PDF 10291221WEB F PDF Louisiana Department of Revenue 2021

Understanding the Louisiana Sales Tax Form R-1029

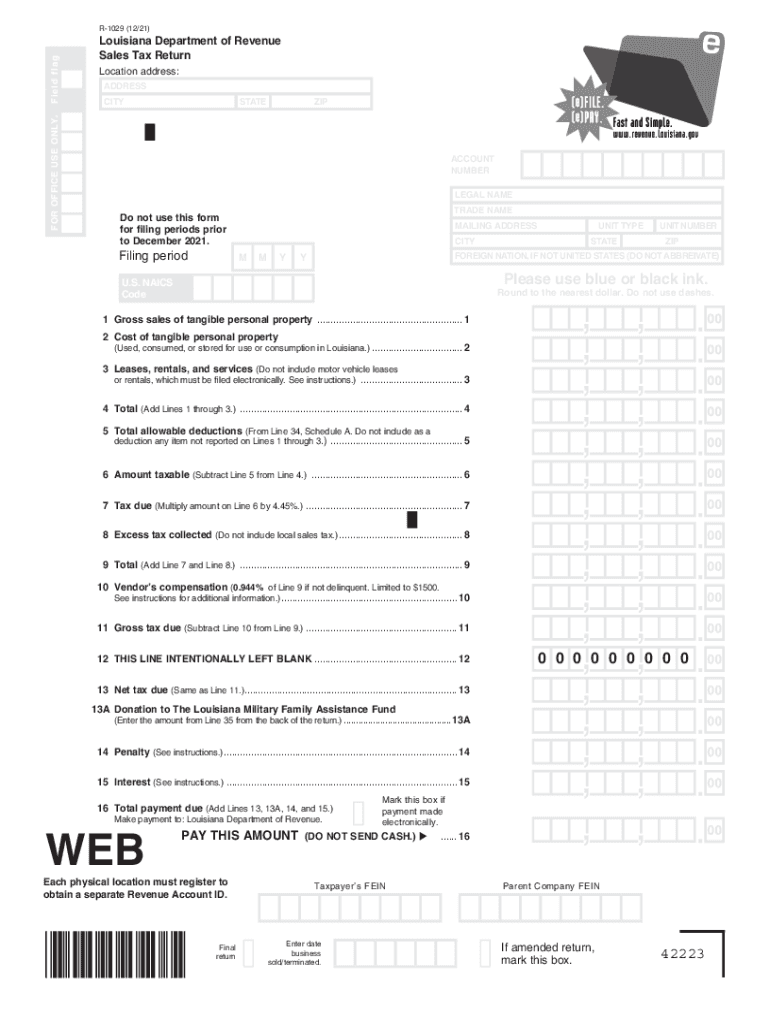

The Louisiana sales tax form R-1029 is a crucial document for businesses operating within the state. This form is used to report sales tax collected from customers and to remit that tax to the Louisiana Department of Revenue. It is essential for maintaining compliance with state tax regulations and ensuring that businesses fulfill their tax obligations accurately and on time.

Steps to Complete the Louisiana Sales Tax Form R-1029

Completing the Louisiana sales tax form R-1029 involves several key steps to ensure accuracy and compliance. First, gather all relevant sales data for the reporting period, including total sales and the amount of sales tax collected. Next, fill in the required fields on the form, which typically include business information, sales figures, and tax calculations. After completing the form, review it for any errors before submission. Finally, submit the form electronically or via mail, depending on your preference and the requirements set by the Louisiana Department of Revenue.

Filing Deadlines for the Louisiana Sales Tax Form

Timely filing of the Louisiana sales tax form R-1029 is essential to avoid penalties. The deadlines for submission vary depending on the frequency of your tax reporting, which could be monthly, quarterly, or annually. Generally, monthly filers must submit their forms by the 20th of the following month, while quarterly and annual filers have different deadlines. It is advisable to check the Louisiana Department of Revenue's official guidelines for specific dates to ensure compliance.

Form Submission Methods for the Louisiana Sales Tax Form R-1029

The Louisiana sales tax form R-1029 can be submitted through various methods, providing flexibility for businesses. The most common submission methods include electronic filing through the Louisiana Department of Revenue's online portal, which is efficient and allows for immediate confirmation of receipt. Alternatively, businesses may choose to mail the completed form to the appropriate department address. In-person submissions are also an option for those who prefer direct interaction.

Penalties for Non-Compliance with the Louisiana Sales Tax Regulations

Failure to file the Louisiana sales tax form R-1029 on time or inaccuracies in reporting can result in significant penalties. The Louisiana Department of Revenue imposes fines for late submissions, which can accumulate over time. Additionally, businesses may face interest charges on unpaid taxes. Understanding these consequences emphasizes the importance of timely and accurate filing to maintain compliance and avoid unnecessary financial burdens.

Key Elements of the Louisiana Sales Tax Form R-1029

The Louisiana sales tax form R-1029 contains several key elements that are vital for accurate reporting. These include the business's name, address, and account number, as well as detailed sections for reporting total sales, taxable sales, and the amount of sales tax collected. Understanding these components is essential for ensuring that the form is completed correctly and that all necessary information is provided to the state.

Quick guide on how to complete pdf 10291221web fpdf louisiana department of revenue

Complete PDF 10291221WEB F pdf Louisiana Department Of Revenue effortlessly on any device

Digital document management has gained traction among both organizations and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any holdups. Manage PDF 10291221WEB F pdf Louisiana Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to alter and electronically sign PDF 10291221WEB F pdf Louisiana Department Of Revenue without hassle

- Find PDF 10291221WEB F pdf Louisiana Department Of Revenue and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about missing or misplaced files, tedious form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign PDF 10291221WEB F pdf Louisiana Department Of Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf 10291221web fpdf louisiana department of revenue

Create this form in 5 minutes!

How to create an eSignature for the pdf 10291221web fpdf louisiana department of revenue

The best way to create an e-signature for your PDF file online

The best way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

How to make an e-signature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an e-signature for a PDF on Android devices

People also ask

-

What is the louisiana sales tax form used for?

The louisiana sales tax form is used by businesses to report and pay sales tax collected from customers. It ensures compliance with state tax regulations and helps businesses avoid penalties. By accurately filing this form, you can maintain a good standing with the Louisiana Department of Revenue.

-

How can airSlate SignNow help with the louisiana sales tax form?

airSlate SignNow streamlines the process of filling out and eSigning the louisiana sales tax form. Our platform allows you to easily send documents for signature, ensuring that your tax submissions are handled swiftly and securely. This saves you time and reduces the risk of errors when filing your forms.

-

What features does airSlate SignNow offer for managing the louisiana sales tax form?

With airSlate SignNow, you get features like customizable templates, eSignature capabilities, and secure document storage specifically for the louisiana sales tax form. These tools enhance your workflow, making it easier to prepare and submit your tax forms without hassle. Plus, you can access your documents anytime, anywhere.

-

Is airSlate SignNow cost-effective for filing the louisiana sales tax form?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for businesses managing the louisiana sales tax form. Our affordable pricing ensures that you can eSign and send documents without exceeding your budget. You also benefit from added features that enhance your document management experience.

-

Are there any integrations available for the louisiana sales tax form with airSlate SignNow?

Absolutely! airSlate SignNow supports various integrations to help you manage the louisiana sales tax form seamlessly. Integrate with popular accounting and tax software to auto-import data, reducing manual entry and minimizing errors. This ensures that your workflow remains efficient and organized.

-

What are the benefits of using airSlate SignNow for the louisiana sales tax form?

Using airSlate SignNow for the louisiana sales tax form provides numerous benefits, including improved efficiency, enhanced accuracy, and easy compliance with tax regulations. Our platform simplifies the eSigning process, allowing you to get documents signed quickly. You will also have access to audit trails for your submissions, ensuring transparency.

-

Can I store my completed louisiana sales tax forms securely with airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for your completed louisiana sales tax forms. This feature ensures that your documents are safely stored and easily retrievable whenever needed. With end-to-end encryption, you can trust that your sensitive tax information remains secure.

Get more for PDF 10291221WEB F pdf Louisiana Department Of Revenue

- Notice prior demand form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property mississippi form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential mississippi form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property mississippi form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497313894 form

- Agreed written termination of lease by landlord and tenant mississippi form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497313898 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for nonresidential property 497313899 form

Find out other PDF 10291221WEB F pdf Louisiana Department Of Revenue

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template