNowly enhance collaboration and ensure document accuracy.

-

Can I integrate airSlate SignNow with other applications for managing Form N 884, Rev Forms?

Absolutely! airSlate SignNow supports integrations with popular applications such as Google Drive, Dropbox, and many others. This allows for seamless management and storage of Form N 884, Rev Forms within your existing workflow.

-

How secure is the data when using airSlate SignNow for Form N 884, Rev Forms?

Security is a top priority for airSlate SignNow. When using our service for Form N 884, Rev Forms, data is protected with advanced encryption protocols, ensuring that sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for Form N 884, Rev Forms?

The primary benefits of using airSlate SignNow for Form N 884, Rev Forms include enhanced efficiency, reduced turnaround times, and improved accuracy. Additionally, users can easily access their documents from anywhere, supporting flexible work arrangements.

Get more for Form N 884, Rev Forms

- Rutgers camden withdrawal form office of the registrar

- Patient encounter form template

- Ri use tax form

- Title internationaler frachtbrief cmr author formblitz ag subject transportlogistik keywords frachtbrief timex kuriere

- Aug05v1 form

- 1880 united states federal census form

- Gift and estate planning technique form

- Formulaire de procuration pour une demande de permis ou de certificat

Find out other Form N 884, Rev Forms

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe