Department of the Treasury Instructions for Form CT 1 2021

What is the Department of the Treasury Instructions for Form CT-1

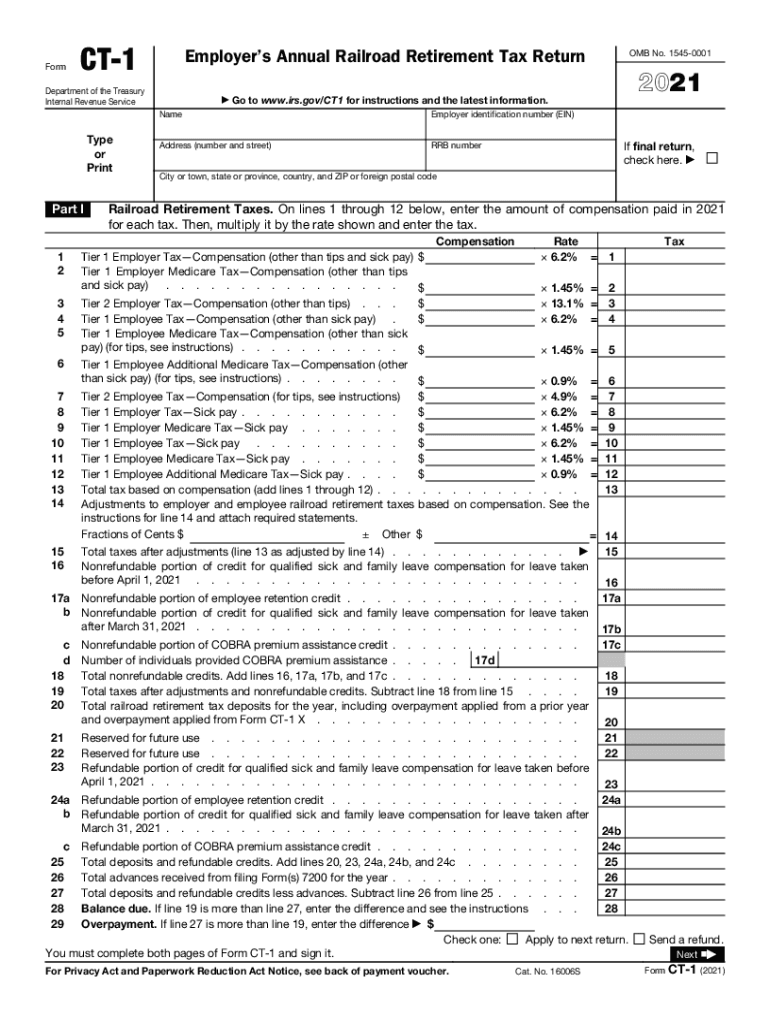

The Department of the Treasury Instructions for Form CT-1 provide essential guidance for employers regarding the payment of certain taxes. This form is specifically designed for employers who need to report and pay the taxes imposed under the Railroad Retirement Tax Act (RRTA). Understanding these instructions is crucial for compliance with federal tax obligations. The instructions detail the necessary steps for accurately completing the form, ensuring that employers meet their legal responsibilities while avoiding potential penalties.

Steps to Complete the Department of the Treasury Instructions for Form CT-1

Completing the Department of the Treasury Instructions for Form CT-1 involves several key steps:

- Gather necessary information, including employer identification details and employee compensation data.

- Fill out the form accurately, ensuring that all required fields are completed.

- Calculate the total taxes owed based on the provided guidelines.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Following these steps will help ensure that the form is filled out correctly and submitted on time.

Legal Use of the Department of the Treasury Instructions for Form CT-1

The legal use of the Department of the Treasury Instructions for Form CT-1 is essential for employers to maintain compliance with federal tax laws. The instructions outline the legal framework governing the Railroad Retirement Tax Act, detailing the obligations of employers regarding tax withholding and reporting. By adhering to these guidelines, employers can ensure that their tax submissions are legally valid and recognized by the IRS, thereby avoiding potential legal issues or penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form CT-1 are critical for employers to observe. Generally, the form must be filed quarterly, with specific due dates for each quarter. Employers should be aware of the following important dates:

- First quarter: Due by April 30

- Second quarter: Due by July 31

- Third quarter: Due by October 31

- Fourth quarter: Due by January 31 of the following year

Meeting these deadlines is essential to avoid late fees and maintain compliance with federal regulations.

Who Issues the Form

The Form CT-1 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. Employers must rely on the IRS for the most current version of the form and its accompanying instructions. The IRS provides the necessary resources and updates to ensure that employers have the correct information for tax reporting and compliance.

Penalties for Non-Compliance

Employers who fail to comply with the requirements outlined in the Department of the Treasury Instructions for Form CT-1 may face significant penalties. These can include:

- Late filing penalties, which increase the longer the form is overdue.

- Failure to pay penalties if taxes owed are not submitted on time.

- Interest charges on unpaid taxes.

Understanding these penalties emphasizes the importance of timely and accurate filing to avoid financial repercussions.

Required Documents

To complete the Department of the Treasury Instructions for Form CT-1, employers must have several key documents on hand. These include:

- Employer Identification Number (EIN)

- Records of employee compensation subject to RRTA taxes

- Previous tax filings for reference

Having these documents readily available will facilitate the accurate completion of the form and ensure compliance with reporting requirements.

Quick guide on how to complete department of the treasury instructions for form ct 1

Prepare Department Of The Treasury Instructions For Form CT 1 effortlessly on any device

Digital document management has become prevalent among companies and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed paperwork, as you can acquire the appropriate form and securely preserve it online. airSlate SignNow provides you with all the resources necessary to create, alter, and electronically sign your documents quickly without delays. Handle Department Of The Treasury Instructions For Form CT 1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Department Of The Treasury Instructions For Form CT 1 seamlessly

- Obtain Department Of The Treasury Instructions For Form CT 1 and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Department Of The Treasury Instructions For Form CT 1 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of the treasury instructions for form ct 1

Create this form in 5 minutes!

People also ask

-

What is a 1 employer form?

A 1 employer form is a document that simplifies the collection and management of employee information. It serves as a centralized resource for employers to gather crucial data efficiently. Using airSlate SignNow, you can create, send, and eSign your 1 employer form seamlessly.

-

How does airSlate SignNow help with 1 employer forms?

airSlate SignNow streamlines the process of creating and managing 1 employer forms by allowing easy customization and safe sharing of documents. The platform ensures you can obtain legally binding eSignatures quickly. This not only saves time but also enhances the overall efficiency of your HR processes.

-

Is there a cost associated with using airSlate SignNow for 1 employer forms?

Yes, there is a pricing model for airSlate SignNow based on your organization's needs. You can select a plan that accommodates the number of 1 employer forms and signatures required. By investing in this solution, you ensure compliance and efficiency in your document workflows.

-

What features does airSlate SignNow offer for managing 1 employer forms?

airSlate SignNow provides various features for 1 employer forms, including customizable templates, automated workflows, and instant eSigning capabilities. Additionally, you can track the status of your forms and receive notifications when they are signed. This enhances your document management strategy.

-

Can I integrate airSlate SignNow with other tools for my 1 employer forms?

Absolutely! airSlate SignNow integrates with numerous applications, enhancing the usability of your 1 employer forms. Whether you’re using CRM systems or project management tools, these integrations ensure that the document process is streamlined and connected with your existing workflows.

-

What benefits will our organization gain from using airSlate SignNow for 1 employer forms?

By utilizing airSlate SignNow for your 1 employer forms, your organization can reduce paperwork, improve accuracy, and accelerate the signing process. These benefits lead to increased productivity among HR teams and provide a more organized approach to managing employee documents.

-

How secure is airSlate SignNow when handling 1 employer forms?

Security is a top priority for airSlate SignNow, especially for sensitive documents like 1 employer forms. The platform employs advanced encryption and compliance protocols to protect your data. You can confidently use airSlate SignNow knowing that your information is safeguarded against unauthorized access.

Get more for Department Of The Treasury Instructions For Form CT 1

- Bill of sale without warranty by corporate seller ohio form

- Change workers compensation form

- Correction statement and agreement ohio form

- Ohio closing form

- Flood zone statement and authorization ohio form

- Name affidavit of buyer ohio form

- Name affidavit of seller ohio form

- Non foreign affidavit under irc 1445 ohio form

Find out other Department Of The Treasury Instructions For Form CT 1

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now