N 884 2017

What is the N 884

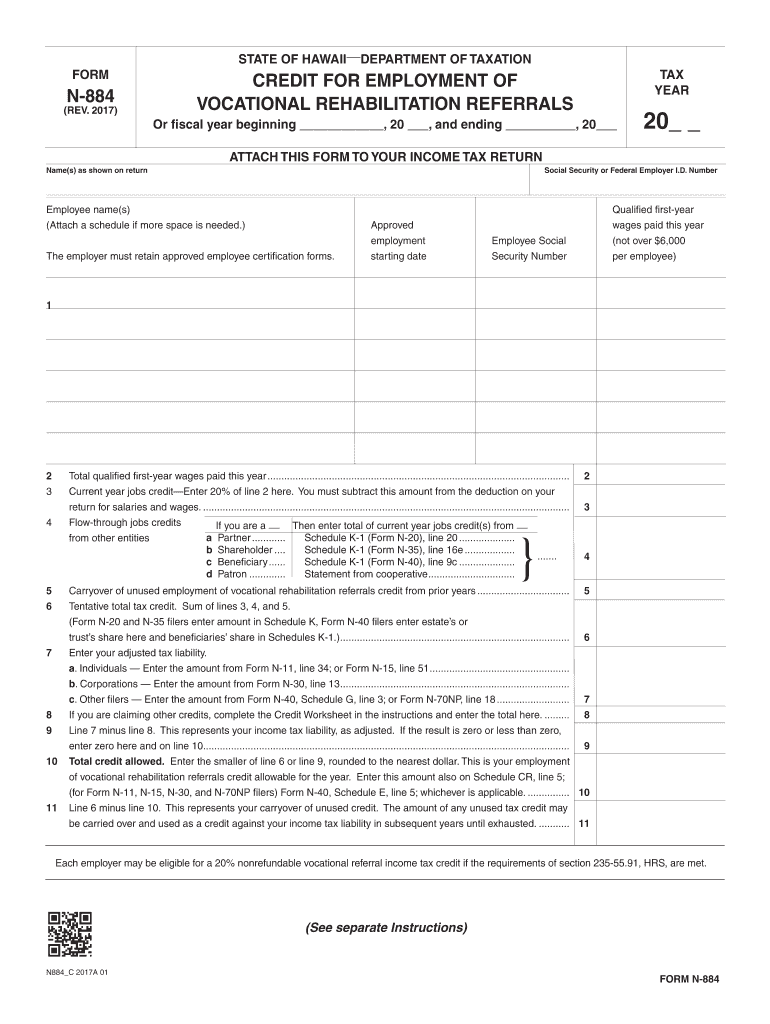

The N 884 is a specific form used in tax reporting, primarily for individuals and businesses to provide necessary information to the IRS. This form is essential for ensuring compliance with federal tax regulations. It includes sections where taxpayers can input their financial details, allowing for accurate processing of their tax obligations. Understanding the purpose and requirements of the N 884 is crucial for anyone looking to file their taxes correctly.

How to use the N 884

Using the N 884 involves several straightforward steps. First, gather all relevant financial documents, such as income statements and previous tax returns. Next, access the form through the IRS website or a trusted tax preparation service. Fill out the required fields with accurate information, ensuring that all entries are complete and correct. After completing the form, review it for any errors before submitting it to the IRS, either electronically or by mail. Utilizing an eSignature platform like signNow can streamline this process, making it easier to sign and send your completed form securely.

Steps to complete the N 884

Completing the N 884 requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all necessary documentation, including income records and previous tax filings.

- Obtain the N 884 form from the IRS website or a tax preparation service.

- Fill in your personal information, including name, address, and Social Security number.

- Input your financial details as required by the form.

- Double-check all entries for accuracy and completeness.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the N 884

The N 884 must be used in accordance with IRS regulations to ensure its legal validity. This includes following guidelines for information accuracy and submission methods. Taxpayers should be aware that any discrepancies or errors can lead to penalties or delays in processing. It is important to maintain compliance with federal tax laws and to use the form solely for its intended purpose, which is to report tax-related information to the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the N 884 are critical to avoid penalties. Generally, the form must be submitted by the annual tax filing deadline, which is typically April fifteenth for individual taxpayers. However, specific circumstances, such as extensions or special cases, may alter these dates. It is essential to stay informed about any changes to the filing schedule and to plan accordingly to ensure timely submission.

Required Documents

To accurately complete the N 884, certain documents are necessary. These typically include:

- Income statements, such as W-2 or 1099 forms.

- Previous tax returns for reference.

- Documentation of any deductions or credits being claimed.

- Identification documents, including your Social Security number.

Having these documents readily available will facilitate a smoother filing process and help ensure that the information provided on the N 884 is accurate and complete.

Quick guide on how to complete form n 884 rev 2017 forms 2017

Your assistance manual on how to prepare your N 884

If you’re curious about how to generate and submit your N 884, here are a few straightforward guidelines to make tax submission more manageable.

To initiate, you simply need to create your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is a remarkably user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax paperwork effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, allowing you to revisit and alter responses as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the following steps to complete your N 884 swiftly:

- Create your account and start editing PDFs within minutes.

- Utilize our catalog to locate any IRS tax form; explore different versions and schedules.

- Click Obtain form to access your N 884 in our editor.

- Populate the mandatory fillable fields with your information (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting in paper format can lead to increased return errors and delayed refunds. Of course, prior to e-filing your taxes, consult the IRS website for reporting guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form n 884 rev 2017 forms 2017

FAQs

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

The Mh CET 2017 application forms were released yesterday. Is it better to fill out the form now or later?

No hard and fast rule for that!It would be better if you fill it early as possible.Because later the traffic will go on increasing and these Government websites are more likely to crash when the traffic is high.fill the forms in initial days if you can..

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

Create this form in 5 minutes!

How to create an eSignature for the form n 884 rev 2017 forms 2017

How to make an electronic signature for the Form N 884 Rev 2017 Forms 2017 in the online mode

How to make an electronic signature for your Form N 884 Rev 2017 Forms 2017 in Chrome

How to create an electronic signature for putting it on the Form N 884 Rev 2017 Forms 2017 in Gmail

How to generate an eSignature for the Form N 884 Rev 2017 Forms 2017 straight from your mobile device

How to generate an eSignature for the Form N 884 Rev 2017 Forms 2017 on iOS

How to make an electronic signature for the Form N 884 Rev 2017 Forms 2017 on Android

People also ask

-

What is N 884 in the context of airSlate SignNow?

N 884 refers to a specific document type that can be managed and signed using airSlate SignNow. This platform allows users to easily create, send, and eSign N 884 forms securely, streamlining the document workflow for businesses. By utilizing airSlate SignNow, you ensure that your N 884 documents are processed efficiently and in compliance with legal standards.

-

How does airSlate SignNow handle N 884 document security?

airSlate SignNow takes document security seriously, especially for sensitive forms like N 884. The platform employs advanced encryption and secure storage protocols to protect your N 884 documents during transmission and at rest. This ensures that your data remains confidential and secure throughout the signing process.

-

What are the costs associated with using airSlate SignNow for N 884 documents?

The pricing for using airSlate SignNow to manage N 884 documents is competitive and designed to fit various business needs. You can choose from different subscription plans that cater to individual users or teams, providing flexibility based on how often you need to send and eSign N 884 forms. Each plan includes access to essential features, ensuring you get value for your investment.

-

Can I integrate airSlate SignNow with other software for managing N 884 documents?

Yes, airSlate SignNow offers seamless integrations with popular software applications, enhancing your ability to manage N 884 documents. You can connect it with CRM systems, cloud storage services, and productivity tools, making it easier to access and send N 884 forms directly from your preferred platforms. This integration capability improves workflow efficiency and saves time.

-

What are the main features of airSlate SignNow for handling N 884 documents?

airSlate SignNow includes a variety of features specifically designed for handling N 884 documents effectively. These features include customizable templates, bulk sending options, automated reminders, and in-app messaging for real-time communication. Such tools make it simple for businesses to manage their N 884 forms and ensure all signatures are collected promptly.

-

How can airSlate SignNow benefit my business when working with N 884 documents?

Using airSlate SignNow for N 884 documents can signNowly enhance your business's efficiency and productivity. The platform simplifies the signing process, reduces paperwork, and speeds up transaction times. With its user-friendly interface, your team can focus on core activities while ensuring that N 884 forms are handled professionally.

-

Is it easy to get started with airSlate SignNow for N 884 document management?

Absolutely! Getting started with airSlate SignNow for N 884 document management is quick and straightforward. You can sign up for a free trial, explore the user-friendly dashboard, and begin creating and sending your N 884 forms within minutes. The intuitive setup process ensures that you can start benefiting from the platform right away.

Get more for N 884

- Cacfp blank menu form

- Uq undergraduate application form for international students scholarships online

- Pdq 4 online form

- Uob cda giro form

- Colorado road and community safety act rcsa affidavit form

- Monthly maintenance report for owner operators form

- Fazaia education welfare scheme form

- Residential cleaning service agreement template form

Find out other N 884

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF