Form R 1029DSEi Louisiana Department of Revenue 2020

What is the Form R-1029 Louisiana Department of Revenue?

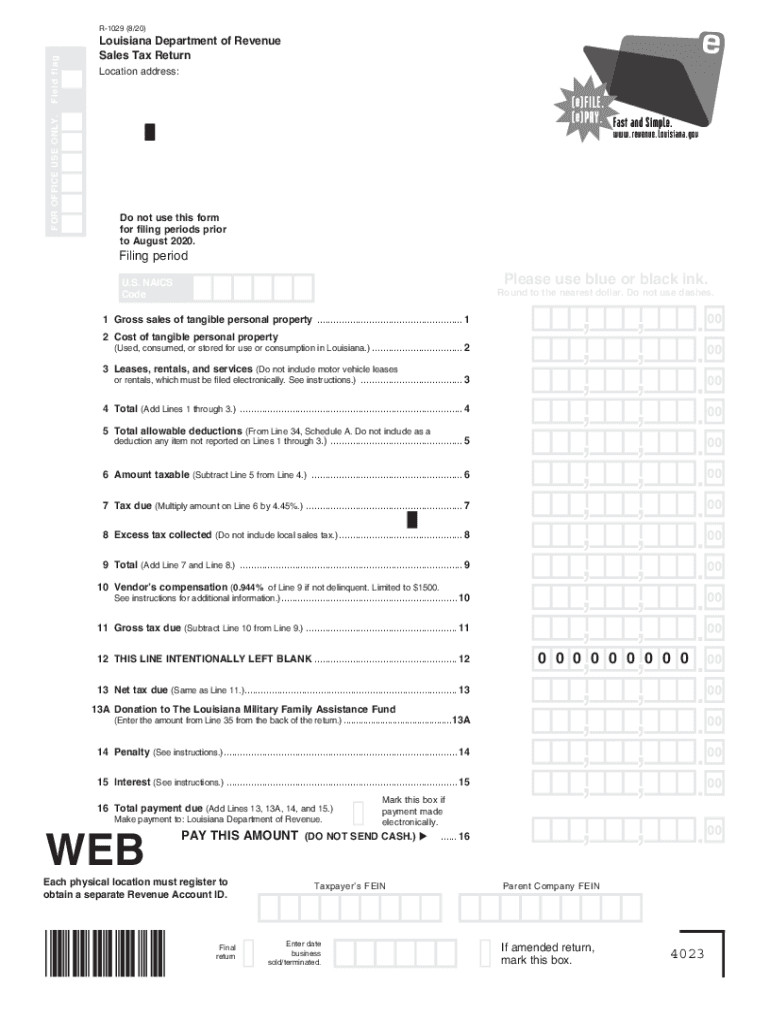

The Form R-1029 is a sales tax return form used by businesses in Louisiana to report and remit sales tax collected during a specific period. This form is essential for ensuring compliance with state tax regulations and helps the Louisiana Department of Revenue track sales tax revenue. The R-1029 is designed to be user-friendly, allowing businesses to accurately report their sales figures and any applicable exemptions or deductions. Understanding this form is crucial for maintaining good standing with state tax authorities.

Steps to Complete the Form R-1029 Louisiana Department of Revenue

Completing the Form R-1029 involves several key steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect all relevant sales data, including total sales, taxable sales, and any exemptions.

- Fill Out the Form: Enter the required information in the designated fields, ensuring that all figures are accurate and reflect your sales records.

- Calculate Sales Tax: Determine the total sales tax due based on your taxable sales and the applicable tax rate.

- Review for Accuracy: Double-check all entries for errors or omissions before submission.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the Form R-1029 Louisiana Department of Revenue

The Form R-1029 is legally binding when completed and submitted in accordance with Louisiana tax laws. To ensure its legal validity, businesses must adhere to the guidelines set forth by the Louisiana Department of Revenue. This includes accurate reporting of sales figures, timely submission, and compliance with any relevant state regulations. Using a reliable eSignature tool can further enhance the legal standing of the submitted form by providing a secure method for signing and verifying the document.

Form Submission Methods for R-1029

Businesses can submit the Form R-1029 through various methods, accommodating different preferences and needs:

- Online Submission: Many businesses opt to file electronically through the Louisiana Department of Revenue's online portal, which streamlines the process and provides immediate confirmation of receipt.

- Mail: The form can be printed and mailed to the appropriate address listed on the form, ensuring that it is sent well before the filing deadline.

- In-Person: Businesses may also choose to deliver the completed form in person at their local Department of Revenue office for direct processing.

Key Elements of the Form R-1029 Louisiana Department of Revenue

Understanding the key elements of the Form R-1029 is vital for accurate completion:

- Taxpayer Information: This section requires details about the business, including name, address, and taxpayer identification number.

- Sales Information: Businesses must report total sales, taxable sales, and any exemptions claimed during the reporting period.

- Calculation of Tax Due: This section includes fields for calculating the total sales tax owed based on the reported figures.

- Signature Section: A signature is required to validate the form, confirming that the information provided is accurate and complete.

Filing Deadlines for the Form R-1029

Timely filing of the Form R-1029 is crucial to avoid penalties. The Louisiana Department of Revenue typically sets specific deadlines based on the reporting period. Businesses should be aware of these deadlines to ensure compliance. Monthly filers generally need to submit their forms by the 20th of the following month, while quarterly and annual filers have different deadlines. Keeping track of these dates can help prevent late fees and maintain good standing with tax authorities.

Quick guide on how to complete form r 1029dsei louisiana department of revenue

Prepare Form R 1029DSEi Louisiana Department Of Revenue seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Form R 1029DSEi Louisiana Department Of Revenue on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form R 1029DSEi Louisiana Department Of Revenue effortlessly

- Find Form R 1029DSEi Louisiana Department Of Revenue and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Prepare your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you'd prefer. Modify and eSign Form R 1029DSEi Louisiana Department Of Revenue to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form r 1029dsei louisiana department of revenue

Create this form in 5 minutes!

How to create an eSignature for the form r 1029dsei louisiana department of revenue

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is a fillable r 1029 form?

A fillable r 1029 form is a digital document that allows users to input data electronically. This format streamlines the completion process, making it easier to manage and submit necessary information. Using airSlate SignNow, you can create, share, and sign these fillable r 1029 forms effortlessly.

-

How can I create a fillable r 1029 form with airSlate SignNow?

Creating a fillable r 1029 form with airSlate SignNow is simple. Just upload your document, add fillable fields as needed, and customize it according to your requirements. Once your form is ready, you can share it with others for completion and signature.

-

What are the pricing plans for using airSlate SignNow to manage fillable r 1029 forms?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs. You can choose from monthly or annual subscriptions that include access to features designed for managing fillable r 1029 forms. Visit our pricing page for detailed information and find the plan that suits you best.

-

What features does airSlate SignNow offer for fillable r 1029 forms?

With airSlate SignNow, you can enjoy a variety of features to enhance your fillable r 1029 forms. These include customizable templates, secure electronic signatures, and real-time collaboration tools. Our platform ensures your documents are processed efficiently and securely.

-

Are there any benefits to using fillable r 1029 forms?

Yes, using fillable r 1029 forms can signNowly streamline your workflow. They reduce the time spent on paperwork, minimize errors associated with manual entry, and enhance the overall user experience. This efficiency can ultimately lead to higher productivity for your business.

-

Can I integrate airSlate SignNow with other applications when using fillable r 1029 forms?

Absolutely! airSlate SignNow supports various integrations with popular applications to enhance your workflow. You can connect with CRM systems, cloud storage, and other business tools, making it easy to manage fillable r 1029 forms alongside your existing processes.

-

Is it easy to share fillable r 1029 forms with clients or colleagues?

Yes, sharing fillable r 1029 forms is straightforward with airSlate SignNow. You can send forms via email or share a link directly, allowing recipients to access documents quickly and securely. This feature fosters seamless collaboration, making it easy for clients and colleagues to engage with your forms.

Get more for Form R 1029DSEi Louisiana Department Of Revenue

- Waiver and release from liability for adult for four wheeling form

- Waiver release child form

- Waiver release liability form 497427156

- Waiver and release from liability for minor child for amusement park form

- Release adult 497427158 form

- Waiver release child 497427159 form

- Waiver release liability online 497427160 form

- Waiver and release from liability for minor child for motorsports form

Find out other Form R 1029DSEi Louisiana Department Of Revenue

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template