Ct 1 Form 2018

What is the 1 Employer Form

The 1 Employer Form is a crucial document used primarily for tax and employment purposes in the United States. It is designed to provide essential information regarding an employer's tax obligations and employee details. This form is typically required by the IRS to ensure compliance with federal tax laws. Completing the 1 Employer Form accurately is vital for both employers and employees to avoid potential issues with tax reporting and liabilities.

How to Use the 1 Employer Form

Using the 1 Employer Form involves several steps to ensure that all required information is accurately provided. First, gather necessary details such as the employer's identification number, employee information, and any relevant tax data. Next, fill out the form carefully, ensuring that all fields are completed. Once the form is filled out, it can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS.

Steps to Complete the 1 Employer Form

Completing the 1 Employer Form requires attention to detail. Follow these steps for accurate completion:

- Gather all necessary information, including employer and employee details.

- Access the form through the appropriate IRS website or authorized platform.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the form for any errors or omissions.

- Submit the form electronically or print it for mailing, based on your preference.

Legal Use of the 1 Employer Form

The legal use of the 1 Employer Form is governed by IRS regulations. It is essential for employers to understand that this form must be completed and submitted in compliance with federal tax laws. Failure to do so can result in penalties or issues with tax reporting. The form serves as a legal document that verifies employment and tax obligations, making its accuracy paramount.

Filing Deadlines / Important Dates

Filing deadlines for the 1 Employer Form are critical to ensure compliance with IRS requirements. Typically, employers must submit this form by specific dates, which may vary based on the type of employment or tax year. It is advisable to check the IRS guidelines for the most current deadlines to avoid any late filing penalties.

Form Submission Methods

The 1 Employer Form can be submitted through various methods, including:

- Online Submission: Many employers opt to submit the form electronically through the IRS website or authorized software.

- Mail: The form can also be printed and mailed to the appropriate IRS address.

- In-Person: In some cases, forms may be submitted in person at local IRS offices.

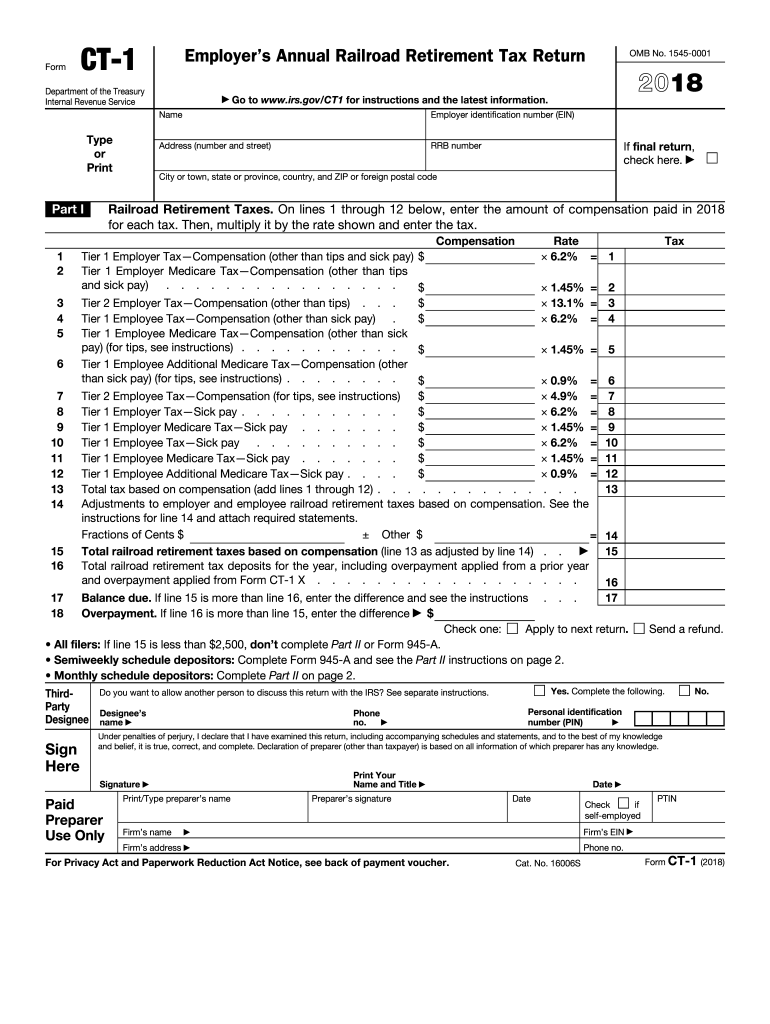

Quick guide on how to complete 2018 form ct 1 employers annual railroad retirement tax return

Easily prepare Ct 1 Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without any delays. Handle Ct 1 Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

Effortlessly edit and eSign Ct 1 Form

- Obtain Ct 1 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as an original wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ct 1 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form ct 1 employers annual railroad retirement tax return

Create this form in 5 minutes!

How to create an eSignature for the 2018 form ct 1 employers annual railroad retirement tax return

How to create an electronic signature for the 2018 Form Ct 1 Employers Annual Railroad Retirement Tax Return online

How to create an electronic signature for the 2018 Form Ct 1 Employers Annual Railroad Retirement Tax Return in Chrome

How to generate an electronic signature for putting it on the 2018 Form Ct 1 Employers Annual Railroad Retirement Tax Return in Gmail

How to make an electronic signature for the 2018 Form Ct 1 Employers Annual Railroad Retirement Tax Return straight from your mobile device

How to create an eSignature for the 2018 Form Ct 1 Employers Annual Railroad Retirement Tax Return on iOS

How to make an electronic signature for the 2018 Form Ct 1 Employers Annual Railroad Retirement Tax Return on Android

People also ask

-

What is a 1 employer form in airSlate SignNow?

The 1 employer form in airSlate SignNow is a digital document designed for businesses to streamline employee-related processes. It simplifies the collection of essential information and signatures, ensuring quick and efficient handling of employment documentation.

-

How can the 1 employer form improve my business processes?

By utilizing the 1 employer form in airSlate SignNow, businesses can signNowly reduce paperwork and manual errors. This digital solution promotes faster onboarding and enhances overall compliance by ensuring that all necessary information is captured accurately.

-

Is airSlate SignNow cost-effective for using the 1 employer form?

Yes, airSlate SignNow offers a cost-effective solution for using the 1 employer form. With competitive pricing plans, businesses can access a range of features that eliminate the need for costly paper-based processes and streamline document handling.

-

What features does the 1 employer form include?

The 1 employer form in airSlate SignNow includes customizable fields, automated workflow management, and secure electronic signatures. These features work together to enhance user experience and ensure that documents are processed efficiently.

-

Can I integrate the 1 employer form with other software?

Absolutely! airSlate SignNow allows for seamless integrations with popular business tools such as CRM systems and cloud storage services. This means you can easily incorporate the 1 employer form into your existing workflows without any disruptions.

-

How secure is the 1 employer form in airSlate SignNow?

The 1 employer form is protected with advanced security measures, including encryption and secure access controls. airSlate SignNow ensures that all your sensitive information is kept safe and complies with industry standards to protect your data.

-

What are the benefits of using airSlate SignNow's 1 employer form?

Using the 1 employer form in airSlate SignNow speeds up your document workflows, reduces administrative tasks, and enhances employee satisfaction. The efficiency gained translates into time savings and cost reductions for your business.

Get more for Ct 1 Form

- City of cape may dog park application form

- Company name or logo here customer refund and credit request form

- Notice of appeal sample form 33938872

- 4a 203 new mexico supreme court nmcompcomm form

- Tanning consultation form

- Form contractor waiver lien

- Respite voucher the moore center moorecenter form

- Canyon county sheriffs inmate labor detail program form

Find out other Ct 1 Form

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract