Please Use Blue or Black Ink 42273 2022

Understanding the Louisiana Sales Tax Form R-1029

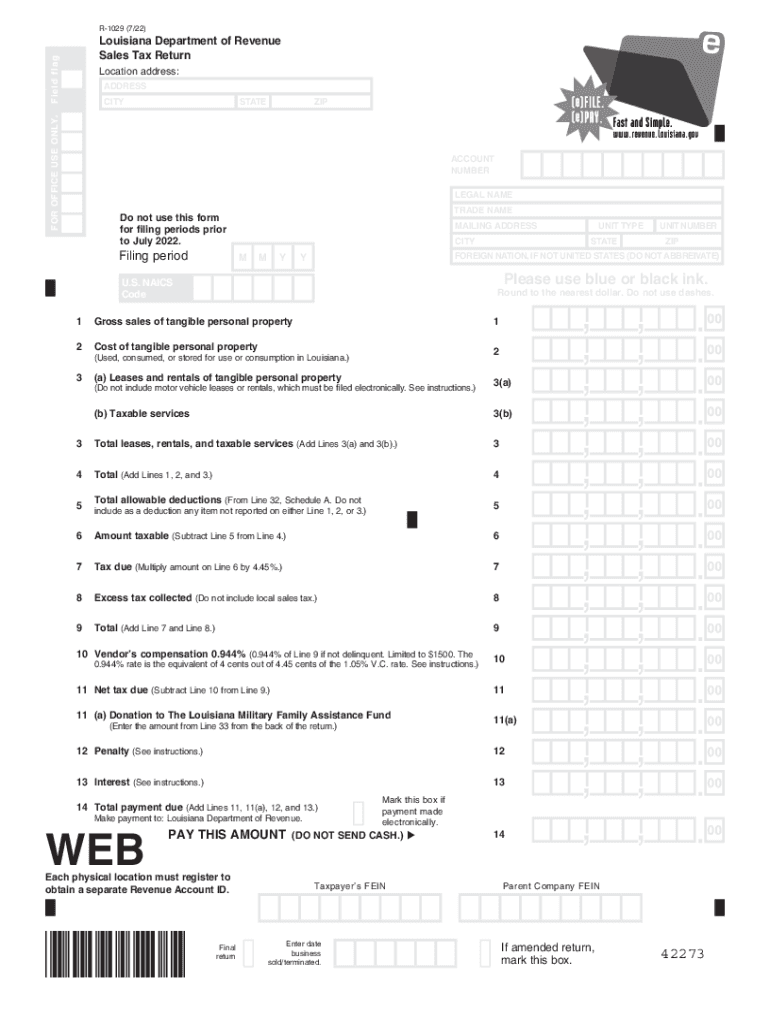

The Louisiana sales tax form R-1029 is essential for businesses operating within the state to report and remit sales tax collected from customers. This form is specifically designed for use by various types of businesses, including retail, service providers, and wholesalers. Completing the R-1029 accurately is crucial to ensure compliance with state tax regulations and avoid potential penalties.

Steps to Complete the Louisiana Sales Tax Form R-1029

Filling out the Louisiana sales tax form R-1029 involves several key steps:

- Gather necessary information, including your business name, address, and sales tax identification number.

- Calculate the total sales made during the reporting period, including taxable and non-taxable sales.

- Determine the amount of sales tax collected based on the applicable Louisiana sales tax rate.

- Complete the form by entering the calculated figures in the appropriate sections.

- Review the form for accuracy and ensure all required fields are filled out.

Filing Deadlines for the Louisiana Sales Tax Form R-1029

Timely filing of the Louisiana sales tax form R-1029 is essential to avoid penalties. The deadlines typically align with the sales reporting period, which can be monthly, quarterly, or annually, depending on your business's sales volume. It is important to check with the Louisiana Department of Revenue for specific deadlines relevant to your business.

Legal Use of the Louisiana Sales Tax Form R-1029

The R-1029 form holds legal significance as it is the official document used to report sales tax obligations to the state. Submitting this form electronically or via mail establishes a legal record of your sales tax activities. Compliance with the Louisiana sales tax regulations is crucial to maintain good standing with tax authorities and avoid legal repercussions.

Required Documents for Filing the Louisiana Sales Tax Form R-1029

To complete the Louisiana sales tax form R-1029, you will need several documents, including:

- Your sales tax registration certificate.

- Records of sales transactions, including receipts and invoices.

- Documentation of any exempt sales, if applicable.

Having these documents on hand will facilitate the accurate completion of the form and help ensure compliance with state tax laws.

Penalties for Non-Compliance with Louisiana Sales Tax Regulations

Failure to file the Louisiana sales tax form R-1029 on time or inaccuracies in reporting can result in significant penalties. The Louisiana Department of Revenue may impose fines, interest on unpaid taxes, and even legal action in severe cases. It is essential for businesses to understand their obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete please use blue or black ink 42273

Prepare Please Use Blue Or Black Ink 42273 easily on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Please Use Blue Or Black Ink 42273 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to alter and eSign Please Use Blue Or Black Ink 42273 effortlessly

- Find Please Use Blue Or Black Ink 42273 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize key sections of your documents or redact sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Please Use Blue Or Black Ink 42273 and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct please use blue or black ink 42273

Create this form in 5 minutes!

People also ask

-

What is the importance of understanding Louisiana sales tax when using airSlate SignNow?

Understanding Louisiana sales tax is essential for businesses that operate within the state. Accurate document signing through airSlate SignNow ensures that all transactions are compliant with state regulations regarding Louisiana sales tax. This helps prevent potential legal issues and keeps your financial operations smooth and transparent.

-

How does airSlate SignNow help with Louisiana sales tax documentation?

airSlate SignNow provides features that streamline the documentation process for Louisiana sales tax. With templates and eSigning capabilities, businesses can easily manage invoices, contracts, and tax-related documents to ensure accuracy. This simplifies tax compliance and helps maintain proper records for any necessary audits.

-

Can I integrate airSlate SignNow with accounting software that handles Louisiana sales tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions that handle Louisiana sales tax. These integrations allow for efficient data transfer and streamlined management of financial documents. This ease of use enhances your efficiency in managing Louisiana sales tax-related tasks.

-

What pricing plans does airSlate SignNow offer for businesses concerned with Louisiana sales tax?

airSlate SignNow offers several pricing plans tailored to meet the needs of different businesses, whether small or large. Each plan includes features that aid in the management of documents related to Louisiana sales tax. By choosing the right plan, you can ensure compliance without overspending on unnecessary features.

-

What features does airSlate SignNow provide to facilitate Louisiana sales tax compliance?

airSlate SignNow offers various features such as custom templates and automated workflows that enhance compliance with Louisiana sales tax regulations. These tools help ensure that all necessary information is included in your documents, minimizing errors and facilitating smooth processing. This is crucial for businesses aiming to remain compliant while efficiently managing their sales tax documentation.

-

Is airSlate SignNow user-friendly for businesses learning about Louisiana sales tax?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it ideal for businesses new to managing Louisiana sales tax. The intuitive interface allows users to easily navigate through the eSigning process and access important features related to tax documentation. This reduces the learning curve and helps businesses get started quickly with their tax management.

-

How can airSlate SignNow help reduce errors related to Louisiana sales tax?

With airSlate SignNow's automation features, businesses can signNowly reduce errors related to Louisiana sales tax. Automated workflows and document templates minimize the chances of human error by standardizing information and checks. This not only increases accuracy but also enhances trust in your financial practices.

Get more for Please Use Blue Or Black Ink 42273

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497307455 form

- Ks codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497307457 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497307458 form

- Ks rules form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497307460 form

- Kansas landlord in form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497307462 form

Find out other Please Use Blue Or Black Ink 42273

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template