CE Revenue Louisiana GovHome Page Louisiana Department of RevenueHome Page Louisiana Department of Revenue 2021

What is the CE Revenue louisiana govHome Page Louisiana Department Of RevenueHome Page Louisiana Department Of Revenue

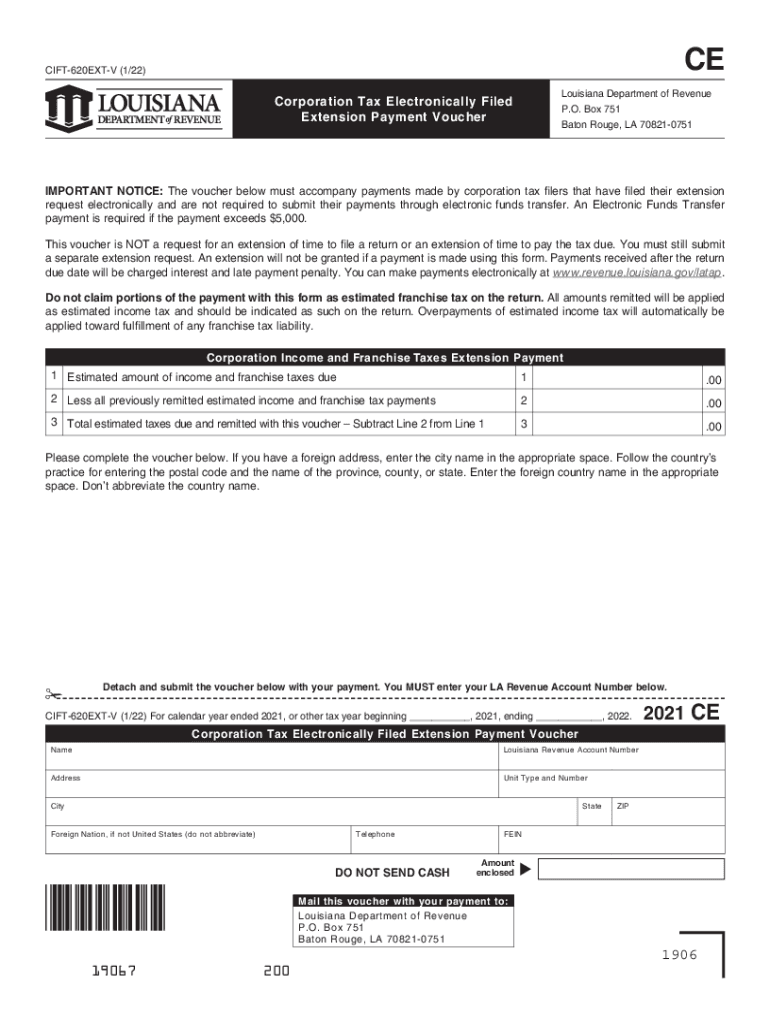

The CE Revenue form is a crucial document managed by the Louisiana Department of Revenue. It serves as a means for individuals and businesses to report and manage their tax obligations within the state. This form is specifically designed to streamline the process of tax compliance, ensuring that all necessary information is accurately captured and submitted to the state authorities. Understanding the purpose and requirements of this form is essential for maintaining compliance with Louisiana tax laws.

How to use the CE Revenue louisiana govHome Page Louisiana Department Of RevenueHome Page Louisiana Department Of Revenue

Utilizing the CE Revenue form involves several straightforward steps. First, gather all relevant financial information and documentation necessary for completing the form. This may include income statements, expense records, and previous tax returns. Next, access the CE Revenue form through the Louisiana Department of Revenue's official website. Carefully fill out the form, ensuring that all fields are completed accurately. After completing the form, review it for any errors before submission. Finally, submit the form electronically or via mail, depending on your preference and the guidelines provided by the Department of Revenue.

Steps to complete the CE Revenue louisiana govHome Page Louisiana Department Of RevenueHome Page Louisiana Department Of Revenue

Completing the CE Revenue form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Collect necessary documentation, including income and expense records.

- Access the CE Revenue form on the Louisiana Department of Revenue website.

- Fill out the form, providing accurate and complete information in each section.

- Review the completed form for any mistakes or omissions.

- Submit the form electronically or print it for mailing, as per the instructions provided.

Legal use of the CE Revenue louisiana govHome Page Louisiana Department Of RevenueHome Page Louisiana Department Of Revenue

The legal use of the CE Revenue form is governed by state tax regulations. To ensure that your submission is recognized as valid, it must adhere to the requirements set forth by the Louisiana Department of Revenue. This includes providing accurate information, submitting the form by the designated deadlines, and ensuring compliance with all applicable laws. The form must be signed, either digitally or physically, to be considered legally binding. Utilizing a reliable eSignature solution can enhance the legal standing of your submission.

Required Documents

When preparing to complete the CE Revenue form, certain documents are essential. These may include:

- Income statements, such as W-2s or 1099 forms.

- Expense documentation, including receipts and invoices.

- Previous tax returns for reference.

- Any additional forms or schedules required by the Louisiana Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

The CE Revenue form can be submitted through various methods to accommodate different preferences. Individuals can choose to submit the form online via the Louisiana Department of Revenue's website, ensuring a quicker processing time. Alternatively, the form can be mailed to the appropriate address provided on the website. For those who prefer in-person interactions, visiting a local Department of Revenue office is also an option. Each submission method has its own guidelines, so it is important to follow the instructions carefully to ensure proper processing.

Quick guide on how to complete ce revenuelouisianagovhome page louisiana department of revenuehome page louisiana department of revenue

Finalize CE Revenue louisiana govHome Page Louisiana Department Of RevenueHome Page Louisiana Department Of Revenue effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle CE Revenue louisiana govHome Page Louisiana Department Of RevenueHome Page Louisiana Department Of Revenue on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and electronically sign CE Revenue louisiana govHome Page Louisiana Department Of RevenueHome Page Louisiana Department Of Revenue with ease

- Locate CE Revenue louisiana govHome Page Louisiana Department Of RevenueHome Page Louisiana Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to retain your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign CE Revenue louisiana govHome Page Louisiana Department Of RevenueHome Page Louisiana Department Of Revenue to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ce revenuelouisianagovhome page louisiana department of revenuehome page louisiana department of revenue

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to the CE Revenue Louisiana gov Home Page?

airSlate SignNow is an electronic signature solution that allows businesses to send and eSign documents efficiently. By using airSlate SignNow, users can easily navigate through processes related to the CE Revenue Louisiana gov Home Page, supporting the seamless submission of documents to the Louisiana Department of Revenue.

-

How can airSlate SignNow benefit users dealing with the Louisiana Department of Revenue?

Using airSlate SignNow simplifies the document management process, ensuring compliance and ease of use when submitting to the Louisiana Department of Revenue. With tailored features that cater specifically to governmental submissions, it streamlines interactions with the CE Revenue Louisiana gov Home Page.

-

What pricing plans are offered for airSlate SignNow?

airSlate SignNow provides flexible pricing plans designed to accommodate businesses of all sizes. Customers can choose between different tiers, ensuring they find a plan that fits their needs for interacting with the CE Revenue Louisiana gov Home Page and the Louisiana Department of Revenue.

-

Does airSlate SignNow integrate with other applications?

Yes, airSlate SignNow offers numerous integrations with popular applications that enhance its functionality. This capability allows users to connect with tools they already use while processing documents related to the CE Revenue Louisiana gov Home Page and the Louisiana Department of Revenue.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow employs industry-leading security measures to protect sensitive information during the eSigning process. This ensures that all documents submitted to the CE Revenue Louisiana gov Home Page and the Louisiana Department of Revenue are safeguarded with state-of-the-art encryption.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes a variety of features such as customizable templates, real-time tracking, and automated reminders for signers. These features enhance user experience and ensure efficient handling of documents related to the CE Revenue Louisiana gov Home Page and the Louisiana Department of Revenue.

-

Can airSlate SignNow help with tax document submissions?

Yes, airSlate SignNow is designed to facilitate the efficient submission of tax documents, including those required by the Louisiana Department of Revenue. By utilizing airSlate SignNow, users can navigate the CE Revenue Louisiana gov Home Page more seamlessly, improving their submission experience.

Get more for CE Revenue louisiana govHome Page Louisiana Department Of RevenueHome Page Louisiana Department Of Revenue

Find out other CE Revenue louisiana govHome Page Louisiana Department Of RevenueHome Page Louisiana Department Of Revenue

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online