Form CT 1 Employer's Annual Railroad Retirement Tax 2024-2026

What is the Form CT 1 Employer's Annual Railroad Retirement Tax

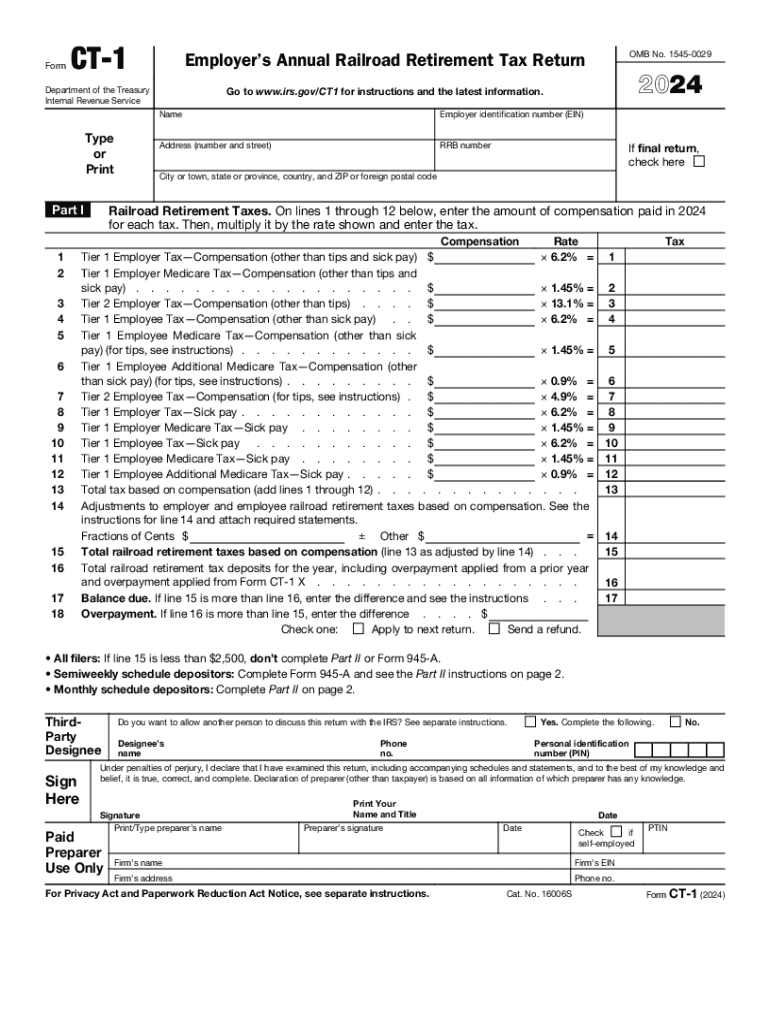

The Form CT 1 is a crucial document used by employers in the railroad industry to report and pay the annual Railroad Retirement Tax. This tax is essential for funding the Railroad Retirement program, which provides retirement, survivor, and disability benefits to eligible railroad workers and their families. The form is specifically designed for employers who are responsible for withholding and remitting these taxes on behalf of their employees.

How to use the Form CT 1 Employer's Annual Railroad Retirement Tax

To use the Form CT 1 effectively, employers must first gather the necessary payroll information for the tax year. This includes total compensation paid to employees, as well as the amount of tax withheld. Employers should fill out the form accurately, ensuring that all required fields are completed. Once filled, the form must be submitted to the appropriate tax authority along with the payment for any taxes owed. It is important to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Form CT 1 Employer's Annual Railroad Retirement Tax

Completing the Form CT 1 involves several key steps:

- Gather all relevant payroll records for the tax year.

- Calculate the total compensation paid to employees subject to Railroad Retirement Tax.

- Determine the amount of tax to be withheld based on the applicable rates.

- Fill out the form, ensuring all fields are accurately completed.

- Review the form for any errors or omissions.

- Submit the form along with the payment to the appropriate tax authority.

Filing Deadlines / Important Dates

It is essential for employers to be aware of the filing deadlines associated with the Form CT 1. Typically, the form must be filed annually, with the deadline falling on the last day of February following the end of the tax year. If the deadline falls on a weekend or holiday, it is usually extended to the next business day. Employers should also be mindful of any changes to deadlines that may occur due to legislative updates.

Legal use of the Form CT 1 Employer's Annual Railroad Retirement Tax

The Form CT 1 is legally required for employers in the railroad industry to report their Railroad Retirement Tax obligations. Failure to file the form or to remit the appropriate taxes can result in penalties and interest charges. It is important for employers to understand their legal responsibilities regarding the form to ensure compliance with federal tax regulations.

Key elements of the Form CT 1 Employer's Annual Railroad Retirement Tax

Key elements of the Form CT 1 include:

- Employer identification information, including name and address.

- Total compensation paid to employees during the tax year.

- Amount of Railroad Retirement Tax withheld from employee wages.

- Signature of the employer or authorized representative.

Each of these elements is critical for accurately reporting tax obligations and ensuring compliance with federal regulations.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1 employers annual railroad retirement tax

Create this form in 5 minutes!

How to create an eSignature for the form ct 1 employers annual railroad retirement tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CT 1 form and how does airSlate SignNow help with it?

The CT 1 form is a crucial document used for various business transactions. airSlate SignNow simplifies the process of sending and eSigning CT 1 forms, ensuring that your documents are securely signed and stored. With our user-friendly interface, you can manage your CT 1 forms efficiently and effectively.

-

How much does it cost to use airSlate SignNow for CT 1 forms?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose from various subscription options that allow you to send and eSign unlimited CT 1 forms at a cost-effective rate. Our pricing is designed to provide value while ensuring you have all the features necessary for your document management.

-

What features does airSlate SignNow offer for managing CT 1 forms?

airSlate SignNow provides a range of features specifically designed for managing CT 1 forms. These include customizable templates, automated workflows, and real-time tracking of document status. Our platform ensures that you can handle your CT 1 forms with ease and efficiency.

-

Can I integrate airSlate SignNow with other applications for CT 1 forms?

Yes, airSlate SignNow offers seamless integrations with various applications to enhance your workflow for CT 1 forms. You can connect with popular tools like Google Drive, Salesforce, and more, allowing you to streamline your document processes. This integration capability ensures that your CT 1 forms are easily accessible and manageable.

-

What are the benefits of using airSlate SignNow for CT 1 forms?

Using airSlate SignNow for CT 1 forms provides numerous benefits, including increased efficiency and reduced turnaround time. Our platform allows for quick eSigning, which accelerates the approval process for your documents. Additionally, the security features ensure that your CT 1 forms are protected throughout the signing process.

-

Is airSlate SignNow secure for handling CT 1 forms?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your CT 1 forms. Our platform is designed to keep your sensitive information safe while allowing for easy access and management. You can trust that your documents are secure with us.

-

How can I get started with airSlate SignNow for CT 1 forms?

Getting started with airSlate SignNow for CT 1 forms is simple. You can sign up for a free trial on our website, where you can explore all the features available for managing your documents. Once registered, you can easily upload, send, and eSign your CT 1 forms in just a few clicks.

Get more for Form CT 1 Employer's Annual Railroad Retirement Tax

- Verification form for students with disabilities the university

- Wcu id form

- 410 706 8212 fax form

- Employee tuition assistance application human resources form

- The university of trinidad and tobago office of the utt form

- Augustaedu form

- Sod studio rental agreement university of utah dance form

- Internpracticum teacher observation form frostburg

Find out other Form CT 1 Employer's Annual Railroad Retirement Tax

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document