Explanation of Form RRB 1099 R Tax Statement 2023

Understanding the CT-1 Tax Form

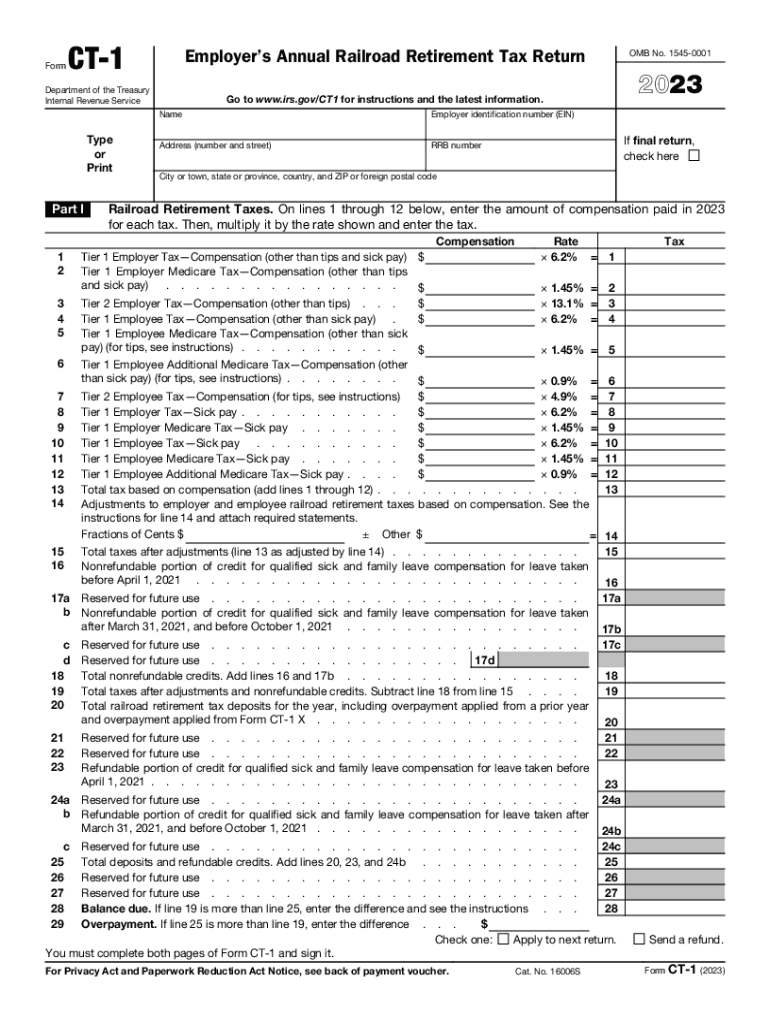

The CT-1 form, also known as the Railroad Tax Return, is a crucial document for employers in the railroad industry. It is used to report taxes related to railroad retirement and unemployment benefits. This form is essential for ensuring compliance with federal tax regulations and accurately reporting wages paid to employees in the railroad sector. The CT-1 form covers a variety of tax obligations, including the Railroad Retirement Tax Act (RRTA) and the Federal Insurance Contributions Act (FICA).

Key Elements of the CT-1 Form

The CT-1 form includes several key components that employers must complete. These elements typically include:

- Employer Information: Name, address, and identification number of the employer.

- Employee Wages: Total wages paid to employees subject to RRTA taxes.

- Tax Calculations: Detailed calculations of the taxes owed based on the reported wages.

- Signature Section: Certification by the employer confirming the accuracy of the information provided.

Steps to Complete the CT-1 Form

Completing the CT-1 form involves several steps to ensure accuracy and compliance. Employers should follow these guidelines:

- Gather all necessary payroll records for the reporting period.

- Calculate the total wages paid to employees subject to RRTA.

- Determine the applicable tax rates and calculate the total taxes owed.

- Fill out the CT-1 form accurately, ensuring all information is correct.

- Review the completed form for any errors before submission.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines for the CT-1 Form

Employers must adhere to specific deadlines when filing the CT-1 form to avoid penalties. Generally, the CT-1 form is due annually, with the filing deadline falling on the last day of February following the end of the tax year. For example, the 2023 CT-1 form would be due by February 29, 2024. It is important to stay informed about any changes to these deadlines, as they can vary based on IRS announcements.

IRS Guidelines for the CT-1 Form

The IRS provides detailed guidelines for completing and submitting the CT-1 form. Employers should refer to the official IRS instructions for the CT-1 form to ensure compliance with all requirements. These guidelines cover aspects such as recordkeeping, tax calculations, and submission methods. Adhering to these instructions helps prevent errors and ensures that all tax obligations are met accurately.

Penalties for Non-Compliance with the CT-1 Form

Failure to file the CT-1 form on time or providing inaccurate information can result in significant penalties. The IRS may impose fines based on the severity of the non-compliance, including late filing penalties and interest on unpaid taxes. Employers should take care to file the form accurately and on time to avoid these financial repercussions.

Quick guide on how to complete explanation of form rrb 1099 r tax statement

Complete Explanation Of Form RRB 1099 R Tax Statement effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can locate the desired form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Explanation Of Form RRB 1099 R Tax Statement on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Explanation Of Form RRB 1099 R Tax Statement without any hassle

- Find Explanation Of Form RRB 1099 R Tax Statement and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Explanation Of Form RRB 1099 R Tax Statement and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct explanation of form rrb 1099 r tax statement

Create this form in 5 minutes!

How to create an eSignature for the explanation of form rrb 1099 r tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 1 and how can it benefit my business?

ct 1 is a powerful feature within airSlate SignNow that streamlines the electronic signing process. By utilizing ct 1, businesses can enhance their workflow efficiency, reduce paper usage, and speed up document turnaround times. This results in signNow time savings and improved operational effectiveness.

-

How does ct 1 integrate with other software?

ct 1 offers seamless integrations with a variety of popular business applications, including Salesforce, Google Drive, and others. This allows users to easily incorporate electronic signatures into their existing workflows without interruption. By leveraging these integrations, businesses can enhance their productivity while utilizing their preferred tools.

-

What are the pricing options for ct 1?

airSlate SignNow offers flexible pricing plans for ct 1, catering to businesses of all sizes. You can choose from individual, team, or enterprise plans, ensuring that you only pay for the features you need. Each plan includes access to essential tools that make e-signing documents simple and efficient.

-

Is ct 1 secure for sensitive documents?

Yes, ct 1 is designed with top-notch security features, ensuring that all documents are protected during the signing process. It includes SSL encryption and complies with industry standards, making it safe to handle sensitive information. Trusting ct 1 means trusting your document security.

-

What types of documents can be signed using ct 1?

With ct 1, you can sign various types of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different industries. This flexibility allows businesses to efficiently manage all their signing needs within one solution.

-

Can I customize my e-signature with ct 1?

Absolutely! ct 1 allows users to customize their e-signatures to reflect their brand and personal touch. You can choose from different styles or upload your unique signature image, ensuring that your signed documents align with your branding and preferences.

-

What support is available for users of ct 1?

airSlate SignNow provides comprehensive support for all ct 1 users, including tutorials, FAQs, and live chat options. Whether you're a new user or need assistance with advanced features, the support team is ready to help you make the most out of your experience. This ensures that you can effectively utilize ct 1 without any hassles.

Get more for Explanation Of Form RRB 1099 R Tax Statement

Find out other Explanation Of Form RRB 1099 R Tax Statement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template