Form N 884, Rev Credit for Employment of Hawaii Gov 2015

What is the Form N-884, Rev Credit For Employment Of Hawaii Gov

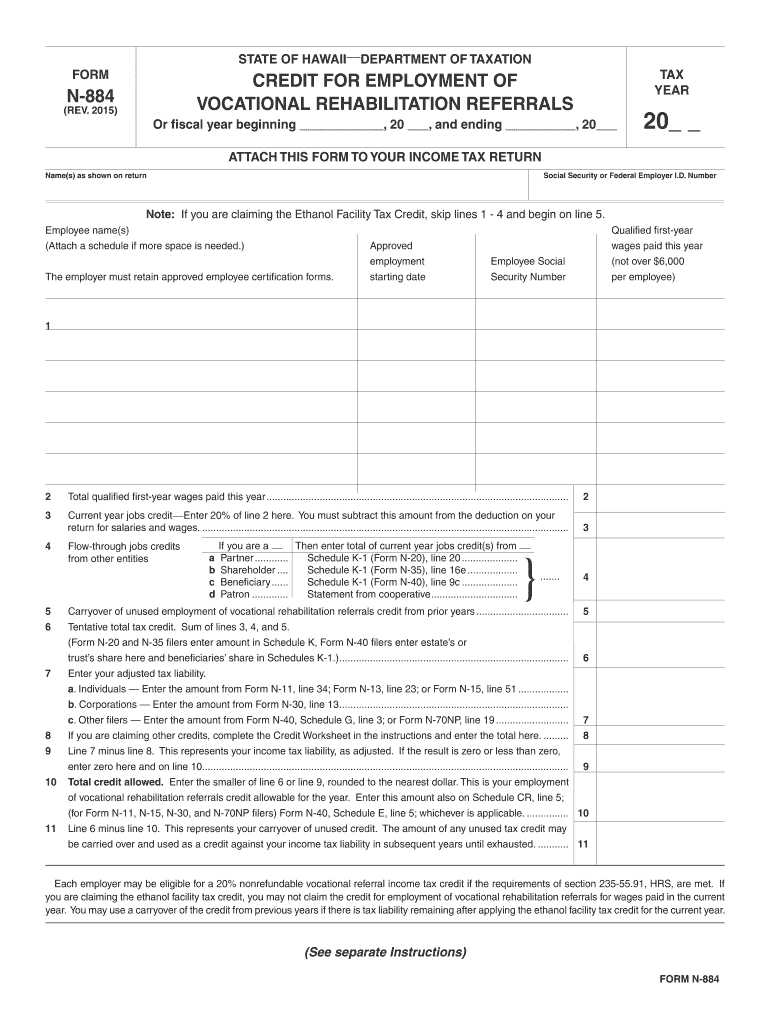

The Form N-884, Rev Credit For Employment Of Hawaii Gov is a tax form used by employers in Hawaii to claim a credit for employment-related expenses. This form is specifically designed to assist businesses in reporting their eligibility for tax credits associated with hiring and retaining employees. It is essential for employers to understand the requirements and benefits associated with this form to ensure compliance with state tax regulations.

How to Obtain the Form N-884, Rev Credit For Employment Of Hawaii Gov

Employers can obtain the Form N-884, Rev Credit For Employment Of Hawaii Gov through the official Hawaii Department of Taxation website. The form is available in a downloadable PDF format, allowing users to print and fill it out manually or complete it digitally using eSignature solutions. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to Complete the Form N-884, Rev Credit For Employment Of Hawaii Gov

Completing the Form N-884 involves several key steps:

- Gather necessary information about your business, including your Employer Identification Number (EIN).

- Provide details about the employees for whom you are claiming the credit, including their names and Social Security numbers.

- Complete the sections of the form that pertain to the specific credits you are claiming.

- Review the form for accuracy and completeness before signing.

- Submit the completed form either online or by mail, following the submission guidelines provided by the Hawaii Department of Taxation.

Key Elements of the Form N-884, Rev Credit For Employment Of Hawaii Gov

The Form N-884 includes several key elements that employers must fill out accurately:

- Employer Information: This section requires basic details about the business, including the name, address, and EIN.

- Employee Information: Employers must list the employees for whom the credit is being claimed, including their respective Social Security numbers.

- Credit Calculation: This part of the form outlines how to calculate the credit based on the number of employees and the specific expenses incurred.

- Signature Section: The form must be signed by an authorized representative of the business to validate the submission.

Legal Use of the Form N-884, Rev Credit For Employment Of Hawaii Gov

The Form N-884 is legally binding and must be completed in accordance with Hawaii state tax laws. Employers are required to ensure that all information provided is truthful and accurate. Misrepresentation or failure to comply with the guidelines can result in penalties or denial of the claimed credit. It is advisable for businesses to consult with a tax professional if they have questions regarding the legal implications of using this form.

Filing Deadlines / Important Dates

Employers should be aware of the filing deadlines associated with the Form N-884. Typically, the form must be submitted alongside the employer's annual tax return. It is crucial to check the specific deadlines set by the Hawaii Department of Taxation to ensure timely filing and avoid any late penalties. Keeping track of these dates can help businesses maximize their tax benefits.

Quick guide on how to complete form n 884 rev 2015 credit for employment of hawaiigov

Your assistance manual on how to prepare your Form N 884, Rev Credit For Employment Of Hawaii gov

If you wish to understand how to generate and dispatch your Form N 884, Rev Credit For Employment Of Hawaii gov, here are some brief guidelines on how to simplify the tax filing process.

To start off, you must create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to edit, draft, and complete your income tax forms with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify details as required. Streamline your tax management with advanced PDF editing, eSigning, and user-friendly sharing options.

Follow the steps below to complete your Form N 884, Rev Credit For Employment Of Hawaii gov in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Form N 884, Rev Credit For Employment Of Hawaii gov in our editor.

- Complete the necessary fillable fields with your information (text, figures, check marks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may lead to increased errors and delays in refunds. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form n 884 rev 2015 credit for employment of hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the form n 884 rev 2015 credit for employment of hawaiigov

How to create an electronic signature for the Form N 884 Rev 2015 Credit For Employment Of Hawaiigov online

How to generate an eSignature for your Form N 884 Rev 2015 Credit For Employment Of Hawaiigov in Google Chrome

How to generate an eSignature for putting it on the Form N 884 Rev 2015 Credit For Employment Of Hawaiigov in Gmail

How to make an electronic signature for the Form N 884 Rev 2015 Credit For Employment Of Hawaiigov from your smartphone

How to make an electronic signature for the Form N 884 Rev 2015 Credit For Employment Of Hawaiigov on iOS devices

How to make an eSignature for the Form N 884 Rev 2015 Credit For Employment Of Hawaiigov on Android devices

People also ask

-

What is Form N 884, Rev Credit For Employment Of Hawaii gov.?

Form N 884, Rev Credit For Employment Of Hawaii gov. is designed to help employers claim a tax credit for hiring eligible employees in Hawaii. This form is essential for businesses looking to maximize their benefits under state tax regulations. Understanding this form can signNowly enhance your business's financial planning.

-

How can airSlate SignNow assist with Form N 884, Rev Credit For Employment Of Hawaii gov.?

airSlate SignNow streamlines the process of signing and submitting Form N 884, Rev Credit For Employment Of Hawaii gov. With our user-friendly platform, you can easily prepare, send, and eSign your documents securely. This reduces the time spent on paperwork and accelerates your eligibility for the credit.

-

Is airSlate SignNow a cost-effective solution for handling Form N 884, Rev Credit For Employment Of Hawaii gov.?

Yes, airSlate SignNow offers an affordable pricing structure, making it a cost-effective solution for managing Form N 884, Rev Credit For Employment Of Hawaii gov. Our platform is designed to save you both time and resources, allowing you to focus on your core business activities while efficiently handling your documentation needs.

-

What features does airSlate SignNow offer for preparing Form N 884, Rev Credit For Employment Of Hawaii gov.?

airSlate SignNow includes several features to facilitate the preparation of Form N 884, Rev Credit For Employment Of Hawaii gov. These features include customizable templates, an intuitive drag-and-drop interface, and the ability to set signing permissions. This ensures that your documents are completed accurately and expediently.

-

Are there integrations available for airSlate SignNow that can help with Form N 884, Rev Credit For Employment Of Hawaii gov.?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing the efficiency of managing Form N 884, Rev Credit For Employment Of Hawaii gov. You can connect it with your CRM, cloud storage, and other business tools, creating a comprehensive workflow that optimizes document management.

-

Can I track the status of Form N 884, Rev Credit For Employment Of Hawaii gov. submissions with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features that allow you to monitor the status of your Form N 884, Rev Credit For Employment Of Hawaii gov. submissions. You will receive notifications when documents are viewed, signed, or completed, ensuring you are always informed about your document's progress.

-

How secure is my data when using airSlate SignNow for Form N 884, Rev Credit For Employment Of Hawaii gov.?

Security is a top priority at airSlate SignNow. Our platform employs industry-leading encryption and security measures to protect sensitive data, including information related to Form N 884, Rev Credit For Employment Of Hawaii gov. You can trust that your documents are safe and your personal information is secure.

Get more for Form N 884, Rev Credit For Employment Of Hawaii gov

Find out other Form N 884, Rev Credit For Employment Of Hawaii gov

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast