Job CreationHiring Credits Employment of Vocational Job 2023

Understanding the Job Creation Hiring Credits Employment of Vocational Job

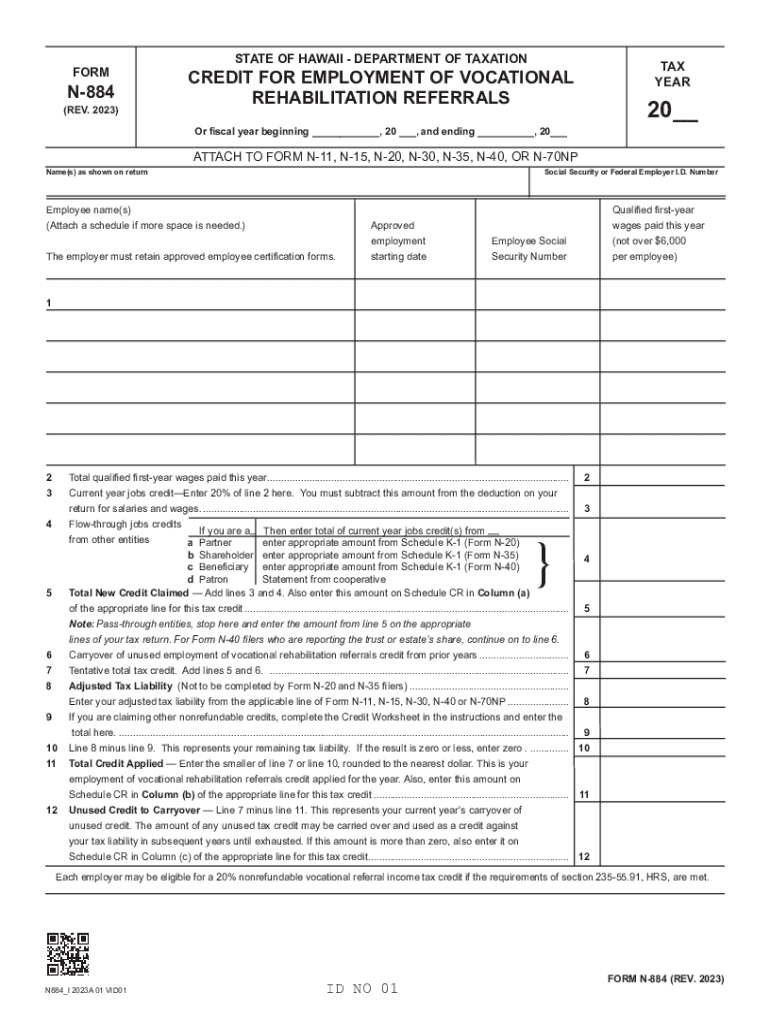

The Job Creation Hiring Credits Employment of Vocational Job is designed to incentivize businesses in Hawaii to hire individuals who are part of vocational rehabilitation programs. This initiative aims to reduce unemployment rates among those facing barriers to employment, including individuals with disabilities. By offering financial credits, the program encourages employers to create job opportunities that may not have been feasible otherwise.

Steps to Complete the Job Creation Hiring Credits Employment of Vocational Job

To successfully complete the Job Creation Hiring Credits Employment of Vocational Job, follow these steps:

- Determine eligibility by reviewing the criteria set forth by the Hawaii Department of Labor and Industrial Relations.

- Gather necessary documentation, including proof of employment and details of the vocational rehabilitation program.

- Complete the required forms accurately, ensuring all information is up to date.

- Submit the forms through the designated channels, either online or by mail, as specified by the state.

- Keep copies of all submitted documents for your records and future reference.

Eligibility Criteria for the Job Creation Hiring Credits Employment of Vocational Job

Eligibility for the Job Creation Hiring Credits Employment of Vocational Job generally includes the following criteria:

- The employer must be a registered business in Hawaii.

- The employee must be enrolled in a vocational rehabilitation program recognized by the state.

- The job created must be a new position that contributes to the overall workforce development.

- Employers must comply with all applicable labor laws and regulations.

Required Documents for the Job Creation Hiring Credits Employment of Vocational Job

When applying for the Job Creation Hiring Credits Employment of Vocational Job, the following documents are typically required:

- Proof of the employee's enrollment in a vocational rehabilitation program.

- Documentation of the job offer or employment contract.

- Completed application forms as specified by the Hawaii Department of Labor.

- Tax identification information for the business.

Form Submission Methods for the Job Creation Hiring Credits Employment of Vocational Job

Employers can submit the necessary forms for the Job Creation Hiring Credits Employment of Vocational Job through various methods:

- Online submission via the Hawaii Department of Labor's official website.

- Mailing the completed forms to the appropriate state office.

- In-person submission at designated state offices, if applicable.

Key Elements of the Job Creation Hiring Credits Employment of Vocational Job

Understanding the key elements of the Job Creation Hiring Credits Employment of Vocational Job is essential for employers. Important aspects include:

- The financial incentives offered to businesses for hiring vocational rehabilitation participants.

- The duration for which the credits can be claimed.

- The impact of these credits on overall business tax obligations.

Quick guide on how to complete job creationhiring credits employment of vocational job

Complete Job CreationHiring Credits Employment Of Vocational Job effortlessly on any device

Digital document management has become widely adopted by organizations and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle Job CreationHiring Credits Employment Of Vocational Job on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and electronically sign Job CreationHiring Credits Employment Of Vocational Job with ease

- Find Job CreationHiring Credits Employment Of Vocational Job and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Job CreationHiring Credits Employment Of Vocational Job to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct job creationhiring credits employment of vocational job

Create this form in 5 minutes!

How to create an eSignature for the job creationhiring credits employment of vocational job

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Hawaii employment referrals and how do they work?

Hawaii employment referrals are recommendations made by individuals who can connect businesses to qualified candidates in Hawaii. These referrals streamline the hiring process by leveraging personal networks and local expertise to find the best talent.

-

How can airSlate SignNow assist with Hawaii employment referrals?

AirSlate SignNow provides a seamless platform for managing documents involved in Hawaii employment referrals. From signing contracts to securely sharing job offers, our solution simplifies the entire process, making it easier for businesses to hire top talent.

-

Is there a pricing plan specifically for Hawaii employment referrals?

While we don't have a pricing plan specifically for Hawaii employment referrals, airSlate SignNow offers various flexible pricing tiers. This allows businesses of all sizes in Hawaii to choose a plan that best suits their document signing needs.

-

What features make airSlate SignNow ideal for Hawaii employment referrals?

AirSlate SignNow offers features such as customizable templates, real-time tracking, and mobile accessibility, which are ideal for managing Hawaii employment referrals. These tools help businesses streamline their hiring processes and ensure compliance with local regulations.

-

Can I integrate airSlate SignNow with other platforms for Hawaii employment referrals?

Yes, airSlate SignNow integrates with popular HR and recruitment platforms to enhance your Hawaii employment referrals process. These integrations allow for a more cohesive workflow, connecting your referral systems and document management seamlessly.

-

What benefits do businesses gain by using airSlate SignNow for Hawaii employment referrals?

Utilizing airSlate SignNow for Hawaii employment referrals can signNowly reduce the time spent on paperwork and improve overall efficiency. By streamlining document processes, businesses can focus more on connecting with candidates and enhancing their hiring strategies.

-

Are there any security measures in place for documents related to Hawaii employment referrals?

Absolutely! AirSlate SignNow prioritizes the security of your documents, employing advanced encryption and secure cloud storage for all files associated with Hawaii employment referrals. This ensures that sensitive information remains protected throughout the hiring process.

Get more for Job CreationHiring Credits Employment Of Vocational Job

- Twenty four hour affidavit ohio department of public safety form

- Incomplete information will result in the delay of processing your application

- Application for address ohio department of public safety publicsafety ohio form

- Handicap parking permit oklahoma application print form

- Ok 701 7 form

- Department of public safety handicap parking placard application fillable form

- Form 701 7 ok

- Oregon odot request form

Find out other Job CreationHiring Credits Employment Of Vocational Job

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online